Question: Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from a. Set up a ratio worksheet similar to the one in Exhibit 3-6,

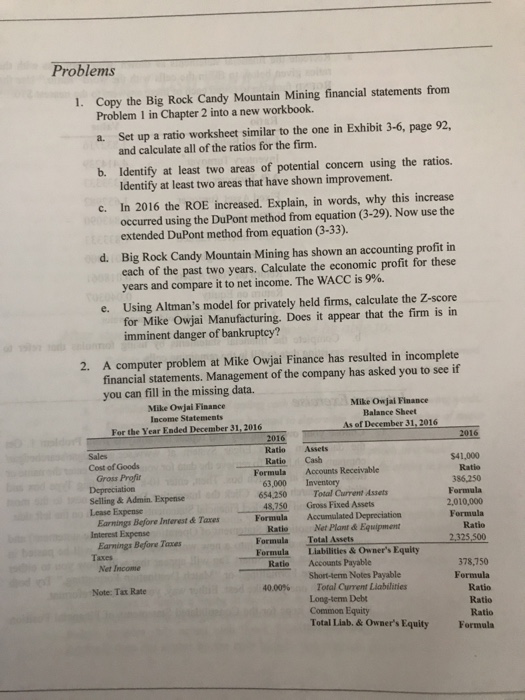

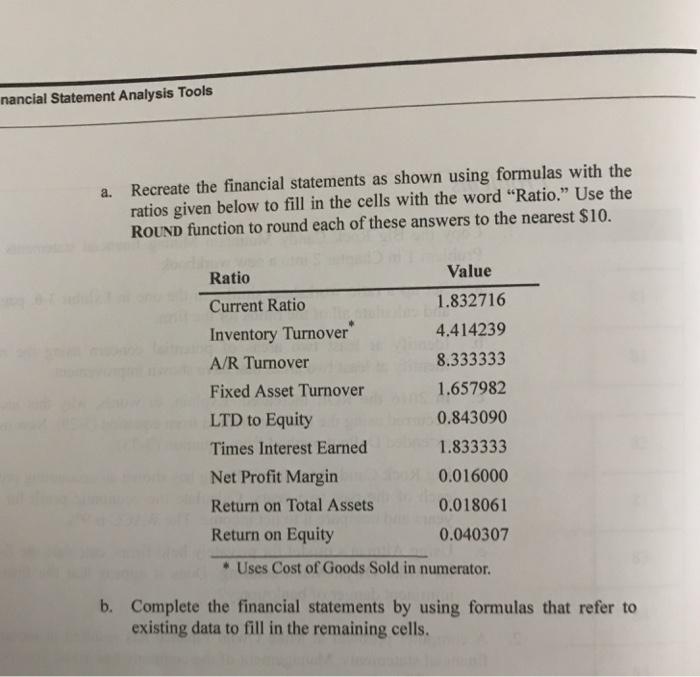

Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 92, b. Identify at least two areas of potential concern using the ratios. c. In 2016 the ROE increased. Explain, in words, why this increase Problem 1 in Chapter 2 into a new workbook. and calculate all of the ratios for the firm. Identify at least two areas that have shown improvement. occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33) d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income-The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? 2. A computer problem at Mike Owjai Finance has resulted in incomplete financial statements. Management of the company has asked you to see if you can fill in the missing data. Mike Owjai Finance Income Statements For the Year Ended December 31, 2016 Mike Owjai Finance Balance Sheet As of December 31,2016 2016 Ratio Assets Sales Cost of Goods $41,000 Ratio Cash 63,000 Inventory 48,750 Gross Fixed Assets RatioNet Plant&Equipment Ratio Formula Accounts Receivable 654,250Total Current Assets Formula Accumulated Depreciation Formula Total Assets Gross Profir 386,250 Formula 2,010,000 Formala Ratio 2,325,500 Selling & Admin. Expense Lease Expense Earnings Before Interest & Taxes Earnings Before Taxes Net Income Interest Expense Taxes FormulaLiabilities& Owner's Equity Ratio Accounts Payable 378,750 Formula Ratio Short-term Notes Payable Total Current Liabilities Long-term Debt Common Equity Total Liab. & Owner's Equity Note: Tax Rate 40.00% Ratio Ratio Formula Problems 1. Copy the Big Rock Candy Mountain Mining financial statements from a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 92, b. Identify at least two areas of potential concern using the ratios. c. In 2016 the ROE increased. Explain, in words, why this increase Problem 1 in Chapter 2 into a new workbook. and calculate all of the ratios for the firm. Identify at least two areas that have shown improvement. occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33) d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income-The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? 2. A computer problem at Mike Owjai Finance has resulted in incomplete financial statements. Management of the company has asked you to see if you can fill in the missing data. Mike Owjai Finance Income Statements For the Year Ended December 31, 2016 Mike Owjai Finance Balance Sheet As of December 31,2016 2016 Ratio Assets Sales Cost of Goods $41,000 Ratio Cash 63,000 Inventory 48,750 Gross Fixed Assets RatioNet Plant&Equipment Ratio Formula Accounts Receivable 654,250Total Current Assets Formula Accumulated Depreciation Formula Total Assets Gross Profir 386,250 Formula 2,010,000 Formala Ratio 2,325,500 Selling & Admin. Expense Lease Expense Earnings Before Interest & Taxes Earnings Before Taxes Net Income Interest Expense Taxes FormulaLiabilities& Owner's Equity Ratio Accounts Payable 378,750 Formula Ratio Short-term Notes Payable Total Current Liabilities Long-term Debt Common Equity Total Liab. & Owner's Equity Note: Tax Rate 40.00% Ratio Ratio Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts