Question: Problem4 Numerous variations on the basic design of options have been proposed. These nonstandard options are sometimes called as exotic options. One example is a

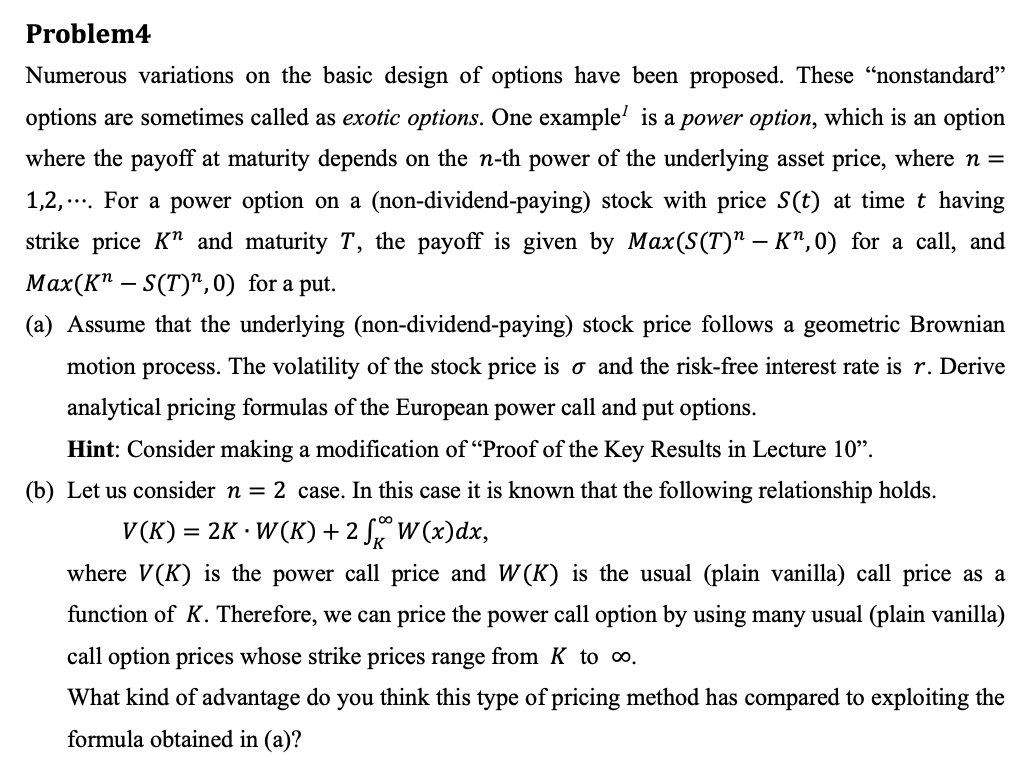

Problem4 Numerous variations on the basic design of options have been proposed. These nonstandard options are sometimes called as exotic options. One example is a power option, which is an option where the payoff at maturity depends on the n-th power of the underlying asset price, where n = 1,2,... For a power option on a (non-dividend-paying) stock with price S(t) at time t having strike price K and maturity T, the payoff is given by Max(S(T) K",0) for a call, and Max(K S(T),0) for a put. (a) Assume that the underlying (non-dividend-paying) stock price follows a geometric Brownian motion process. The volatility of the stock price is o and the risk-free interest rate is r. Derive analytical pricing formulas of the European power call and put options. Hint: Consider making a modification of Proof of the Key Results in Lecture 10. (b) Let us consider n = 2 case. In this case it is known that the following relationship holds. V(K) = 2K W(K) +2 57W(x)dx, where V(K) is the power call price and W(K) is the usual (plain vanilla) call price as a function of K. Therefore, we can price the power call option by using many usual (plain vanilla) call option prices whose strike prices range from K to oo. What kind of advantage do you think this type of pricing method has compared to exploiting the formula obtained in (a)? Problem4 Numerous variations on the basic design of options have been proposed. These nonstandard options are sometimes called as exotic options. One example is a power option, which is an option where the payoff at maturity depends on the n-th power of the underlying asset price, where n = 1,2,... For a power option on a (non-dividend-paying) stock with price S(t) at time t having strike price K and maturity T, the payoff is given by Max(S(T) K",0) for a call, and Max(K S(T),0) for a put. (a) Assume that the underlying (non-dividend-paying) stock price follows a geometric Brownian motion process. The volatility of the stock price is o and the risk-free interest rate is r. Derive analytical pricing formulas of the European power call and put options. Hint: Consider making a modification of Proof of the Key Results in Lecture 10. (b) Let us consider n = 2 case. In this case it is known that the following relationship holds. V(K) = 2K W(K) +2 57W(x)dx, where V(K) is the power call price and W(K) is the usual (plain vanilla) call price as a function of K. Therefore, we can price the power call option by using many usual (plain vanilla) call option prices whose strike prices range from K to oo. What kind of advantage do you think this type of pricing method has compared to exploiting the formula obtained in (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts