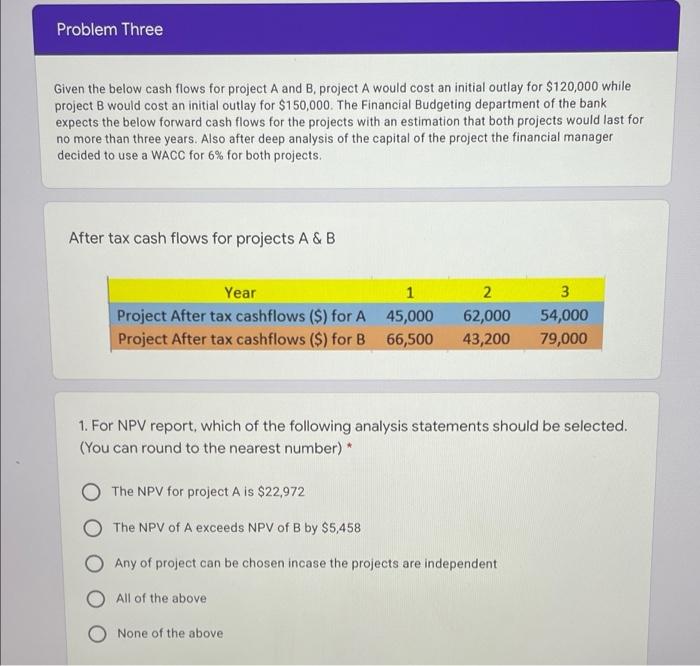

Question: Problem Three Given the below cash flows for project A and B project A would cost an initial outlay for $120,000 while project B would

Problem Three Given the below cash flows for project A and B project A would cost an initial outlay for $120,000 while project B would cost an initial outlay for $150,000. The Financial Budgeting department of the bank expects the below forward cash flows for the projects with an estimation that both projects would last for no more than three years. Also after deep analysis of the capital of the project the financial manager decided to use a WACC for 6% for both projects. After tax cash flows for projects A&B Year Project After tax cashflows ($) for A 45,000 Project After tax cashflows ($) for B 66,500 2 62,000 43,200 3 54,000 79,000 1. For NPV report, which of the following analysis statements should be selected. (You can round to the nearest number) * The NPV for project A is $22,972 The NPV of A exceeds NPV of B by $5,458 Any of project can be chosen incase the projects are independent All of the above None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts