Question: Problem Set 4: Static Homogenous Product Oligopoly. Upload to Carmen before 5pm on Wednesday, 9/23. 1. Boeing and Airbus are the two major airplane producers.

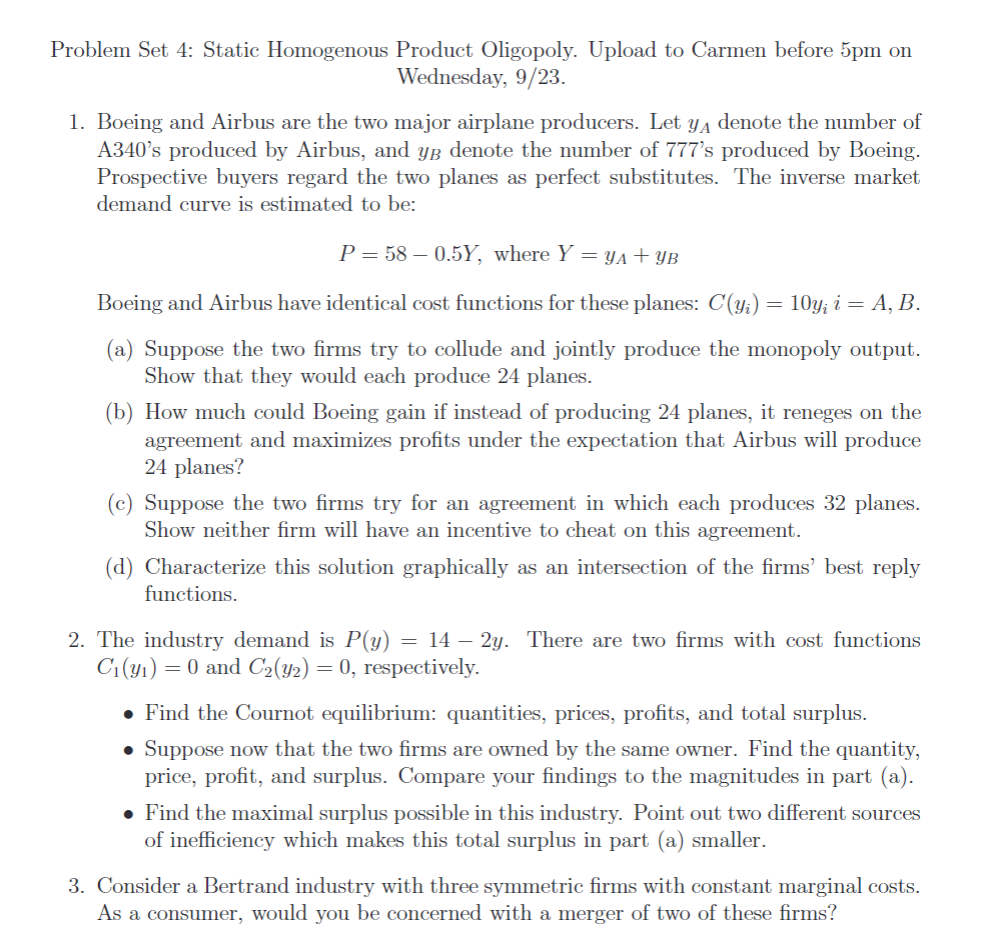

Problem Set 4: Static Homogenous Product Oligopoly. Upload to Carmen before 5pm on Wednesday, 9/23. 1. Boeing and Airbus are the two major airplane producers. Let yA denote the number of A340's produced by Airbus, and ya denote the number of 777's produced by Boeing. Prospective buyers regard the two planes as perfect substitutes. The inverse market demand curve is estimated to be: P=580.5Y, where Y 2:954 +511; Boeing and Airbus have identical cost functions for these planes: C (3,1,) = 10y,- 1' = A, B. (a) Suppose the two rms try to collude and jointly produce the monopoly output. Show that they would each produce 24 planes. (b) How much could Boeing gain if instead of producing 24 planes, it reneges on the agreement and maximizes prots under the expectation that Airbus will produce 24 planes? (c) Suppose the two rms try for an agreement in which each produces 32 planes. Show neither rm will have an incentive to cheat on this agreement. (d) Characterize this solution graphically as an intersection of the rms1 best reply functions. 2. The industry demand is P(y) = 14 2y. There are two rms with cost functions 01(y1) = U and 02(y2) = 0, respectively. 0 Find the Coumot equilibrium: quantities, prices, prots, and total surplus. 0 Suppose now that the two rms are owned by the same owner. Find the quantity, price, prot, and surplus. Compare your ndings to the magnitudes in part (a). c Find the maximal surplus possible in this industry. Point out two dierent sources of ineiciency which makes this total surplus in part (a) smaller. 3. Consider a Bertrand industry with three symmetric rms with constant marginal costs. As a consumer, would you be concerned with a merger of two of these rms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts