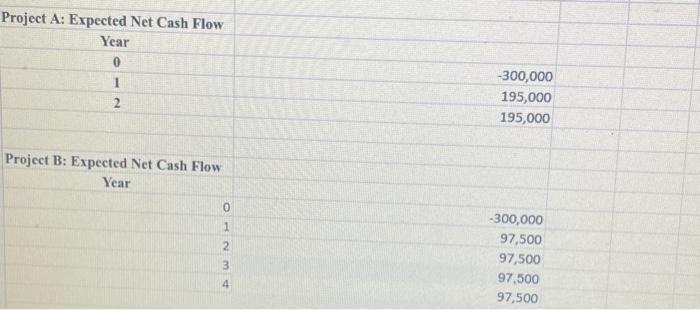

Question: Project A: Expected Net Cash Flow begin{tabular}{c|c|} hline Year & hline 0 & 300,000 hline 1 & 195,000 hline 2 & 195,000

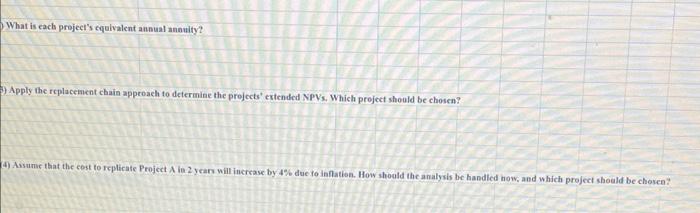

Project A: Expected Net Cash Flow \begin{tabular}{c|c|} \hline Year & \\ \hline 0 & 300,000 \\ \hline 1 & 195,000 \\ \hline 2 & 195,000 \\ \hline \end{tabular} Project B: Expected Net Cash Flow What is cach project's cqulvalent annual annuity? A) Apply the replacement chain approaeh to determine the projects' extended NPVs. Which project should be chosen? 4) Assume that the cest to replicate Project A in 2 years will increase by 4% due fo inflation. How should the analysis be handied how, and which project should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts