Question: Problem solving: Show your solutions, please. Round off final answers to two decimal places. Label all your numbers, example nper ( number of periods )

Problem solving: Show your solutions, please. Round off final answers to two decimal places. Label all your numbers, example nper number of periods Use excels for your solutions. Highlight final answer.

Determine the equilibrium price of the security given the following information. What is quantity demanded and quantity supplied?

Quantity demanded: BDp

Quantity supplied: BSp

Suppose you buy a year bond today for $ and that the coupon rate is paid semiannually. After a year, the market interest rate decreases to determine: a bond price; b rate of return for the bond.

Which will you prefer to invest your $: a a twoyear bond with interest rate of or b two oneyear bonds, Year the bond will earn and year the second bond will earn Which bond will you buy?

Suppose that the interest rate on a oneyear bond is today and interest rates expected on oneyear bonds in the future are in one year, in two years and in three years

According to the expectations theory of the term structure, what are the interest rates today on a a twoyear bond; b a threeyear bond and c a fouryear bond?

If the term premium is equal to percent, what are the interest rates today for a twoyear bond, threeyear bond; fouryear bond.

If the expected real interest rate is expected inflation rate is determine the nominal interest rate and aftertax expected real interest rate. Tax rate is

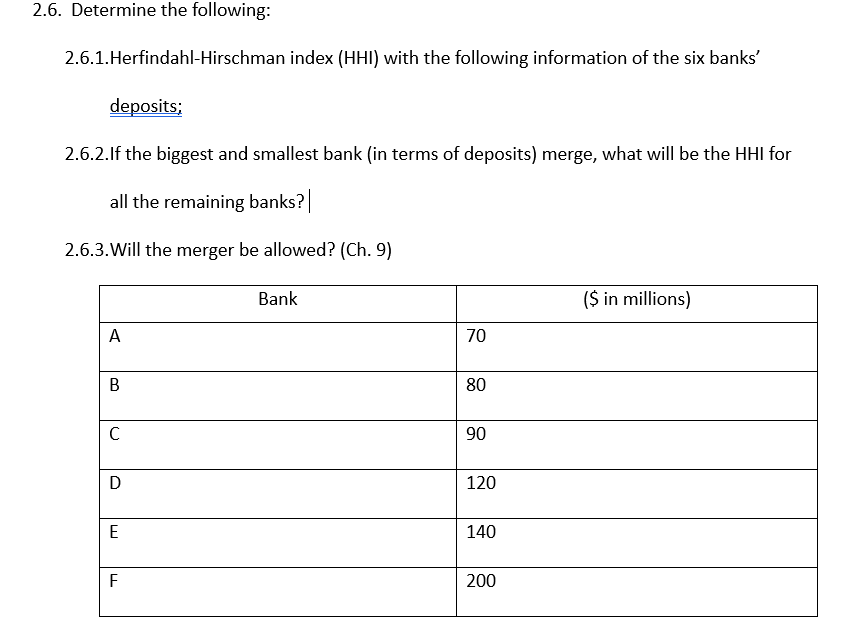

Determine the following:

HerfindahlHirschman index HHI with the following information of the six banks deposits;

If the biggest and smallest bank in terms of deposits merge, what will be the HHI for all the remaining banks?

Will the merger be allowed?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock