Question: PROCUREMENT & SUPPLY MGMT (MGSC-5123) Assignment 2 Question 1 We assume that - One end item needs 2 units L, 1 unit C and 3

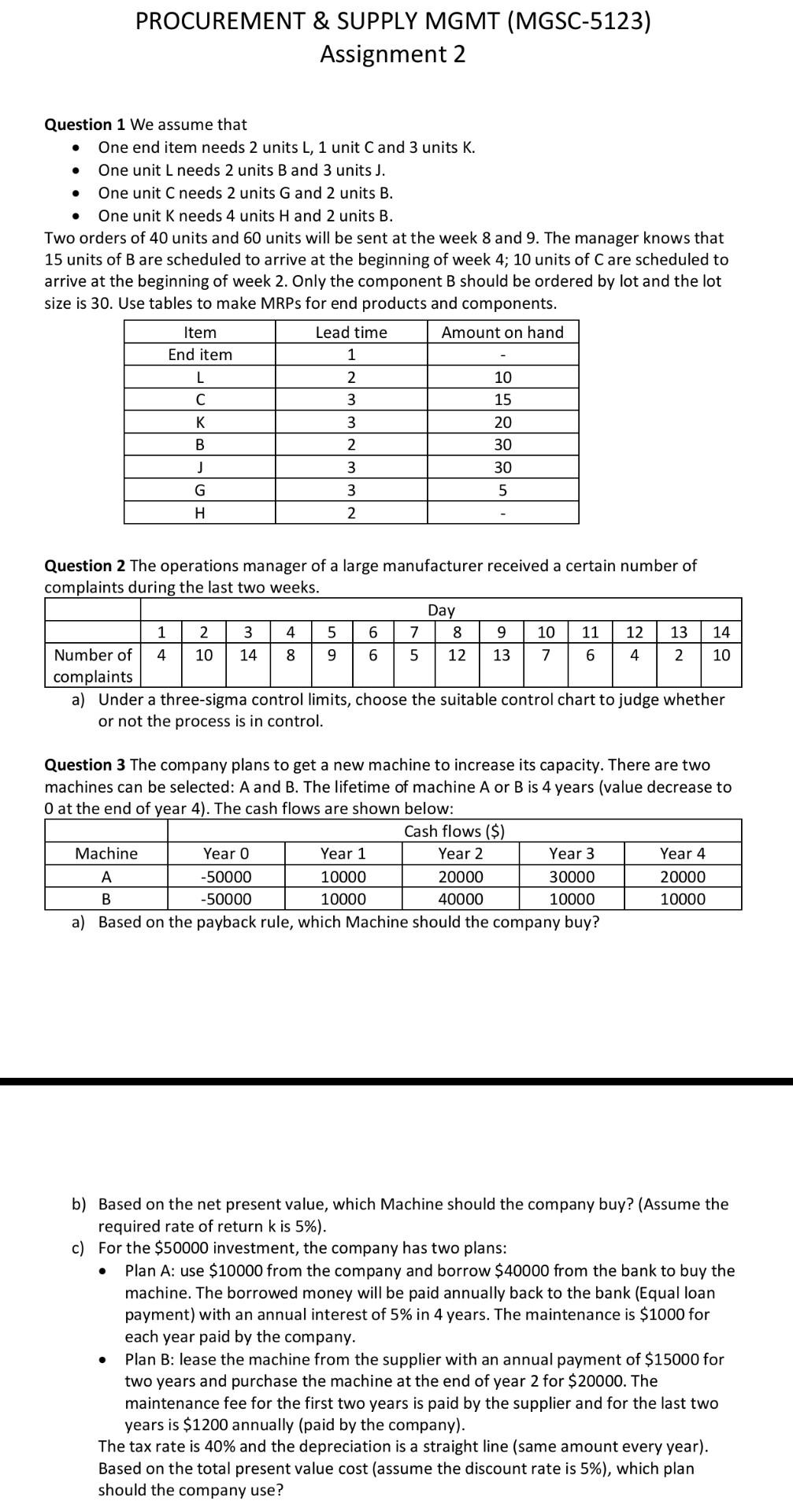

PROCUREMENT \& SUPPLY MGMT (MGSC-5123) Assignment 2 Question 1 We assume that - One end item needs 2 units L, 1 unit C and 3 units K. - One unit L needs 2 units B and 3 units J. - One unit C needs 2 units G and 2 units B. - One unit K needs 4 units H and 2 units B. Two orders of 40 units and 60 units will be sent at the week 8 and 9 . The manager knows that 15 units of B are scheduled to arrive at the beginning of week 4;10 units of C are scheduled to arrive at the beginning of week 2 . Only the component B should be ordered by lot and the lot size is 30 . Use tables to make MRPs for end products and components. Question 2 The operations manager of a large manufacturer received a certain number of complaints during the last two weeks. a) Under a three-sigma control limits, choose the suitable control chart to judge whether or not the process is in control. Question 3 The company plans to get a new machine to increase its capacity. There are two machines can be selected: A and B. The lifetime of machine A or B is 4 years (value decrease to 0 at the end of year 4). The cash flows are shown below: a) Based on the payback rule, which Machine should the company buy? b) Based on the net present value, which Machine should the company buy? (Assume the required rate of return k is 5% ). c) For the $50000 investment, the company has two plans: - Plan A: use $10000 from the company and borrow $40000 from the bank to buy the machine. The borrowed money will be paid annually back to the bank (Equal loan payment) with an annual interest of 5% in 4 years. The maintenance is $1000 for each year paid by the company. - Plan B: lease the machine from the supplier with an annual payment of $15000 for two years and purchase the machine at the end of year 2 for $20000. The maintenance fee for the first two years is paid by the supplier and for the last two years is $1200 annually (paid by the company). The tax rate is 40% and the depreciation is a straight line (same amount every year). Based on the total present value cost (assume the discount rate is 5% ), which plan should the company use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts