Question: Problem2 We consider pricing a European call option on a stock S which pays a known dividend yield at a rate ? (continuously compounded)The current

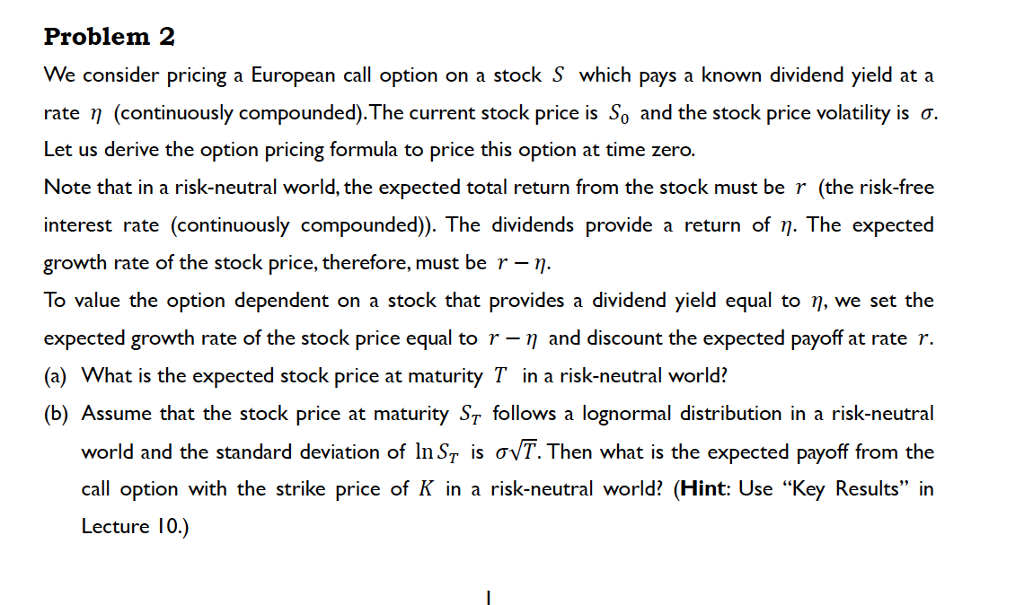

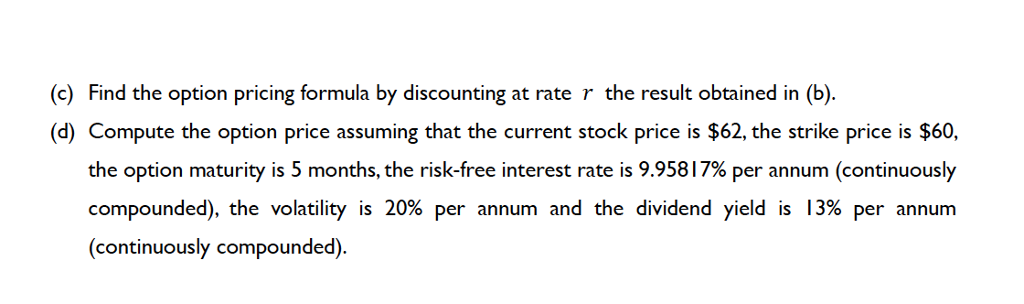

Problem2 We consider pricing a European call option on a stock S which pays a known dividend yield at a rate ? (continuously compounded)The current stock price is So and the stock price volatility is ?. Let us derive the option pricing formula to price this option at time zero. Note that in a risk-neutral world, the expected total return from the stock must be r (the risk-free interest rate (continuously compounded). The dividends provide a return of ?. The expected growth rate of the stock price, therefore, must be r-. To value the option dependent on a stock that provides a dividend yield equal to ?, we set the expected growth rate of the stock price equal to r-? and discount the expected payoff at rate r. (a) What is the expected stock price at maturity T in a risk-neutral world? (b) Assume that the stock price at maturity ST follows a lognormal distribution in a risk-neutral world and the standard deviation of InSq is ? T. Then what is the expected payoff from the call option with the strike price of K in a risk-neutral world? (Hint: Use "Key Results" in Lecture 10.) Problem2 We consider pricing a European call option on a stock S which pays a known dividend yield at a rate ? (continuously compounded)The current stock price is So and the stock price volatility is ?. Let us derive the option pricing formula to price this option at time zero. Note that in a risk-neutral world, the expected total return from the stock must be r (the risk-free interest rate (continuously compounded). The dividends provide a return of ?. The expected growth rate of the stock price, therefore, must be r-. To value the option dependent on a stock that provides a dividend yield equal to ?, we set the expected growth rate of the stock price equal to r-? and discount the expected payoff at rate r. (a) What is the expected stock price at maturity T in a risk-neutral world? (b) Assume that the stock price at maturity ST follows a lognormal distribution in a risk-neutral world and the standard deviation of InSq is ? T. Then what is the expected payoff from the call option with the strike price of K in a risk-neutral world? (Hint: Use "Key Results" in Lecture 10.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts