Question: Problem Set B For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. PROBLEM 15-1B On December 31

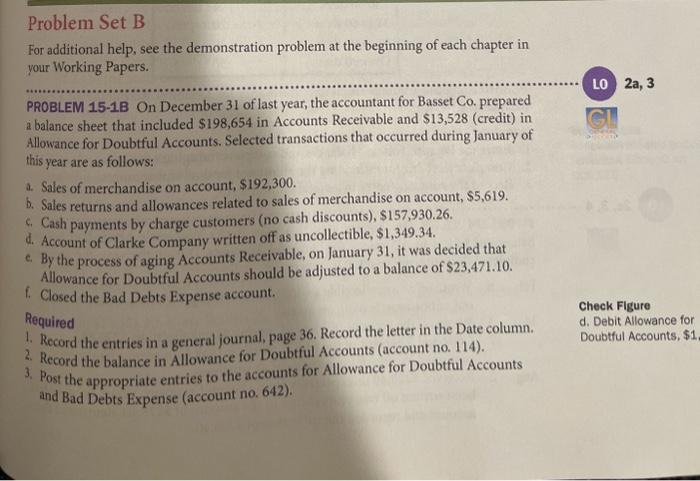

For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. L0 2a,3 PROBLEM 15-1B On December 31 of last year, the accountant for Basset Co. prepared a balance sheet that included \$198,654 in Accounts Receivable and \$13,528 (credit) in Allowance for Doubtful Accounts. Selected transactions that occurred during January of this year are as follows: a. Sales of merchandise on account, $192,300. b. Sales returns and allowances related to sales of merchandise on account, $5,619. c. Cash payments by charge customers (no cash discounts), $157,930.26. d. Account of Clarke Company written off as uncollectible, $1,349.34. c. By the process of aging Accounts Receivable, on January 31, it was decided that Allowance for Doubtful Accounts should be adjusted to a balance of $23,471.10. f. Closed the Bad Debts Expense account. Required Check Figure 1. Record the entries in a general journal, page 36. Record the letter in the Date column. d. Debit Allowance for 2. Record the balance in Allowance for Doubtful Accounts (account no. 114). Doubtful Accounts, $1 3. Post the appropriate entries to the accounts for Allowance for Doubtful Accounts and Bad Debts Expense (account no. 642)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts