Question: Problems In th e problems below, you can use a market risk premium of 55% and a tax rate of 40% where none is specified.

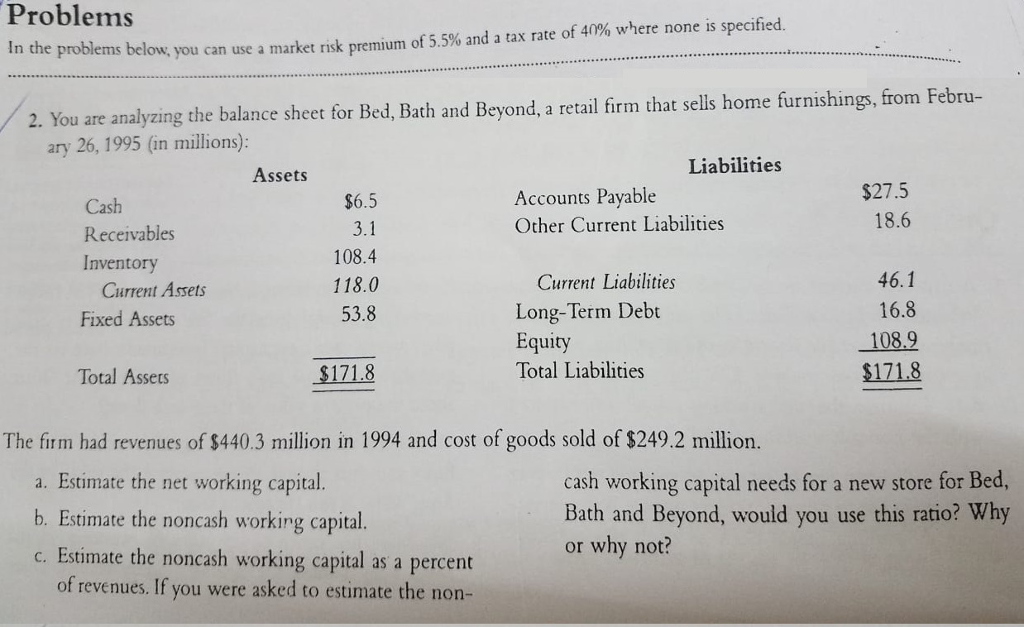

Problems In th e problems below, you can use a market risk premium of 55% and a tax rate of 40% where none is specified. 2. You are analyzing the balance sheet for Bed, Bath and Beyond, a retail firm that sells home furnishings, from Febru- ary 26, 1995 (in millions): Liabilities Assets Accounts Payable Other Current Liabilities $27.5 18.6 Cash Receivables Inventory $6.5 3.1 108.4 118.0 53.8 Current Liabilities Long-Term Debt Equity Total Liabilities 46.1 16.8 108.9 $171.8 Current Assets Fixed Assets Total Assets $171.8 The firm had revenues of $440.3 million in 1994 and cost of goods sold of $249.2 million. a. Estimate the net working capital. b. Estimate the noncash working capital c. Estimate the noncash working capital as a percent cash working capital needs for a new store for Bed, Bath and Beyond, would you use this ratio? Why or why not? of revenues. If you were asked to estimate the non

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts