Question: Problem POS-71 Today is May 3 (time 0). The price of XYZ stock is $29. The following options on XY stock are given Security Strike

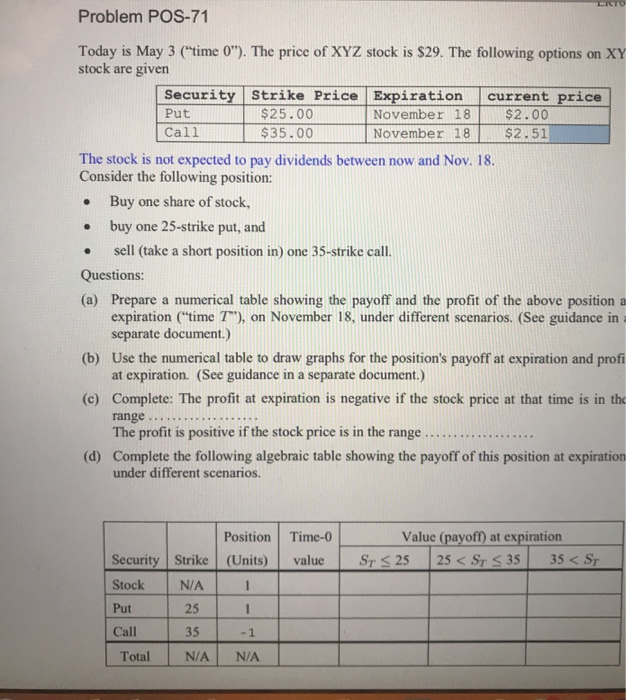

Problem POS-71 Today is May 3 ("time 0"). The price of XYZ stock is $29. The following options on XY stock are given Security Strike Price Expiration current price Put Call $25.00 $35.00 November 18 $2.00 November 18 $2.51 The stock is not expected to pay dividends between now and Nov. 18 Consider the following position: . Buy one share of stock, e buy one 25-strike put, and sell (take a short position in) one 35-strike call Questions: (a) Prepare a numerical table showing the payoff and the profit of the above position a expiration ('"time 7), on November 18, under different scenarios. (See guidance in separate document) (b) Use the numerical table to draw graphs for the position's payoff at expiration and prof at expiration. (See guidance in a separate document.) (c) Complete: The profit at expiration is negative if the stock price at that time is in th range The profit is positive if the stock price is in the range Complete the following algebraic table showing the payoff of this position at expiration (d) under different scenarios. Position Time-0 Value (payoff) at expiration Security Strike (Units) value Sr2525

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts