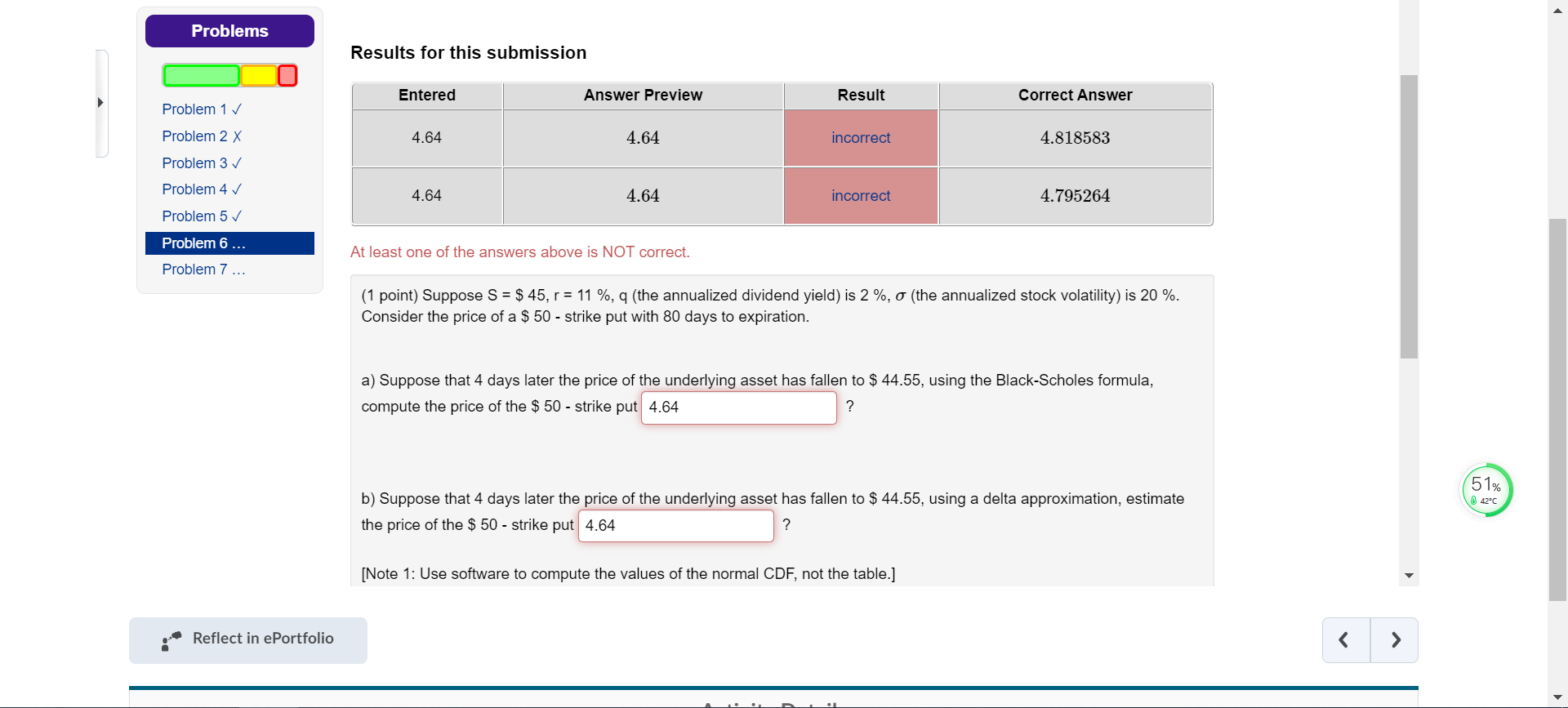

Question: Problems Results for this submission Entered Answer Preview Result Correct Answer 4.64 4.64 incorrect 4.818583 Problem 1 Problem 2 x Problem 3 Problem 4 Problem

Problems Results for this submission Entered Answer Preview Result Correct Answer 4.64 4.64 incorrect 4.818583 Problem 1 Problem 2 x Problem 3 Problem 4 Problem 5 4.64 4.64 incorrect 4.795264 Problem 6... At least one of the answers above is NOT correct. Problem 7... (1 point) Suppose S = $ 45, r = 11 %, 9 (the annualized dividend yield) is 2%, o (the annualized stock volatility) is 20 %. Consider the price of a $ 50 - strike put with 80 days to expiration. a) Suppose that 4 days later the price of the underlying asset has fallen to $ 44.55, using the Black-Scholes formula, compute the price of the $ 50 - strike put 4.64 51% 42C b) Suppose that 4 days later the price of the underlying asset has fallen to $ 44.55, using a delta approximation, estimate the price of the $ 50 - strike put 4.64 [Note 1: Use software to compute the values of the normal CDF, not the table.] Reflect in ePortfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts