Question: Problems 8-5 and 8-6 in an excel document. N(d) 0.50000 According to the Black-Scholes option pricing model, what is the option's value The current price

Problems 8-5 and 8-6 in an excel document.

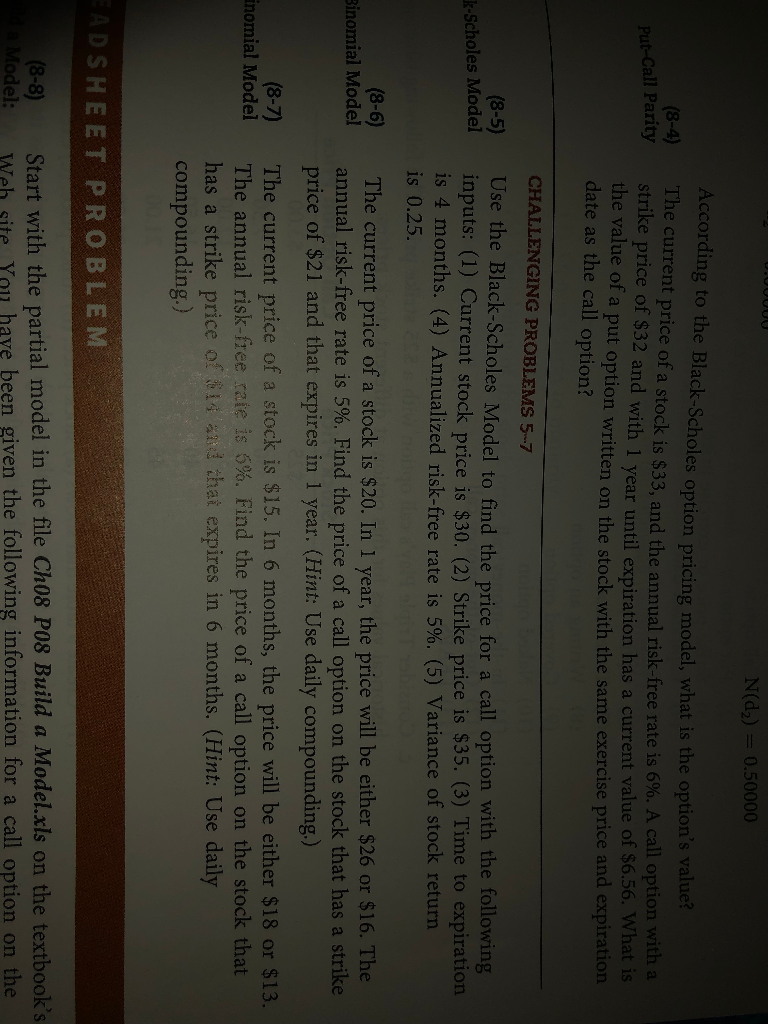

N(d) 0.50000 According to the Black-Scholes option pricing model, what is the option's value The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of so the value date as the call option? (84) ut-Call Parity .56. What is ot a put option written on the stock with the same exercise price and expiration CHALLENGING PROBLEMS 5-7 (8-5) Use the Black-Scholes Model to find the price for a call option with the following k-Scholes Model inputs: (1) Current stock price is $30. (2) Strike price is $35. (3) Time to expiration is 4 months. (4) Annualized risk-free rate is 5%. (5) Variance of stock return is 0.25. (8-6) inomial Model The current price of a stock is $20. In 1 year, the price will be either $26 or $16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of $21 and that expires in 1 year. (Hint: Use daily compounding.) The current price of a stock is $15. In 6 months, the price will be either $18 or $13. The annual risk free rate is 6%. Find the price of a call option on the stock that has a strike price of compounding.) (8-7) inom ial Model thai expires in 6 months. (Hint: Use daily ADSHEET PRO BLEM (8-8) Start with the partial model in the file Cho8 P08 Build a Modelxls on the textbooks Model: Web site You have been given the following information for a call option on the N(d) 0.50000 According to the Black-Scholes option pricing model, what is the option's value The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of so the value date as the call option? (84) ut-Call Parity .56. What is ot a put option written on the stock with the same exercise price and expiration CHALLENGING PROBLEMS 5-7 (8-5) Use the Black-Scholes Model to find the price for a call option with the following k-Scholes Model inputs: (1) Current stock price is $30. (2) Strike price is $35. (3) Time to expiration is 4 months. (4) Annualized risk-free rate is 5%. (5) Variance of stock return is 0.25. (8-6) inomial Model The current price of a stock is $20. In 1 year, the price will be either $26 or $16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of $21 and that expires in 1 year. (Hint: Use daily compounding.) The current price of a stock is $15. In 6 months, the price will be either $18 or $13. The annual risk free rate is 6%. Find the price of a call option on the stock that has a strike price of compounding.) (8-7) inom ial Model thai expires in 6 months. (Hint: Use daily ADSHEET PRO BLEM (8-8) Start with the partial model in the file Cho8 P08 Build a Modelxls on the textbooks Model: Web site You have been given the following information for a call option on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts