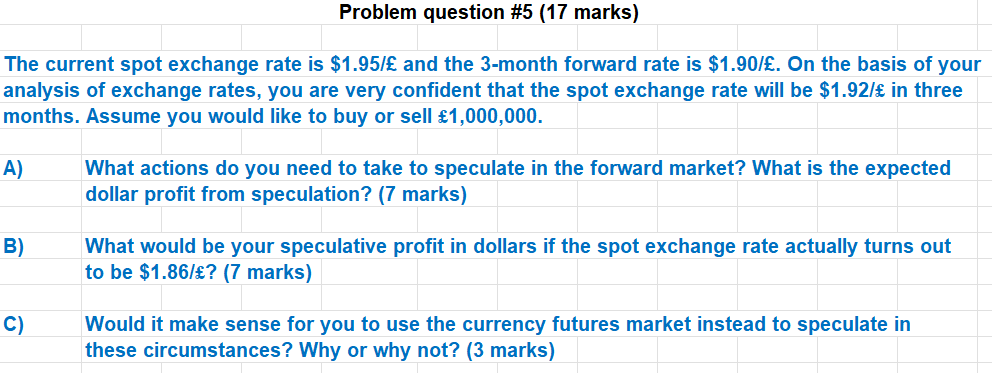

Question: Problem question #5 (17 marks) The current spot exchange rate is $1.95/ and the 3-month forward rate is $1.90/. On the basis of your analysis

Problem question #5 (17 marks) The current spot exchange rate is $1.95/ and the 3-month forward rate is $1.90/. On the basis of your analysis of exchange rates, you are very confident that the spot exchange rate will be $1.92/ in three months. Assume you would like to buy or sell 1,000,000. A) What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation? (7 marks) B) What would be your speculative profit in dollars if the spot exchange rate actually turns out to be $1.86/? (7 marks) C) Would it make sense for you to use the currency futures market instead to speculate in these circumstances? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts