Question: Problems to work through 1. Use the table on Microsoft options to calculate the payoff value and profits for each of the following June

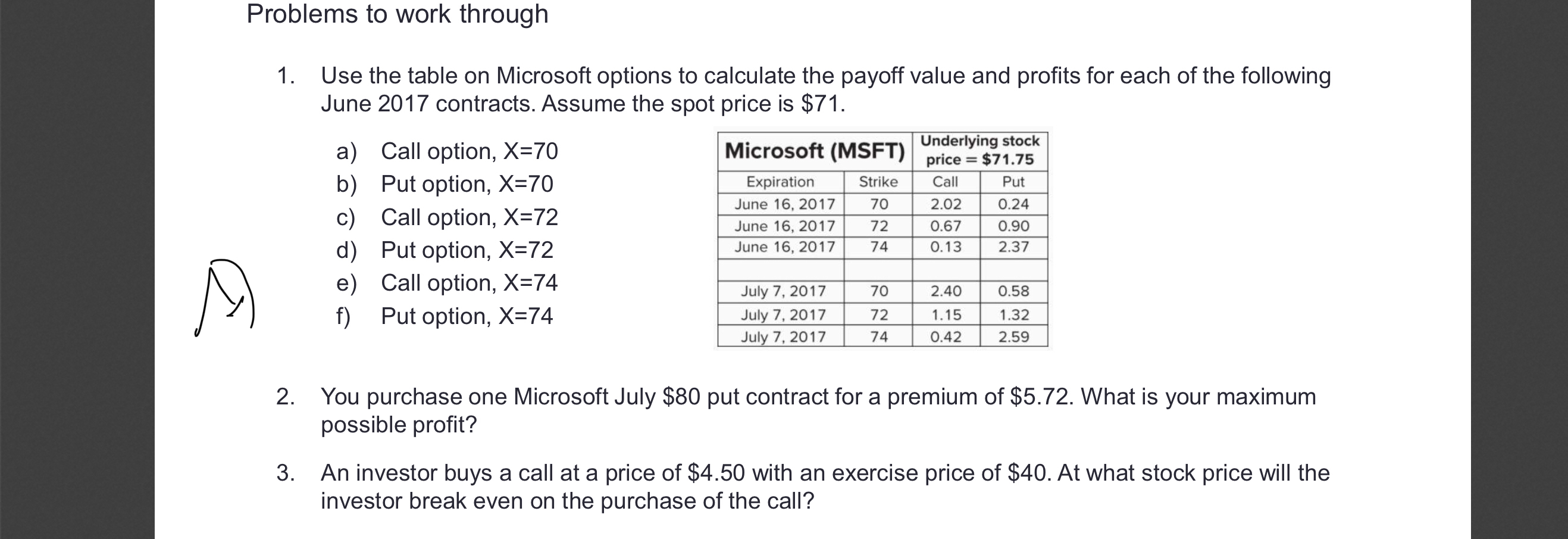

Problems to work through 1. Use the table on Microsoft options to calculate the payoff value and profits for each of the following June 2017 contracts. Assume the spot price is $71. a) Call option, X=70 A Microsoft (MSFT) price = $71.75 Underlying stock b) Put option, X=70 Expiration Strike Call Put June 16, 2017 70 2.02 0.24 c) Call option, X=72 d) Put option, X=72 e) Call option, X=74 f) Put option, X=74 June 16, 2017 72 0.67 0.90 June 16, 2017 74 0.13 2.37 July 7, 2017 70 2.40 0.58 July 7, 2017 72 1.15 1.32 July 7, 2017 74 0.42 2.59 2. You purchase one Microsoft July $80 put contract for a premium of $5.72. What is your maximum possible profit? 3. An investor buys a call at a price of $4.50 with an exercise price of $40. At what stock price will the investor break even on the purchase of the call? Terms (fill out in your own words): 1. Put Option, Call Option 2. Premium 3. Strike Price 4. Exercise an Option 5. Writer versus Holder 6. Intrinsic Value 7. In the money, out of the money, 1. American vs. European Option 2. Index Option 3. Exchange-traded vs. OTC 4. OCC 5. Breakeven 6. Callable & Convertible bond 7. Risk Management with options 2. Covered Call, Protective Put, Collar, Straddle, bulish spread

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts