Question: Programs Plus is a retail firm that sells computer programs for home and business use. Programs Plus operates in a state with no sales tax.

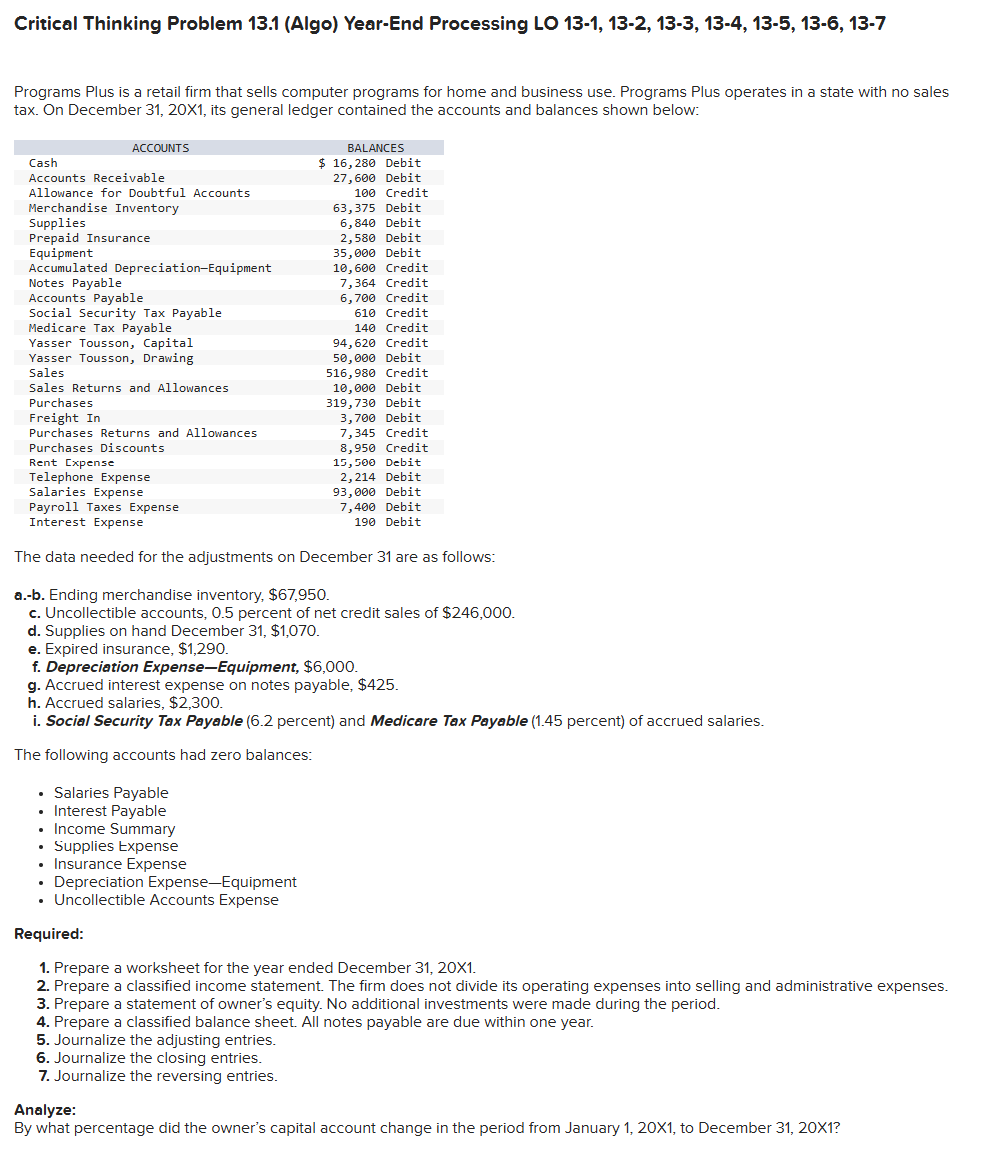

Programs Plus is a retail firm that sells computer programs for home and business use. Programs Plus operates in a state with no sales tax. On December X its general ledger contained the accounts and balances shown below:

The data needed for the adjustments on December are as follows:

ab Ending merchandise inventory, $

c Uncollectible accounts, percent of net credit sales of $

d Supplies on hand December $

e Expired insurance, $

f Depreciation ExpenseEquipment, $

g Accrued interest expense on notes payable, $

h Accrued salaries, $

i Social Security Tax Payable percent and Medicare Tax Payable percent of accrued salaries.

The following accounts had zero balances:

Salaries Payable

Interest Payable

Income Summary

Supplies Expense

Insurance Expense

Depreciation ExpenseEquipment

Uncollectible Accounts Expense

Required:

Prepare a worksheet for the year ended December X

Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses.

Prepare a statement of owner's equity. No additional investments were made during the period.

Prepare a classified balance sheet. All notes payable are due within one year.

Journalize the adjusting entries.

Journalize the closing entries.

Journalize the reversing entries.

Analyze:

By what percentage did the owner's capital account change in the period from January X to December X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock