Question: T accounts For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. On May 1, B. Bangle opened

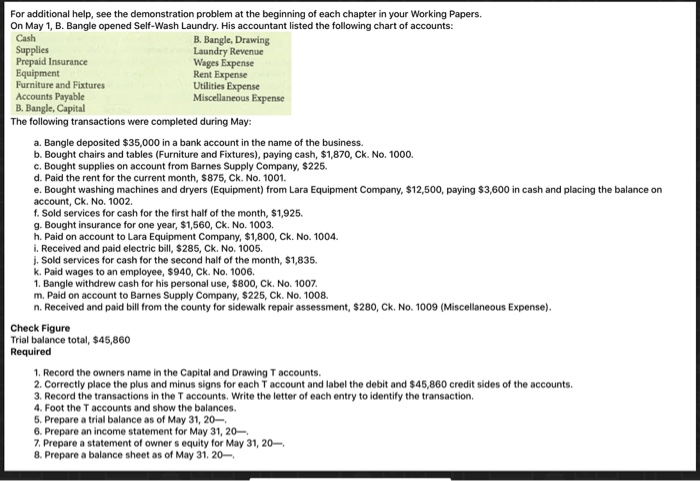

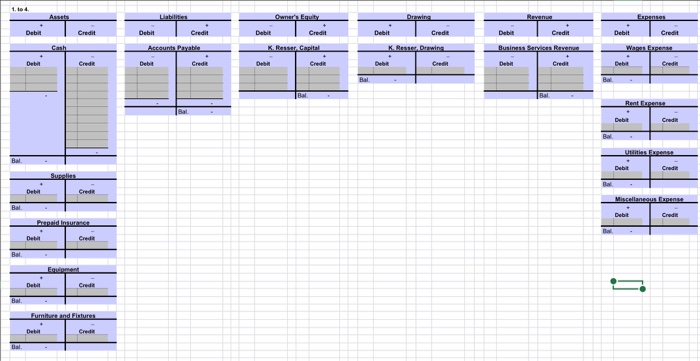

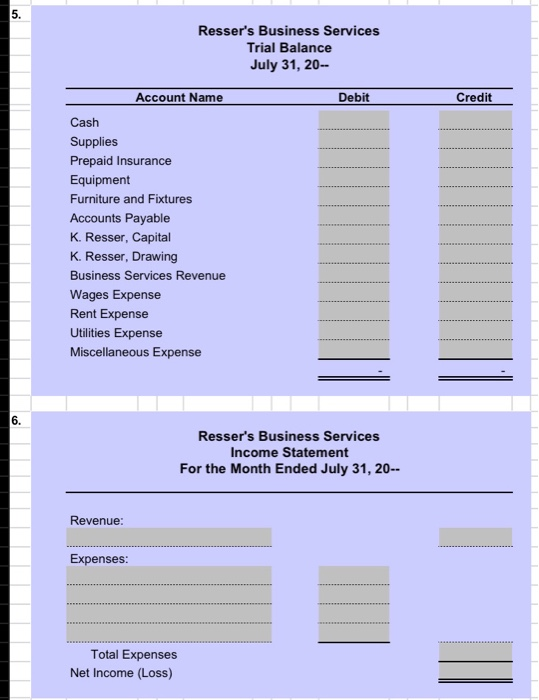

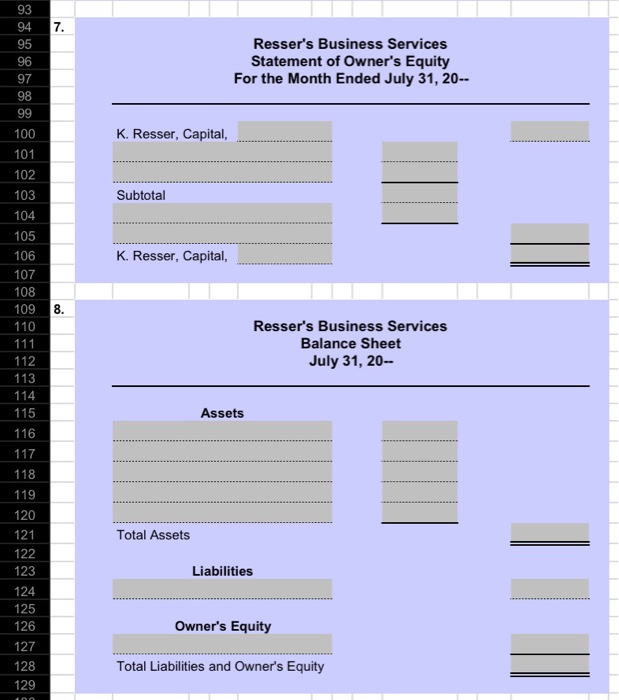

For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. On May 1, B. Bangle opened Self-Wash Laundry. His accountant listed the following chart of accounts: Cash B. Bangle, Drawing Supplies Laundry Revenue Prepaid Insurance Wages Expense Equipment Rent Expense Furniture and Fixtures Utilities Expense Accounts Payable Miscellaneous Expense B. Bangle, Capital The following transactions were completed during May: a. Bangle deposited $35,000 in a bank account in the name of the business. b. Bought chairs and tables (Furniture and Fixtures), paying cash $1,870, Ck. No. 1000 c. Bought supplies on account from Barnes Supply Company, $225. d. Paid the rent for the current month, $875, Ck. No. 1001. e. Bought washing machines and dryers (Equipment) from Lara Equipment Company, $12,500, paying $3,600 in cash and placing the balance on account, Ck. No. 1002 f. Sold Services for cash for the first half of the month, $1,925. g. Bought insurance for one year, $1,560, Ck. No. 1003. h. Paid on account to Lara Equipment Company, $1,800, Ck. No. 1004. i. Received and paid electric bill, $285, Ck. No. 1005. 1. Sold services for cash for the second half of the month, $1,835. k. Paid wages to an employee, $940, Ck. No. 1006. 1. Bangle withdrew cash for his personal use, $800, Ck. No. 1007. m. Paid on account to Barnes Supply Company, $225, Ck. No. 1008. n. Received and paid bill from the county for sidewalk repair assessment, $280, Ck. No. 1009 (Miscellaneous Expense). Check Figure Trial balance total, $45,860 Required 1. Record the owners name in the Capital and Drawing Taccounts. 2. Correctly place the plus and minus signs for each T account and label the debit and $45,860 credit sides of the accounts. 3. Record the transactions in the Taccounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of May 31, 20 6. Prepare an income statement for May 31, 20 7. Prepare a statement of owners equity for May 31, 20 8. Prepare a balance sheet as of May 31, 20 1. led Liabilities Drawing Espen Owner's Equity Debit Credit Debit Credit Debit Crede Debit Credit Debit Credit Cash Debit Credit Account Payable - Debiet Credit K. Resser. Capital K Rawi Business Service Raverve Wagen Debit Credi Derbi Cred Derbi Credit Debe Bal. Bal Bal Rent Expense Bal Credi Bal Bal Crede Debit Miscellaneous Expense Bal Debit Credit Prendist Bal Egid Det Crede 5 Bal Furniture and Futures . Det Bal 5. Resser's Business Services Trial Balance July 31, 20- Debit Credit Account Name Cash Supplies Prepaid Insurance Equipment Furniture and Fixtures Accounts Payable K. Resser, Capital K. Resser, Drawing Business Services Revenue Wages Expense Rent Expense Utilities Expense Miscellaneous Expense 6. Resser's Business Services Income Statement For the Month Ended July 31, 20-- Revenue: Expenses: Total Expenses Net Income (Loss) 7. Resser's Business Services Statement of Owner's Equity For the Month Ended July 31, 20-- K. Resser, Capital, Subtotal 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 K. Resser, Capital, 8. Resser's Business Services Balance Sheet July 31, 20- Assets 116 117 118 119 120 121 122 123 124 125 126 Total Assets Liabilities Owner's Equity 127 Total Liabilities and Owner's Equity 128 129 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts