Question: problem set 1.pdf - Adobe Header File Edit View Window Help OpenDAM 3 173 Tools Fill & Sign Comment DE S L Export PDF 3

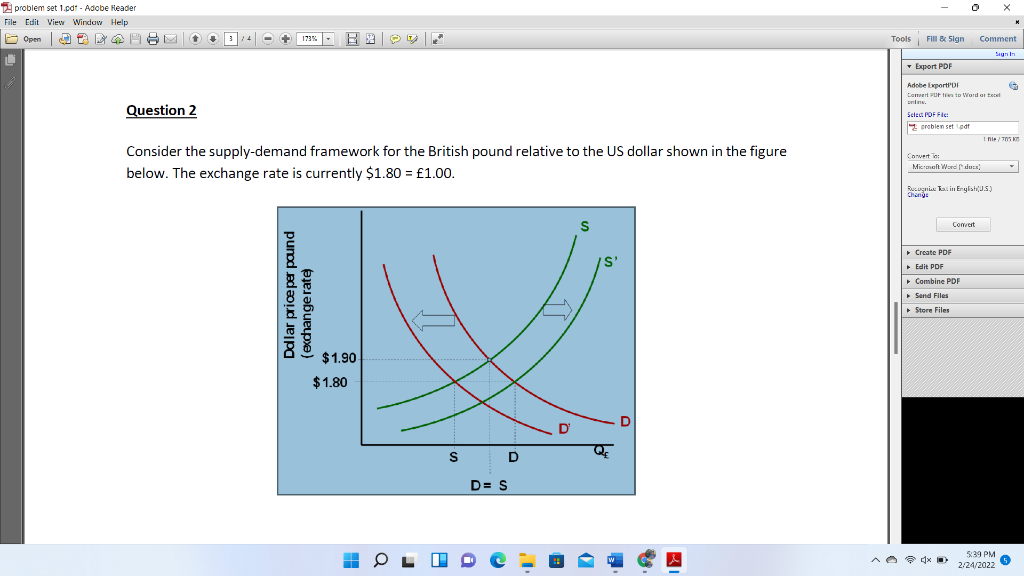

problem set 1.pdf - Adobe Header File Edit View Window Help OpenDAM 3 173 Tools Fill & Sign Comment DE S L Export PDF 3 Adobe lwportPDE Camat PDF to Wardar el Select POFFE robienste 1 nie / a) Suppose that the US government would like to "fix" the exchange rate at $1.80 = 1.00. The government can use monetary or fiscal policy. Suppose that monetary policy were to change. What would the US Federal Reserve do with interest rates to shift the demand curve to the left from D to D'? Convert to Michen Word do Rucni Rai in En sus) Change Convert b) The US Federal Reserve's main policy objectives are to combat inflation and unemployment. Suppose that the US Federal Reserve indicates that given the targets for inflation and unemployment, it will not change interest rates. What fiscal policy could the US government pursue to shift the demand curve to the left? (Hint: the policy could be contractionary or expansionary) Create PDF Edit PDF Combine PDF Send Files Store Files c) Without government intervention to "fix" the exchange rate at $1.80 = 1.00, briefly explain what would happen to the US dollar and the exchange rate with the British pound? OneDrive Screenshot saved The screenshot was added to your OneDrive. O 5:39 PM 2/24/2022 6 problem set 1.pdt - Adobe Reader File Edit View Window Help Open ANOM Tools Fill & Slan Comment L Export PDF Adobe lwportPDE Comment on to Wordar el 3 Question 2 Select POFFE robienste 1 nie / Consider the supply-demand framework for the British pound relative to the US dollar shown in the figure below. The exchange rate is currently $1.80 = 1.00. Convert Michen Word do - Recognitat in Eryl (US) Change S Coment S' Ddlar price per pound (exchange rate Create PDF Edit PDF Combine PDF Send Files Store Files V $ 1.90 $1.80 S D D= S Adx 5:39 PM 2/24/2022 problem set 1.pdf - Adobe Header File Edit View Window Help OpenDAM 3 173 Tools Fill & Sign Comment DE S L Export PDF 3 Adobe lwportPDE Camat PDF to Wardar el Select POFFE robienste 1 nie / a) Suppose that the US government would like to "fix" the exchange rate at $1.80 = 1.00. The government can use monetary or fiscal policy. Suppose that monetary policy were to change. What would the US Federal Reserve do with interest rates to shift the demand curve to the left from D to D'? Convert to Michen Word do Rucni Rai in En sus) Change Convert b) The US Federal Reserve's main policy objectives are to combat inflation and unemployment. Suppose that the US Federal Reserve indicates that given the targets for inflation and unemployment, it will not change interest rates. What fiscal policy could the US government pursue to shift the demand curve to the left? (Hint: the policy could be contractionary or expansionary) Create PDF Edit PDF Combine PDF Send Files Store Files c) Without government intervention to "fix" the exchange rate at $1.80 = 1.00, briefly explain what would happen to the US dollar and the exchange rate with the British pound? OneDrive Screenshot saved The screenshot was added to your OneDrive. O 5:39 PM 2/24/2022 6 problem set 1.pdt - Adobe Reader File Edit View Window Help Open ANOM Tools Fill & Slan Comment L Export PDF Adobe lwportPDE Comment on to Wordar el 3 Question 2 Select POFFE robienste 1 nie / Consider the supply-demand framework for the British pound relative to the US dollar shown in the figure below. The exchange rate is currently $1.80 = 1.00. Convert Michen Word do - Recognitat in Eryl (US) Change S Coment S' Ddlar price per pound (exchange rate Create PDF Edit PDF Combine PDF Send Files Store Files V $ 1.90 $1.80 S D D= S Adx 5:39 PM 2/24/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts