Question: Project #2 - Capital Budgeting Assignment 1. A&B Enterprises is trying to select the best investment from among three alternatives. Each alternative involves an initial

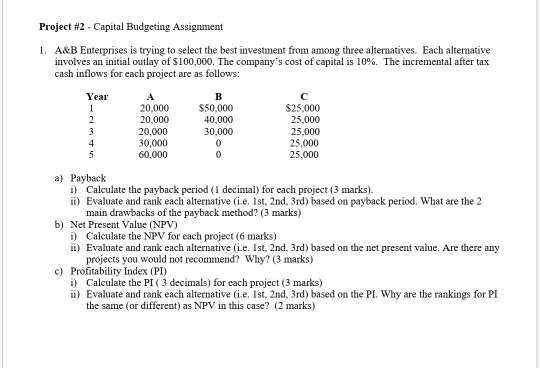

Project #2 - Capital Budgeting Assignment 1. A&B Enterprises is trying to select the best investment from among three alternatives. Each alternative involves an initial outlay of $100,000. The company's cost of capital is 10%. The incremental after tax cash inflows for each project are as follows: Year B 20,000 $50,000 $25,000 2 20,000 40,000 25,000 3 20,000 30,000 25,000 4 30,000 0 25,000 5 60.000 25.000 a) Payback 1) Calculate the payback period (I decimal) for each project (3 marks). ii) Evaluate and rank each alternative (.e. 1st, 2nd, 3rd) based on payback period. What are the 2 main drawbacks of the payback method? (3 marks) b) Net Present Value (NPV) i) Calculate the NPV for each project (6 marks) ii) Evaluate and rank each alternative (i.e. Ist, 2nd, 3rd) based on the net present value. Are there any projects you would not recommend? Why? (3 marks) c) Profitability Index (PI) D) Calculate the PI ( 3 decimals) for each project (3 marks) ii) Evaluate and rank each alternative (i.e. 1st, 2nd, 3rd) based on the PI. Why are the rankings for PI the same (or different) as NPV in this case? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock