Question: PROBLEM Requireed A. On January 1, 2013 Frederick Corp. issued bonds with a maturity value of stated rate of interest on the bonds is 8%

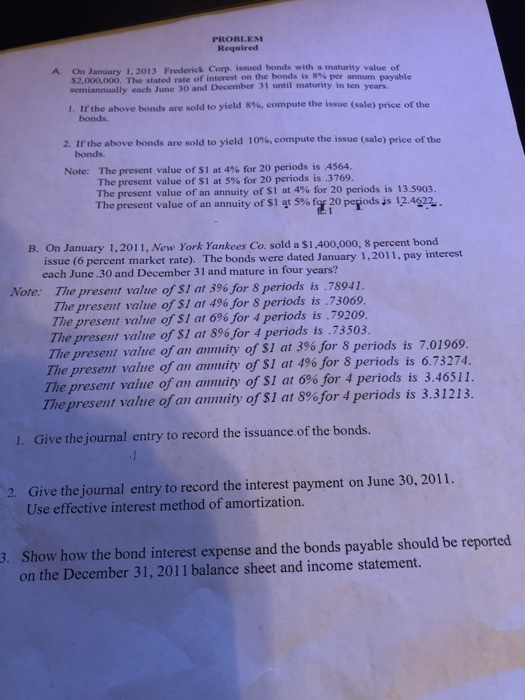

PROBLEM Requireed A. On January 1, 2013 Frederick Corp. issued bonds with a maturity value of stated rate of interest on the bonds is 8% per annum payable $2,000,000. The semiannually each June 30 and December 31 until maturity in t 1. If the above bonds are sold to yield 8%, compute the issue (sale) price of the bonds. 2. If the above bonds are sold to yield 10%. compute the issue (sale) price of the bonds. Note: The present value of SI at 4% for 20 periods is .4564. The present value of SI at 5% for 20 periods is .3769. The present value of an annuity of $1 at 4% for 20 periods is 13.5903. The present value of an annuity of si at 5% fr 20 petods js l2AP B. On January 1,2011, New York Yankees Co. sold a $1,400,000, 8 percent bond issue (6 percent market rate). The bonds were dated January 1,2011, pay interest each June.30 and December 31 and mature in four years? Note: The present value of SI at 39% for 8 periods is .78941. The present value of $1 at 4% for 8 periods is .73069. The present value of SI at 6% for 4 periods is .79209. The present value of S1 at 89% for 4 periods is .73503. The present value of an annuity of S1 at 3% for 8 periods is 7.01969. The present value of an ammuity of SI at 49% for 8 periods is 6.73274. The present vaiue of an anmuity of S1 at 6% for 4 periods is 3.46511. The present value of an annuity of S1 at 8%for 4 periods is 3.31213 Give the journal entry to record the issuance of the bonds. I. Give the journal entry to record the interest payment on June 30, 2011. Use effective interest method of amortization. 2. Show how the bond interest expense and the bonds payable should be reported on the December 31, 2011 balance sheet and income statement. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts