Question: PROBLEM TWO Part B: Revenue Recognition =(20min max) LowCost Construction Company, Inc., entered into a fixed-price contract with Investments-R-Us Company on February 1, 2019, to

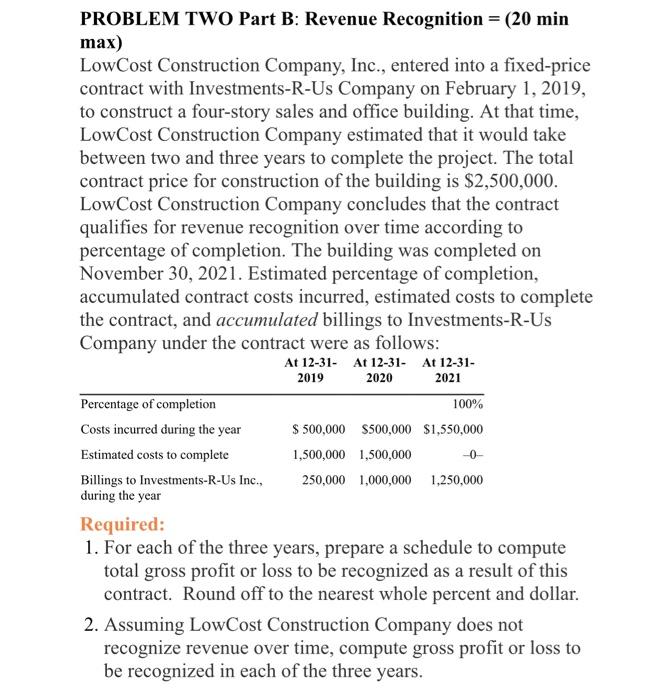

PROBLEM TWO Part B: Revenue Recognition =(20min max) LowCost Construction Company, Inc., entered into a fixed-price contract with Investments-R-Us Company on February 1, 2019, to construct a four-story sales and office building. At that time, LowCost Construction Company estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $2,500,000. LowCost Construction Company concludes that the contract qualifies for revenue recognition over time according to percentage of completion. The building was completed on November 30, 2021. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Investments-R-Us Company under the contract were as follows: contract. Round off to the nearest whole percent and dollar. 2. Assuming LowCost Construction Company does not recognize revenue over time, compute gross profit or loss to be recognized in each of the three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts