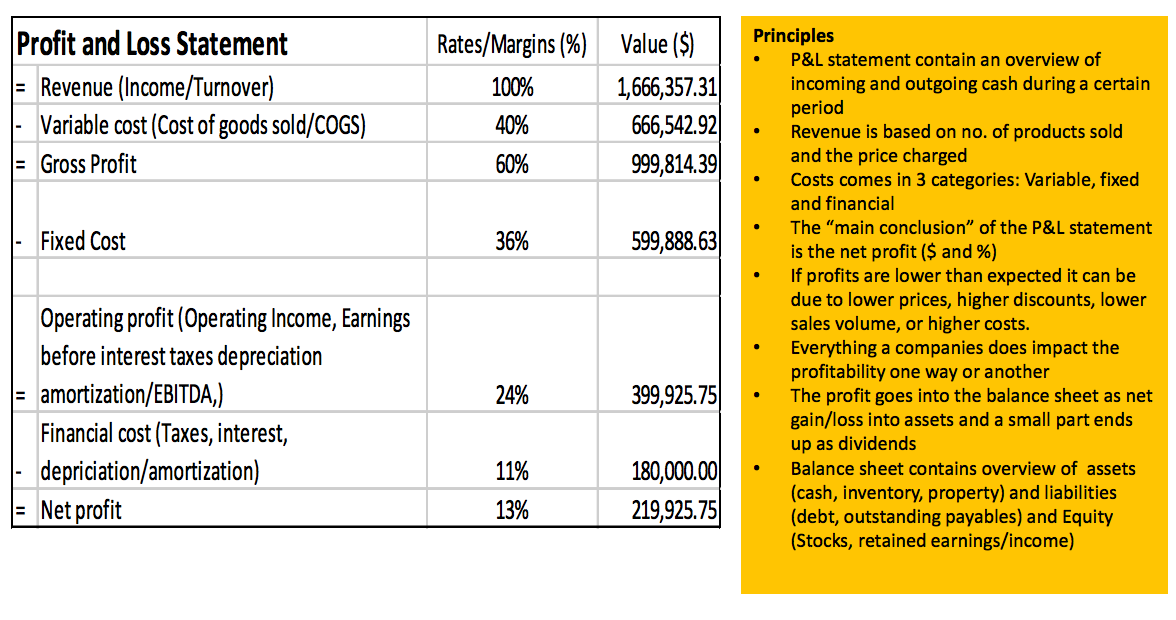

Question: Profit and Loss Statement Rates/Margins (%) Value ($) Principles P &L statement contain an overview of Revenue (Income/Turnover) 100% 1,666,357.31 incoming and outgoing cash during

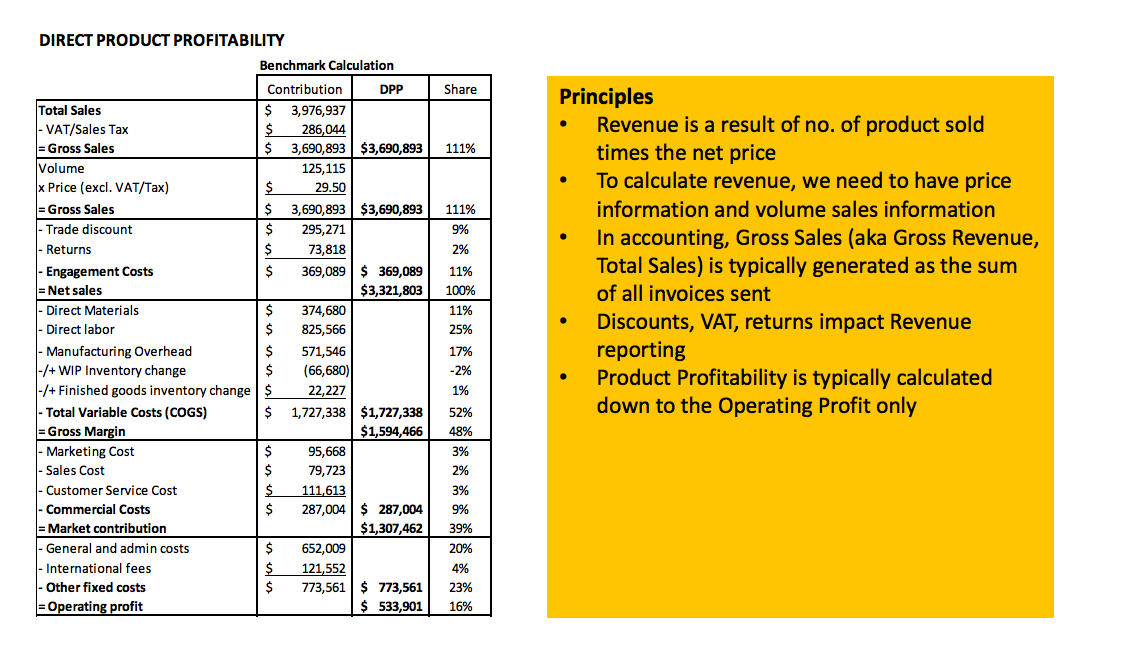

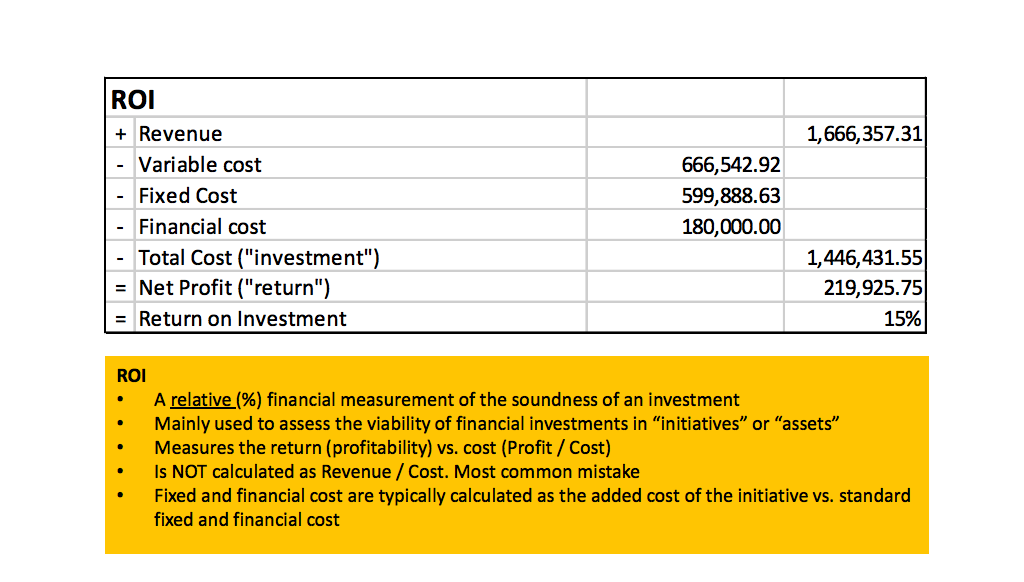

Profit and Loss Statement Rates/Margins (%) Value ($) Principles P &L statement contain an overview of Revenue (Income/Turnover) 100% 1,666,357.31 incoming and outgoing cash during a certain period Variable cost (Cost of goods sold/COGS) 40% 666,542.92 Revenue is based on no. of products sold = Gross Profit 60% 999,814.39 and the price charged Costs comes in 3 categories: Variable, fixed and financial Fixed Cost 36% 599,888.63 The "main conclusion" of the P&L statement is the net profit ($ and %) If profits are lower than expected it can be due to lower prices, higher discounts, lower Operating profit (Operating Income, Earnings sales volume, or higher costs. before interest taxes depreciation Everything a companies does impact the profitability one way or another [amortization/EBITDA,) 24% 399,925.75 The profit goes into the balance sheet as net Financial cost (Taxes, interest, gain/loss into assets and a small part ends up as dividends depriciation/amortization) 11% 180,000.00 Balance sheet contains overview of assets 13% 219,925.75 (cash, inventory, property) and liabilities Net profit (debt, outstanding payables) and Equity (Stocks, retained earnings/income)DIRECT PRODUCT PROFITABILITY Benchmark Calculation Contribution DPP Share Principles Total Sales 3,976,937 VAT/Sales Tax 286,044 . Revenue is a result of no. of product sold = Gross Sales 3,690,893 $3,690,893 111% times the net price Volume 125,115 x Price (excl. VAT/Tax) 29.50 To calculate revenue, we need to have price = Gross Sales 3,690,893 $3,690,893 111% information and volume sales information - Trade discount 295,271 9% 73,818 2% In accounting, Gross Sales (aka Gross Revenue, - Returns Engagement Costs 369,089 $ 369,089 11% Total Sales) is typically generated as the sum = Net sales $3,321,803 100% of all invoices sent - Direct Materials 374,680 11% Direct labor 825,566 25% Discounts, VAT, returns impact Revenue Manufacturing Overhead 571,546 17% reporting /+ WIP Inventory change (66,680) -2% 1% Product Profitability is typically calculated -/+ Finished goods inventory change 22,227 Total Variable Costs (COGS) 1,727,338 $1,727,338 52% down to the Operating Profit only = Gross Margin $1,594,466 48% Marketing Cost 95,668 3% Sales Cost 79,723 2% - Customer Service Cost 111,613 3% Commercial Costs 287,004 $ 287,004 9% = Market contribution $1,307,462 39% General and admin costs 652,009 20% - International fees 121,552 4% Other fixed costs 773,561 773,561 23% = Operating profit 533,901 16%ROI + Revenue 1, 666,357.31 Variable cost 666,542.92 Fixed Cost 599,888.63 Financial cost 180,000.00 Total Cost ("investment") 1,446, 431.55 = Net Profit ("return") 219,925.75 = Return on Investment 15% ROI A relative (%) financial measurement of the soundness of an investment Mainly used to assess the viability of financial investments in "initiatives" or "assets" Measures the return (profitability) vs. cost (Profit / Cost) Is NOT calculated as Revenue / Cost. Most common mistake Fixed and financial cost are typically calculated as the added cost of the initiative vs. standard fixed and financial cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts