Question: a. PROBLEMS 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. Set up a

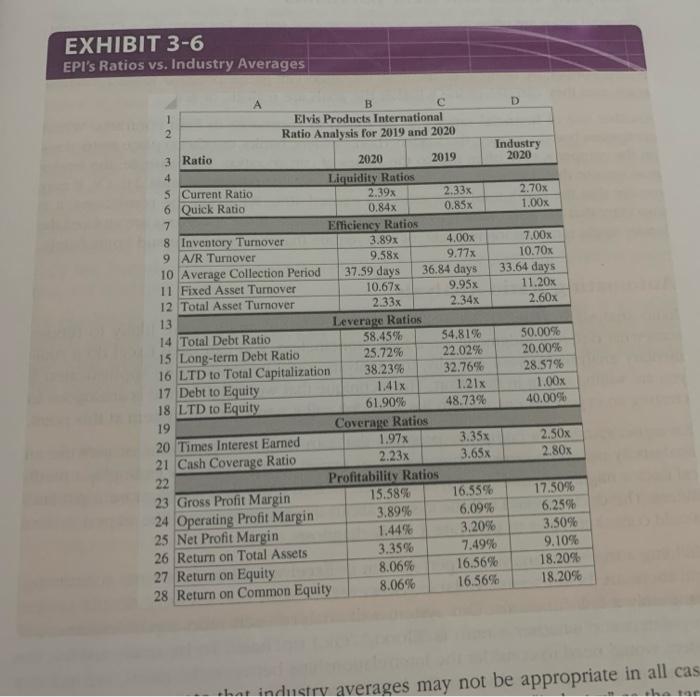

a. PROBLEMS 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 99, and calcu- late all of the ratios for the firm. b. Identify areas of concern, if any, using the ratios. Identify areas that have shown improvement, if any. In 2020 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 9%. c. e. Using Altman's model for privately held firms, calculate the Z-score for Big Rock Candy Mountain Mining. Does it appear that the firm is in imminent danger of bankruptcy? EXHIBIT 3-6 EPI's Ratios vs. Industry Averages B C D 1 Elvis Products International 2 Ratio Analysis for 2019 and 2020 Industry 3 Ratio 2020 2019 2020 4 Liquidity Ratios 5 Current Ratio 2.39% 2.33x 2.70x 6 Quick Ratio 0.84x 0.85% 1.00x 7 Efficiency Ratios 8 Inventory Turnover 3.89 4.00% 7.00x 9 A/R Turnover 9.58x 9.77x 10.70x 10 Average Collection Period 37.59 days 36.84 days 33.64 days 11 Fixed Asset Turnover 10.67% 9.95% 11.20x 12 Total Asset Turnover 2.33x 2.34x 2,60x 13 Leverage Ratios 14 Total Debt Ratio 58.45% 54,81% 50.00% 15 Long-term Debt Ratio 25.72% 22.02% 20.00% 16 LTD to Total Capitalization 38.23% 32.76% 28.57% 17 Debt to Equity 1.41x 1.21% 1.00x 18 LTD to Equity 61.90% 48.73% 40.00% 19 Coverage Ratios 20 Times Interest Earned 1.97x 3.35x 2.50x 21 Cash Coverage Ratio 2.23x 3.65x 2.80x 22 Profitability Ratios 23 Gross Profit Margin 15.58% 16.55% 17.50% 24 Operating Profit Margin 3.89% 6,09% 6.25% 25 Net Profit Margin 1.44% 3.20% 3.50% 26 Return on Total Assets 3.35% 7.49% 9.10% 8.06% 27 Return on Equity 16.56% 18.20% 8.06% 28 Return on Common Equity 16.56% 18.20% har industry averages may not be appropriate in all cas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts