Question: Problem#4: YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 5 years, Coupon rate = 8%, Face value

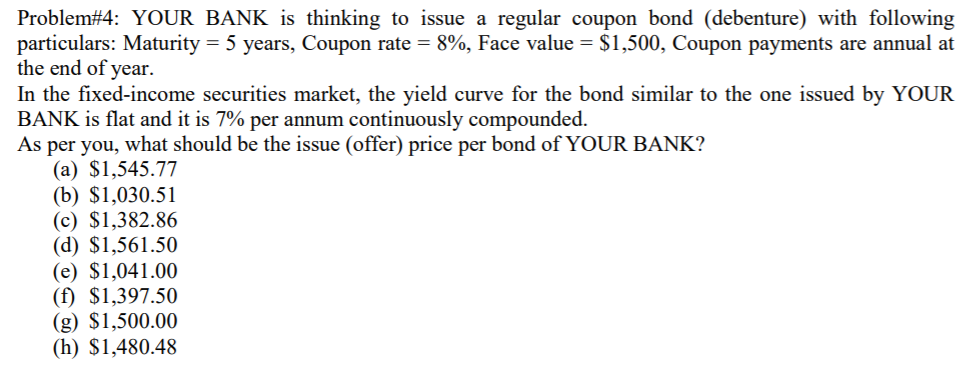

Problem#4: YOUR BANK is thinking to issue a regular coupon bond (debenture) with following particulars: Maturity = 5 years, Coupon rate = 8%, Face value = $1,500, Coupon payments are annual at the end of year. In the fixed-income securities market, the yield curve for the bond similar to the one issued by YOUR BANK is flat and it is 7% per annum continuously compounded. As per you, what should be the issue (offer) price per bond of YOUR BANK? (a) $1,545.77 (6) $1,030.51 (c) $1,382.86 (d) $1,561.50 (e) $1,041.00 (f) $1,397.50 (g) $1,500.00 (h) $1,480.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts