Question: Excel Problem 3 Show All Excel Work (21 points) The Pack Company has employed you to determine its weighted average cost of capital. Next year's

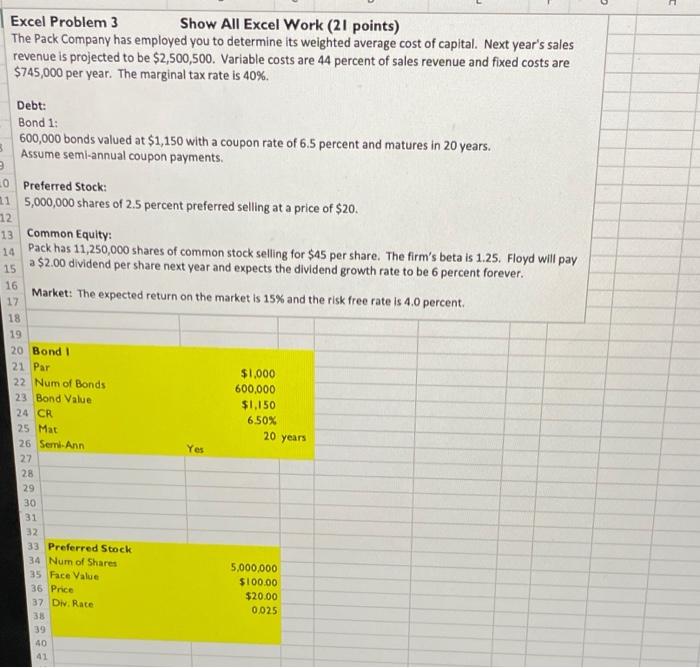

Excel Problem 3 Show All Excel Work (21 points) The Pack Company has employed you to determine its weighted average cost of capital. Next year's sales revenue is projected to be $2,500,500. Variable costs are 44 percent of sales revenue and fixed costs are $745,000 per year. The marginal tax rate is 40%. 3 Debt: Bond 1: 600,000 bonds valued at $1,150 with a coupon rate of 6.5 percent and matures in 20 years. Assume semi-annual coupon payments. 0 Preferred Stock: m1 5,000,000 shares of 2.5 percent preferred selling at a price of $20. 12 13 Common Equity: 14 Pack has 11,250,000 shares of common stock selling for $45 per share. The firm's beta is 1.25. Floyd will pay a $2.00 dividend per share next year and expects the dividend growth rate to be 6 percent forever. Market: The expected return on the market is 15% and the risk free rate is 4.0 percent. $1,000 600,000 $1,150 6.50% 20 years Yes 15 16 12 18 19 20 Bond 21 Par 22 Num of Bonds 23 Bond Value 24 CR 25 Mat 26 SerriAnn 27 28 29 30 31 32 33 Preferred Stock 34 Num of Shares 35 Face Value 36 Price 37 Div. Rate 38 39 40 41 5,000,000 $100.00 $20.00 0.025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts