Question: Project Context & Volume Projections . There are currently 6 Orthopedic and Sports Medicine physicians using an extremities MRI at 850. When these 6 physicians

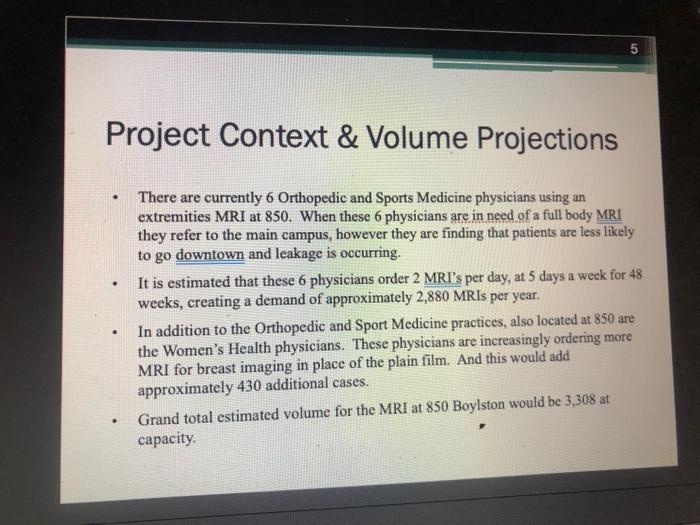

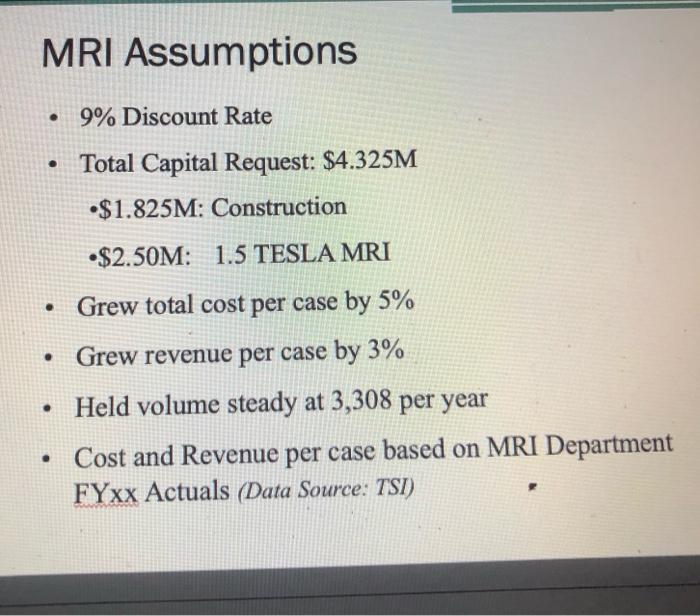

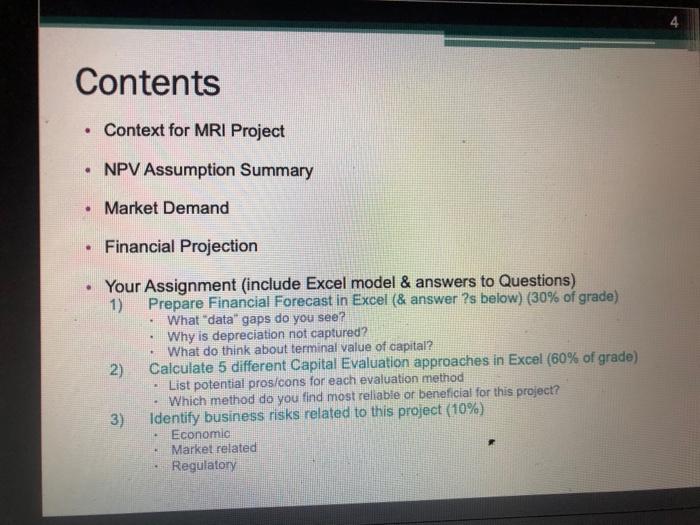

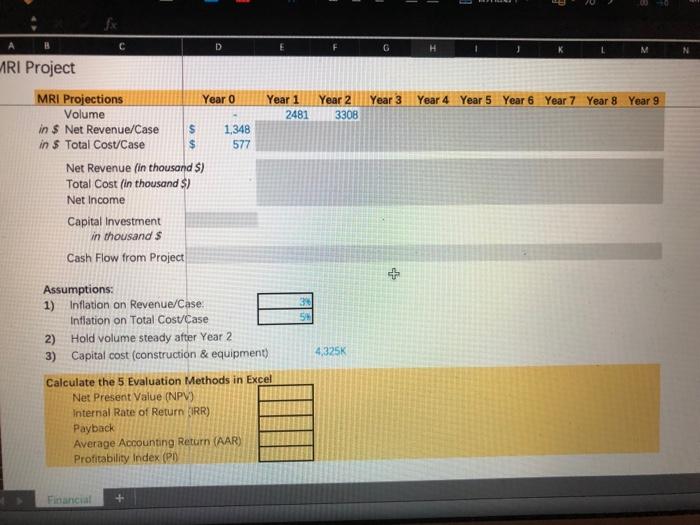

Project Context & Volume Projections . There are currently 6 Orthopedic and Sports Medicine physicians using an extremities MRI at 850. When these 6 physicians are in need of a full body MRI they refer to the main campus, however they are finding that patients are less likely to go downtown and leakage is occurring. It is estimated that these 6 physicians order 2 MRI's per day, at 5 days a week for 48 weeks, creating a demand of approximately 2,880 MRIs per year. In addition to the Orthopedic and Sport Medicine practices, also located at 850 are the Women's Health physicians. These physicians are increasingly ordering more MRI for breast imaging in place of the plain film. And this would add approximately 430 additional cases. Grand total estimated volume for the MRI at 850 Boylston would be 3,308 at capacity . . MRI Assumptions 9% Discount Rate . Total Capital Request: $4.325M $1.825M: Construction $2.50M: 1.5 TESLA MRI . Grew total cost per case by 5% . . Grew revenue per case by 3% Held volume steady at 3,308 per year Cost and Revenue per case based on MRI Department FYxx Actuals (Data Source: TSI) Contents Context for MRI Project NPV Assumption Summary Market Demand Financial Projection . Your Assignment (include Excel model & answers to Questions) 1) Prepare Financial Forecast in Excel (& answer?s below) (30% of grade) What "data" gaps do you see? Why is depreciation not captured? What do think about terminal value of capital? 2) Calculate 5 different Capital Evaluation approaches in Excel (60% of grade) List potential pros/cons for each evaluation method Which method do you find most reliable or beneficial for this project? 3) Identify business risks related to this project (10%) Economic Market related Regulatory - B C D F H L N ARI Project Year 3 Year 1 2481 Year 2 3308 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 MRI Projections Year 0 Volume in $ Net Revenue/Case $ 1.348 in $ Total Cost/Case $ 577 Net Revenue (in thousand S) Total Cost (in thousand $) Net Income Capital Investment in thousands Cash Flow from Project + Assumptions: 1) Inflation on Revenue/Case: Inflation on Total Cost/Case 2) Hold volume steady after Year 2 3) Capital cost (construction & equipment) 4,325K Calculate the 5 Evaluation Methods in Excel Net Present Value (NPV) Internal Rate of Return (IRR) Payback Average Accounting Return (AAR) Profitability Index (PD Financial + Project Context & Volume Projections . There are currently 6 Orthopedic and Sports Medicine physicians using an extremities MRI at 850. When these 6 physicians are in need of a full body MRI they refer to the main campus, however they are finding that patients are less likely to go downtown and leakage is occurring. It is estimated that these 6 physicians order 2 MRI's per day, at 5 days a week for 48 weeks, creating a demand of approximately 2,880 MRIs per year. In addition to the Orthopedic and Sport Medicine practices, also located at 850 are the Women's Health physicians. These physicians are increasingly ordering more MRI for breast imaging in place of the plain film. And this would add approximately 430 additional cases. Grand total estimated volume for the MRI at 850 Boylston would be 3,308 at capacity . . MRI Assumptions 9% Discount Rate . Total Capital Request: $4.325M $1.825M: Construction $2.50M: 1.5 TESLA MRI . Grew total cost per case by 5% . . Grew revenue per case by 3% Held volume steady at 3,308 per year Cost and Revenue per case based on MRI Department FYxx Actuals (Data Source: TSI) Contents Context for MRI Project NPV Assumption Summary Market Demand Financial Projection . Your Assignment (include Excel model & answers to Questions) 1) Prepare Financial Forecast in Excel (& answer?s below) (30% of grade) What "data" gaps do you see? Why is depreciation not captured? What do think about terminal value of capital? 2) Calculate 5 different Capital Evaluation approaches in Excel (60% of grade) List potential pros/cons for each evaluation method Which method do you find most reliable or beneficial for this project? 3) Identify business risks related to this project (10%) Economic Market related Regulatory - B C D F H L N ARI Project Year 3 Year 1 2481 Year 2 3308 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 MRI Projections Year 0 Volume in $ Net Revenue/Case $ 1.348 in $ Total Cost/Case $ 577 Net Revenue (in thousand S) Total Cost (in thousand $) Net Income Capital Investment in thousands Cash Flow from Project + Assumptions: 1) Inflation on Revenue/Case: Inflation on Total Cost/Case 2) Hold volume steady after Year 2 3) Capital cost (construction & equipment) 4,325K Calculate the 5 Evaluation Methods in Excel Net Present Value (NPV) Internal Rate of Return (IRR) Payback Average Accounting Return (AAR) Profitability Index (PD Financial +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts