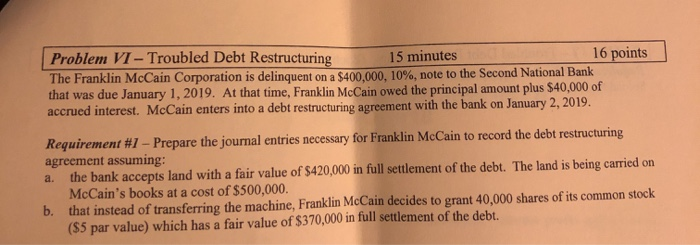

Question: Problem VI - Troubled Debt Restructuring 15 minutes 16 points The Franklin McCain Corporation is delinquent on a $400,000, 10%, note to the Second National

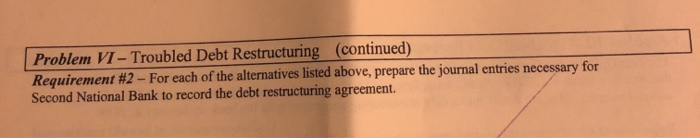

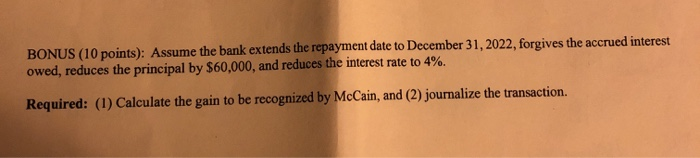

Problem VI - Troubled Debt Restructuring 15 minutes 16 points The Franklin McCain Corporation is delinquent on a $400,000, 10%, note to the Second National Bank that was due January 1, 2019. At that time, Franklin McCain owed the principal amount plus $40,000 of accrued interest. McCain enters into a debt restructuring agreement with the bank on January 2, 2019. Requirement #1 - Prepare the journal entries necessary for Franklin McCain to record the debt restructuring agreement assuming: a. the bank accepts land with a fair value of $420,000 in full settlement of the debt. The land is being carried on McCain's books at a cost of $500,000. b. that instead of transferring the machine, Franklin McCain decides to grant 40,000 shares of its common stock ($5 par value) which has a fair value of $370,000 in full settlement of the debt. Problem VI - Troubled Debt Restructuring (continued) Requirement #2 - For each of the alternatives listed above, prepare the journal entries necessary for Second National Bank to record the debt restructuring agreement. BONUS (10 points): Assume the bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by $60.000, and reduces the interest rate to 4%. Required: (1) Calculate the gain to be recognized by McCain, and (2) journalize the transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts