Question: problem4) what is the risk free rate? problem4) what is the market risk premium? QUESTION marker 1. line. Derive the security market line. What is

problem4) what is the risk free rate? problem4) what is the market risk premium?

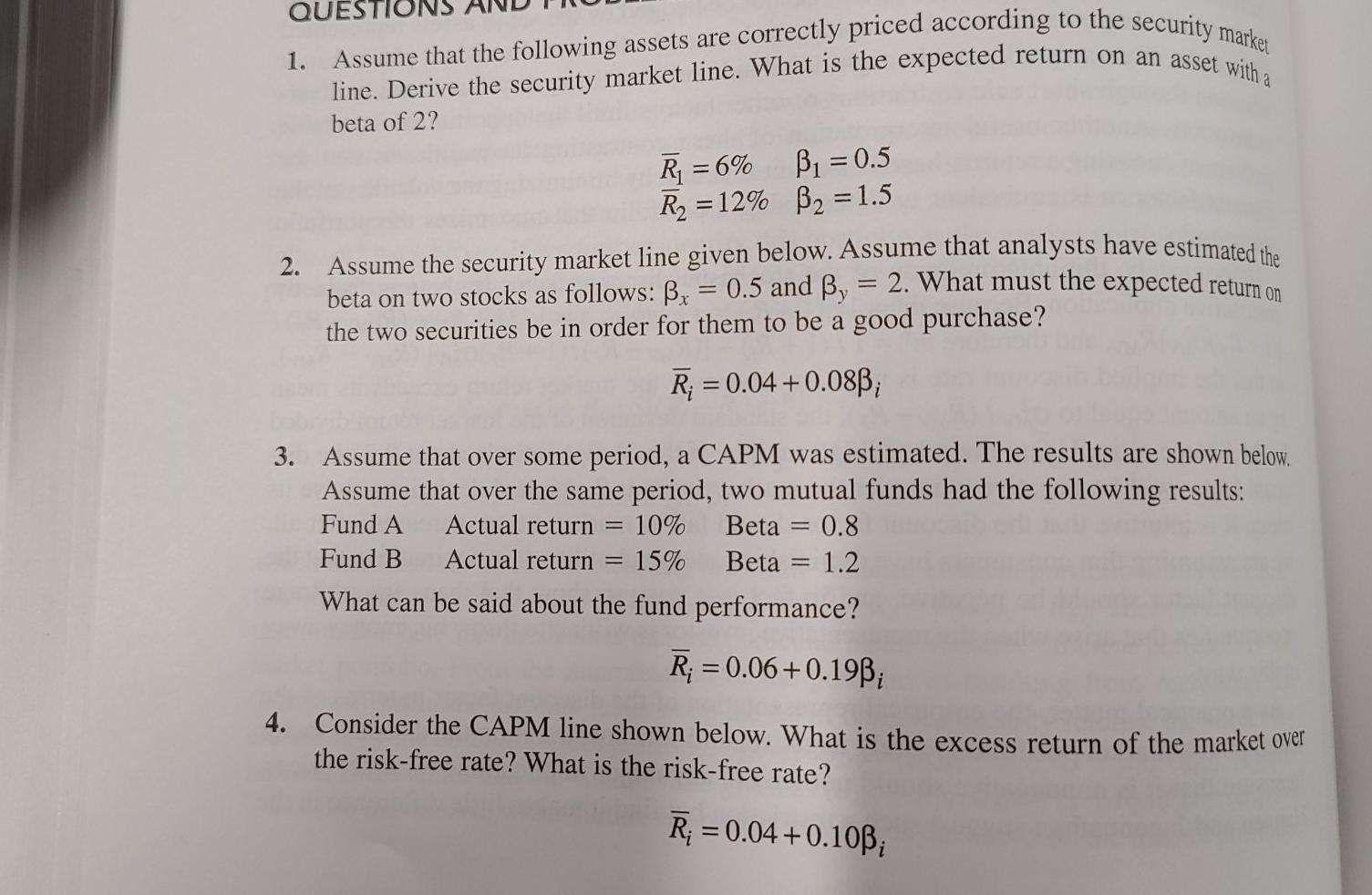

QUESTION marker 1. line. Derive the security market line. What is the expected return on an asset with a beta of 2? 2. R1 = 6% B1 = 0.5 R2 = 12% B2 = 1.5 Assume the security market line given below. Assume that analysts have estimated the beta on two stocks as follows: Bx = 0.5 and By = 2. What must the expected return on the two securities be in order for them to be a good purchase? R; = 0.04 +0.08B; = 3. Assume that over some period, a CAPM was estimated. The results are shown below. Assume that over the same period, two mutual funds had the following results: Fund A Actual return 10% Beta = 0.8 Fund B Actual return 15% Beta = 1.2 What can be said about the fund performance? - = R; = 0.06+0.19B; 4. Consider the CAPM line shown below. What is the excess return of the market over the risk-free rate? What is the risk-free rate? R;=0.04 +0.103

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts