Question: Problem Three (15 points): You are provided the following information for a stock market in which two factors explain returns: Assets bj bj2 Hj

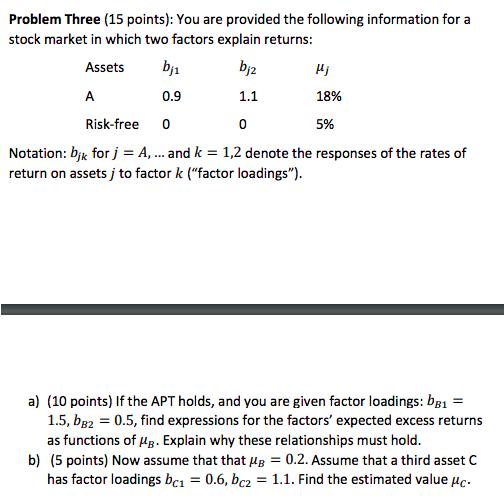

Problem Three (15 points): You are provided the following information for a stock market in which two factors explain returns: Assets bj bj2 Hj A 0.9 1.1 18% Risk-free 0 0 5% Notation: bjk for j = A, ... and k = 1,2 denote the responses of the rates of return on assetsj to factor k ("factor loadings"). = a) (10 points) If the APT holds, and you are given factor loadings: bB1 1.5, bB2 = 0.5, find expressions for the factors' expected excess returns as functions of g. Explain why these relationships must hold. b) (5 points) Now assume that that g = 0.2. Assume that a third asset C has factor loadings bc1 = 0.6, bc2 = 1.1. Find the estimated value c.

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

aThe expected excess return on factor 1 is equal to the sum of the factor loadings multiplied by t... View full answer

Get step-by-step solutions from verified subject matter experts