Question: Project 2 . 4 Topic: Equity Transactions and Equity - based Compensation On 1 1 ? 2 0 1 , Illini has 2 0 ,

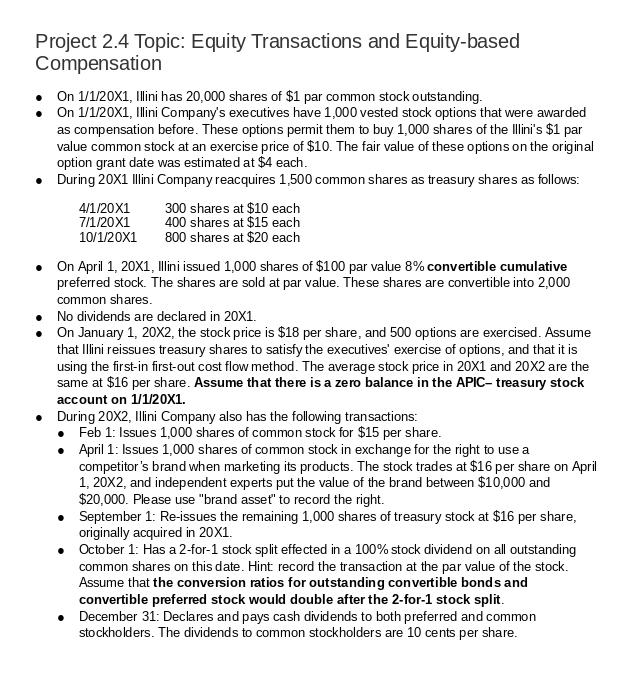

Project Topic: Equity Transactions and Equitybased

Compensation

On Illini has shares of $ par common stock outstanding.

On X Illini Company's executives have vested stock options that were awarded

as compensation before. These options permit them to buy shares of the Illini's $ par

value common stock at an exercise price of $ The fair value of these options on the original

option grant date was estimated at $ each.

During X Illini Company reacquires common shares as treasury shares as follows:

shares $ each

shares $ each

shares $ each

On April X Illini issued shares of $ par value convertible cumulative

preferred stock. The shares are sold at par value. These shares are convertible into

common shares.

No dividends are declared in X

On January X the stock price is $ per share, and options are exercised. Assume

that Illini reissues treasury shares to satisfy the executives' exercise of options, and that it is

using the firstin firstout cost flow method. The average stock price in X and X are the

same at $ per share. Assume that there is a zero balance in the APIC treasury stock

account on

During X Illini Company also has the following transactions:

Feb : Issues shares of common stock for $ per share.

April : Issues shares of common stock in exchange for the right to use a

competitor's brand when marketing its products. The stock trades at $ per share on April

and independent experts put the value of the brand between $ and

$ Please use "brand asset" to record the right.

September : Reissues the remaining shares of treasury stock at $ per share,

originally acquired in

October : Has a for stock split effected in a stock dividend on all outstanding

common shares on this date. Hint: record the transaction at the par value of the stock.

Assume that the conversion ratios for outstanding convertible bonds and

convertible preferred stock would double after the for stock split.

December : Declares and pays cash dividends to both preferred and common

stockholders. The dividends to common stockholders are cents per share. Project Ledger

tableDateAccount Name,Debit,Credit,Treasury stock,ACash,,BTreasury stock,CCash,,DXTreasury stock,Cash,,FXCash,,GPreferred stock,,HCash,,APIC stock options,JTreasury stock,,KAPICtreasury stock,LCash,,MCommon stock,,NAPIC,,Brand asset,PCommon stock,,APAC,,RCash,,SAPICtreasury stock,TRetained earnings,UTreasury stock,,Vtimes Retained earnings,WCommon stock,,XRetained earnings,YCash,,Z

I need help figuring out U through Z

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock