Question: PROBLEMS: ACCOUNTS RECEIVABLES 7. Effective with the year ended December 31, 2023, Vega Company adopted the aging of accounts receivable method instead of the

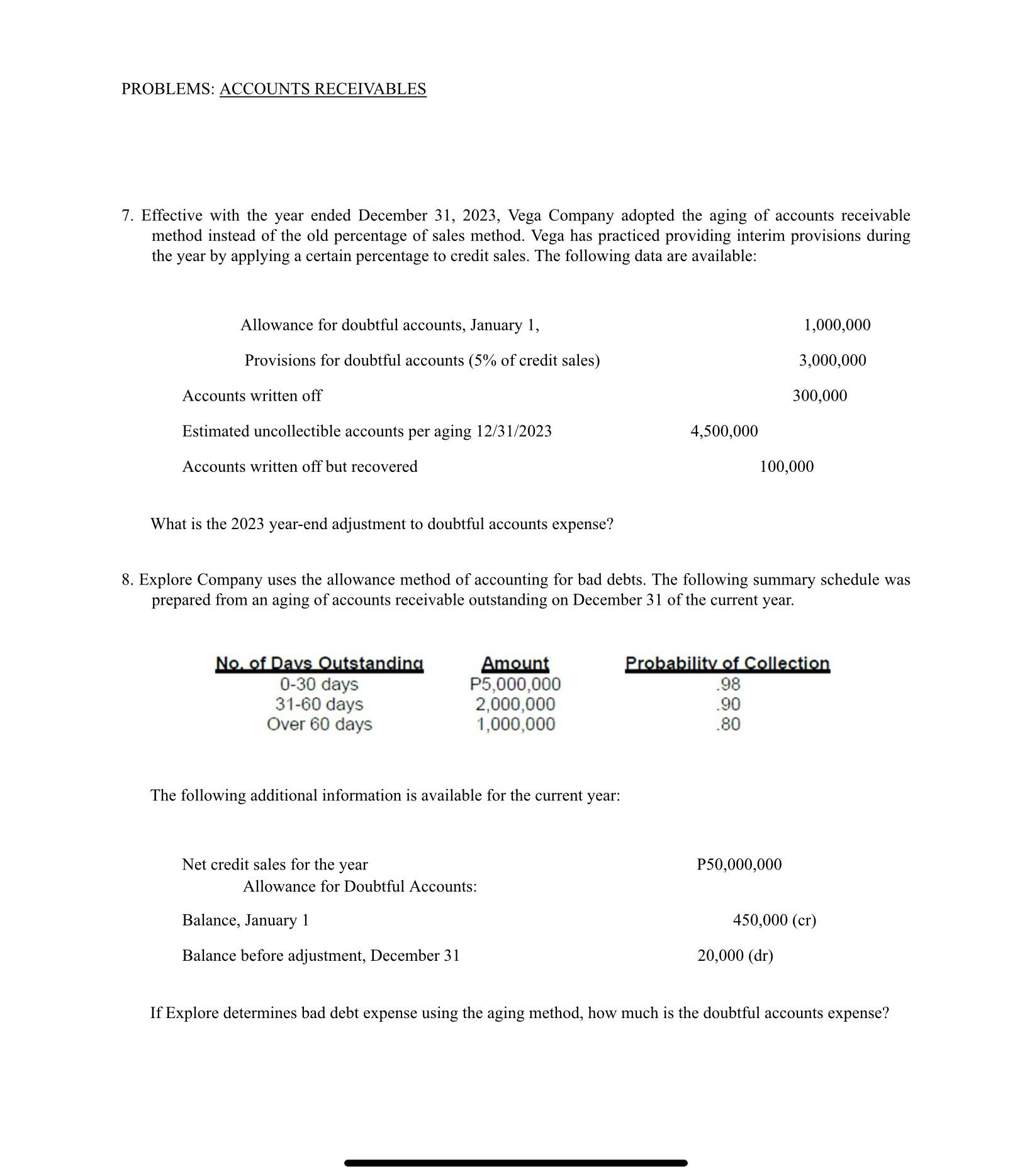

PROBLEMS: ACCOUNTS RECEIVABLES 7. Effective with the year ended December 31, 2023, Vega Company adopted the aging of accounts receivable method instead of the old percentage of sales method. Vega has practiced providing interim provisions during the year by applying a certain percentage to credit sales. The following data are available: Allowance for doubtful accounts, January 1, Provisions for doubtful accounts (5% of credit sales) Accounts written off Estimated uncollectible accounts per aging 12/31/2023 Accounts written off but recovered 1,000,000 3,000,000 300,000 4,500,000 100,000 What is the 2023 year-end adjustment to doubtful accounts expense? 8. Explore Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year. No. of Days Outstanding 0-30 days Amount P5,000,000 31-60 days Over 60 days 2,000,000 1,000,000 The following additional information is available for the current year: Net credit sales for the year Allowance for Doubtful Accounts: Balance, January 1 Balance before adjustment, December 31 Probability of Collection .98 .90 .80 P50,000,000 450,000 (cr) 20,000 (dr) If Explore determines bad debt expense using the aging method, how much is the doubtful accounts expense?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

7 To calculate the yearend adjustment to doubtful accounts expense we need to consider the following ... View full answer

Get step-by-step solutions from verified subject matter experts