Question: PROBLEMS - SERIES B problem 1 0 - 1 6 B Using present value techniques to evaluate alternative investment opportunities perry Automobile Repair Inc. currently

PROBLEMSSERIES B

problem B Using present value techniques to evaluate alternative investment

opportunities

perry Automobile Repair Inc. currently has three repair shops in Boston. Jerry Perry, the president and

chief executive officer, is facing a pleasant dilemma: the business has continued to grow rapidly and

mijor shareholders are arguing about different ways to capture more business opportunities. The com

pany requires a percent rate of return for its investment projects and uses the straightline method of

depreciation for all fixed assets.

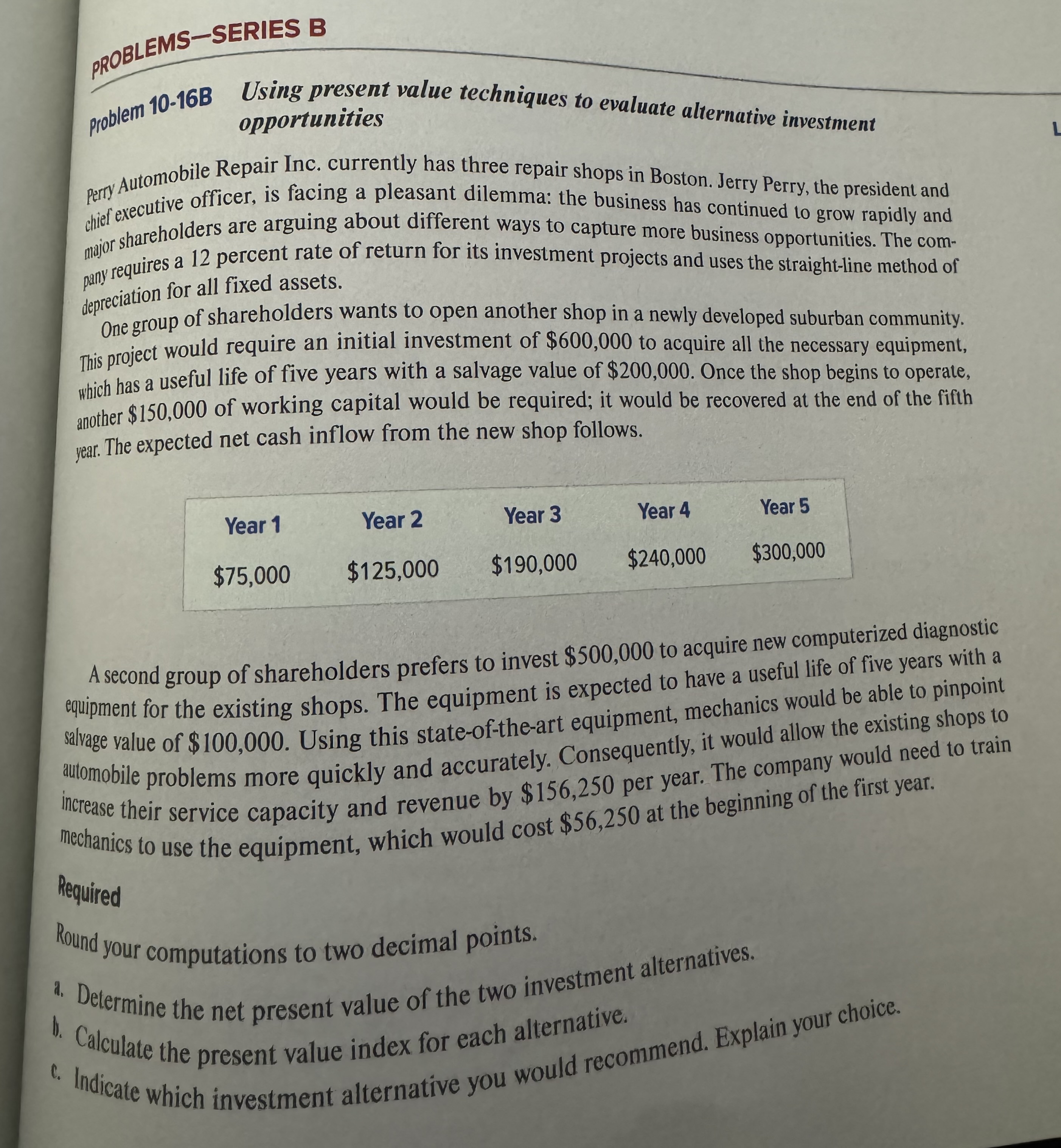

One group of shareholders wants to open another shop in a newly developed suburban community.

This project would require an initial investment of $ to acquire all the necessary equipment,

which has a useful life of five years with a salvage value of $ Once the shop begins to operate,

another $ of working capital would be required; it would be recovered at the end of the fifth

year. The expected net cash inflow from the new shop follows.

A second group of shareholders prefers to invest $ to acquire new computerized diagnostic

equipment for the existing shops. The equipment is expected to have a useful life of five years with a

salvage value of $ Using this stateoftheart equipment, mechanics would be able to pinpoint

automobile problems more quickly and accurately. Consequently, it would allow the existing shops to

increase their service capacity and revenue by $ per year. The company would need to train

mechanics to use the equipment, which would cost $ at the beginning of the first year.

Required

Round your computations to two decimal points.

a Determine the net present value of the two investment alternatives.

b Calculate the present value index for each alternative.

c Indicate which investment

PLEASE INCLUDE EXCEL FORMULAS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock