Question: PROBLEM SET A Since the SUTA rates changes are made at the end of each year and there is much discussion about changes to the

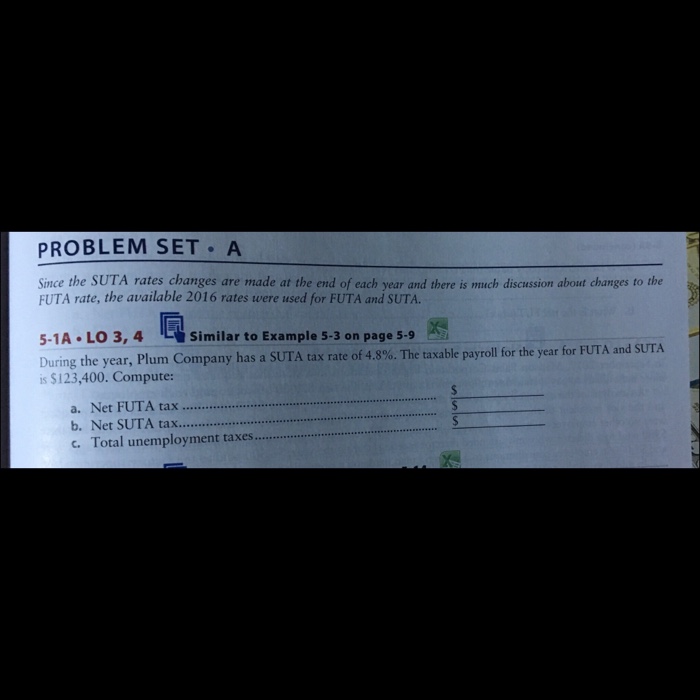

PROBLEM SET A Since the SUTA rates changes are made at the end of each year and there is much discussion about changes to the FUTA rate, the available 2016 rates were used for FUTA and SUTA. ?similar toExample 5-3 on page The 5-1A LO 3,4 During the year, Plum Company has a SUTA tax rate of 4.8%. The taxable payroll for the year for FUTA and S is $123,400. Compute: 4 oab ee UTA py on a. Net FUTA tax... b. Net SUTA tax c. Total unemployment taxes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock