Question: Project: Capital Budgeting Your division is considering two projects. 3. If the two projects are mutually exclusive and the WACC is 10%, which project(s) should

| Project: Capital Budgeting |

Your division is considering two projects.

3. If the two projects are mutually exclusive and the WACC is 10%, which project(s) should be chosen?

4. If the WACC was 5%, would this change your recommendation if the projects were mutually exclusive?

5. If the WACC was 15%, would this change your recommendation? Explain your answers.

6. If the payback was the only method a firm used to accept or reject projects, in your opinion how would you

7. What's the difference between the IRR and the MIRR, and which generally gives a better

8. Why do most academics regard the NPV as being the single best criterion and

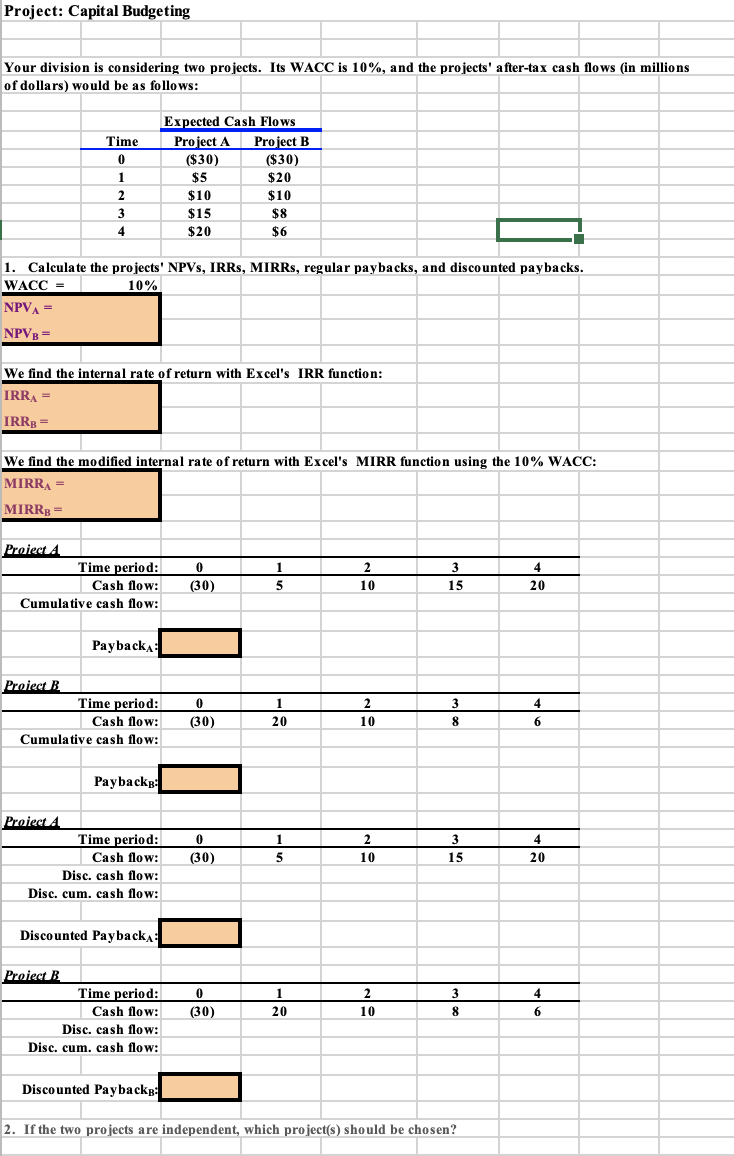

Project: Capital Budgeting Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: : Time 0 1 2 2 3 4 - Expected Cash Flows Project A Project B ($30) ($30) $5 $20 $10 $10 $15 $8 $20 $6 1. Calculate the projects' NPVS, IRRS, MIRRs, regular paybacks, and discounted paybacks. WACC = 10% NPVA = NPVB = We find the internal rate of return with Excel's IRR function: IRRA IRRB = We find the modified internal rate of return with Excel's MIRR function using the 10% WACC: MIRRA MIRRB = 1 4 Proiect 4 Time period: Cash flow: Cumulative cash flow: 0 (30) 2 10 3 15 5 20 Payback: Project B Time period: Cash flow: Cumulative cash flow: 0 (30) 1 20 2 2 10 3 8 4 6 6 Paybacks: 4 Proiect 4 Time period: Cash flow: Disc. cash flow: Disc. cum. cash flow: 0 (30) 1 5 2 10 3 15 20 Discounted Payback 4 Proiect B Time period: Cash flow: Disc. cash flow: Disc. cum. cash flow: 0 (30) 1 20 2 10 3 3 8 6 Discounted Payback: 2. If the two projects are independent, which project(s) should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts