Question: PROBLEM1 Assume DHL will need to replace a piece of equipment in 12 years that will cost $240,000. The company will set up a sinking

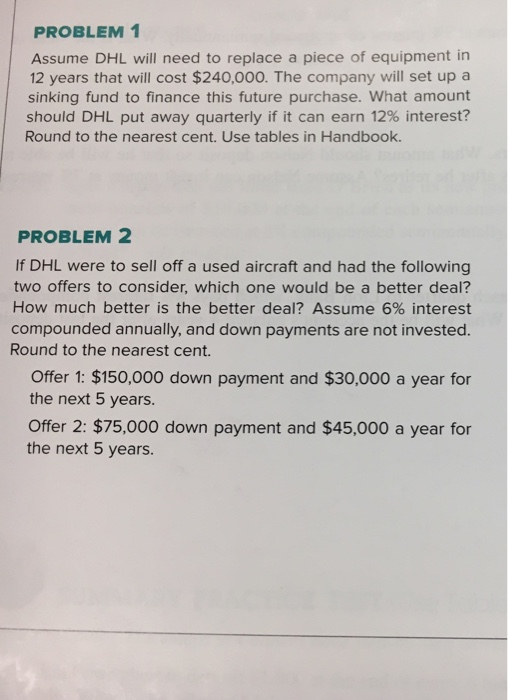

PROBLEM1 Assume DHL will need to replace a piece of equipment in 12 years that will cost $240,000. The company will set up a sinking fund to finance this future purchase. What amount should DHL put away quarterly if it can earn 12% interest? Round to the nearest cent. Use tables in Handbook PROBLEM 2 If DHL were to sell off a used aircraft and had the following two offers to consider, which one would be a better deal? How much better is the better deal? Assume 6% interest compounded annually, and down payments are not invested. Round to the nearest cent. Offer 1: $150,000 down payment and $30,000 a year for the next 5 years. Offer 2: $75,000 down payment and $45,000 a year for the next 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts