Question: Assume that you have set up an Emirati corporation that does business in many countries, including in the USA. Your company is set up as

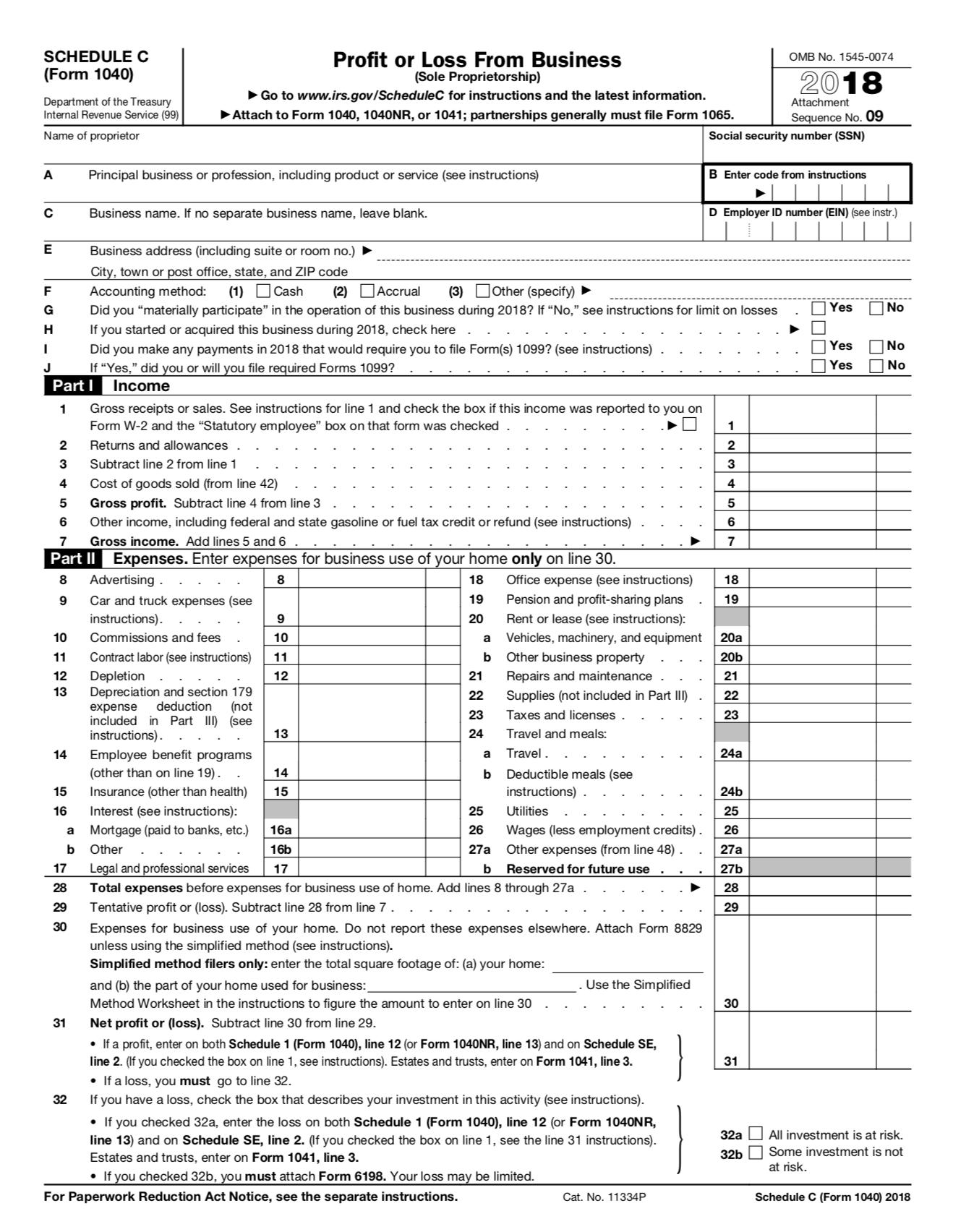

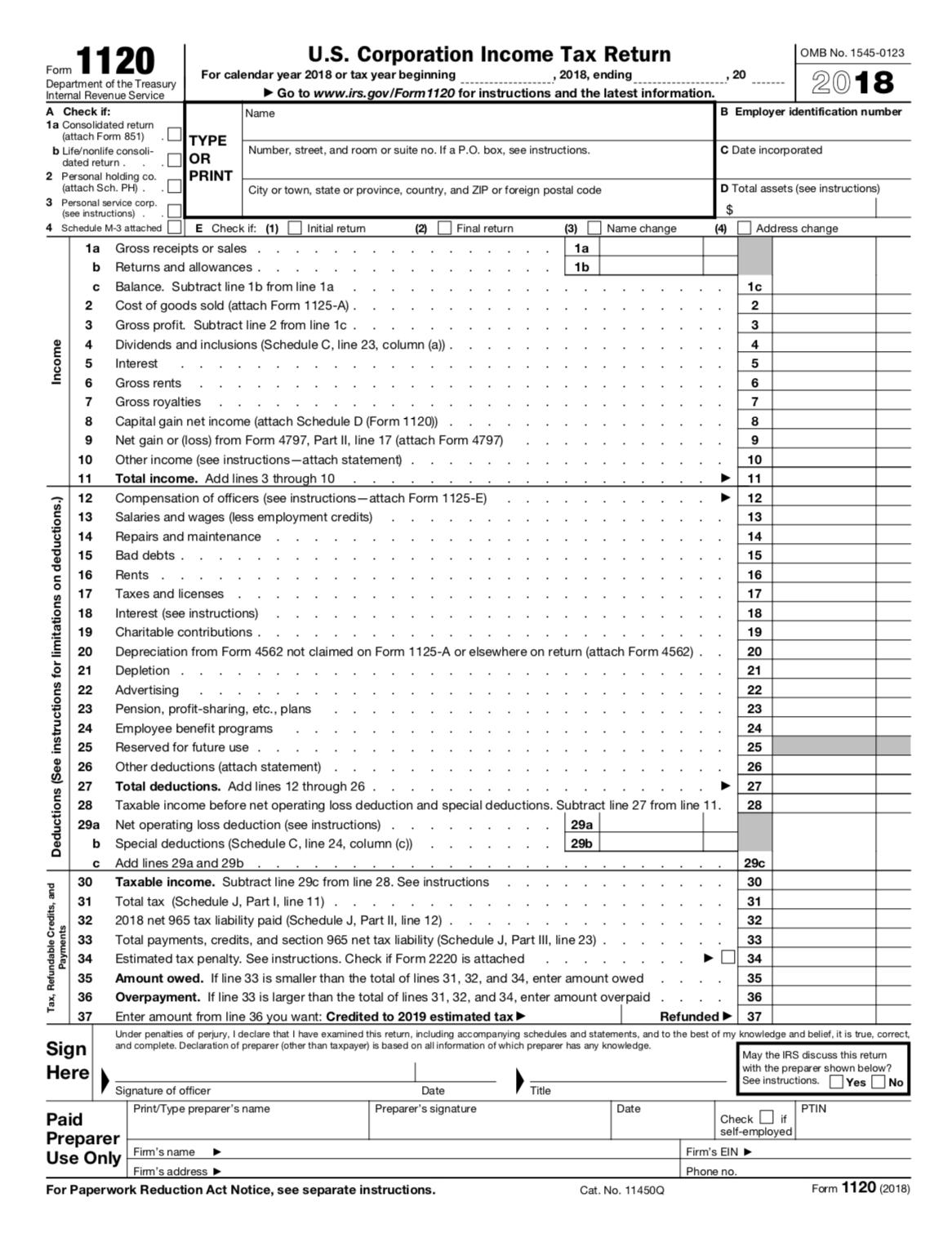

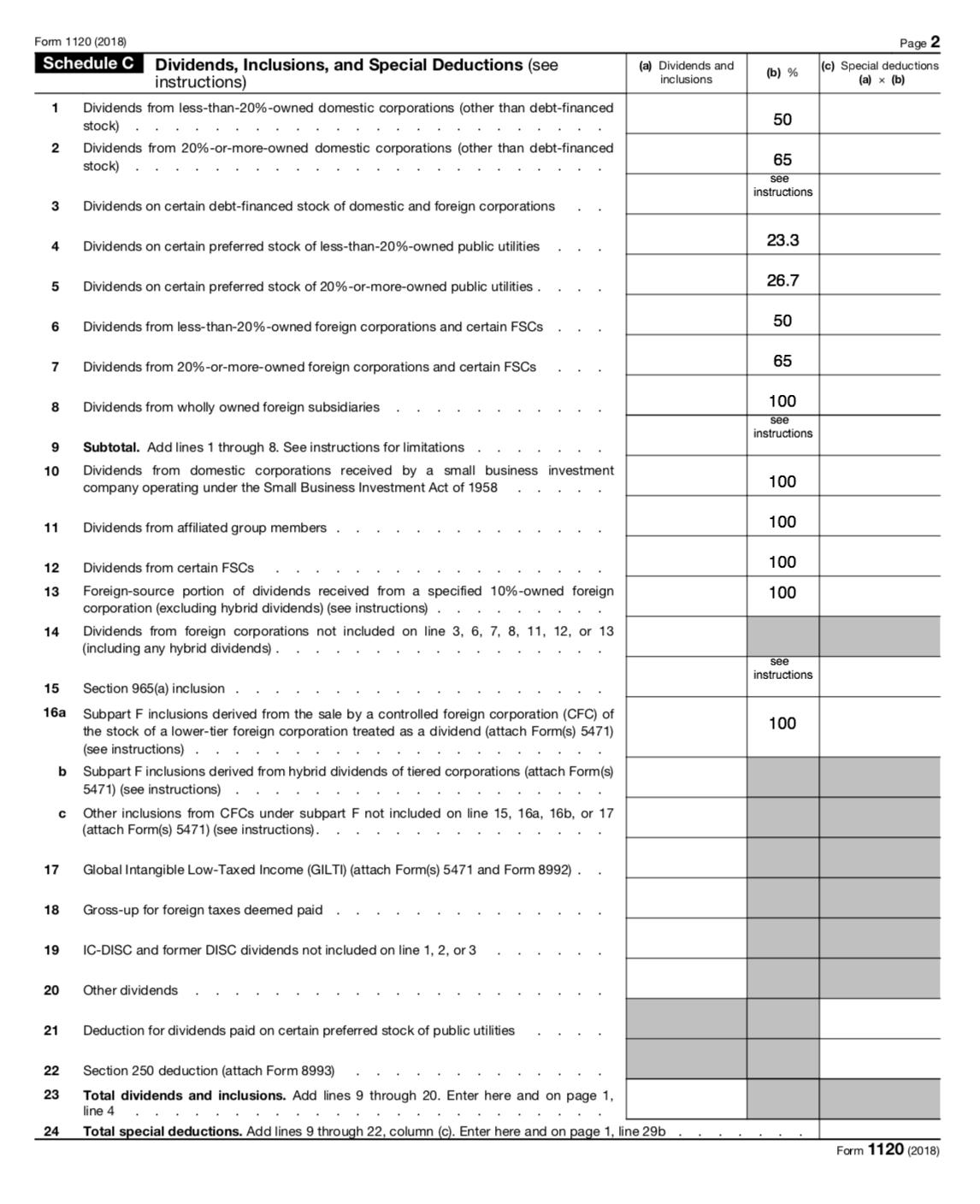

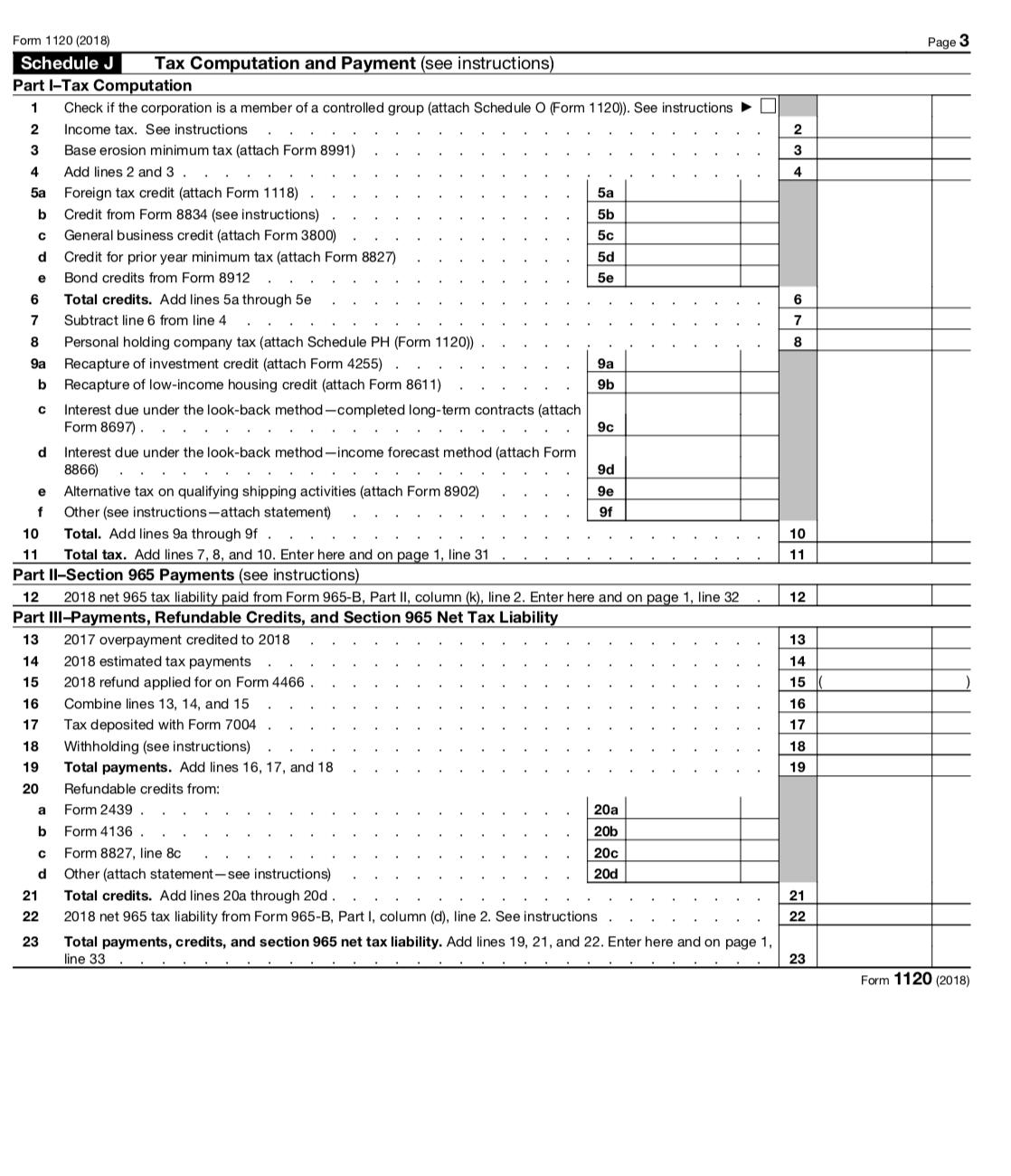

Assume that you have set up an Emirati corporation that does business in many countries, including in the USA. Your company is set up as a large US C-corporation and your company is required to submit Form 1120 to report corporate income. and Schedule C to report dividend income from other companies that your corporation owns.

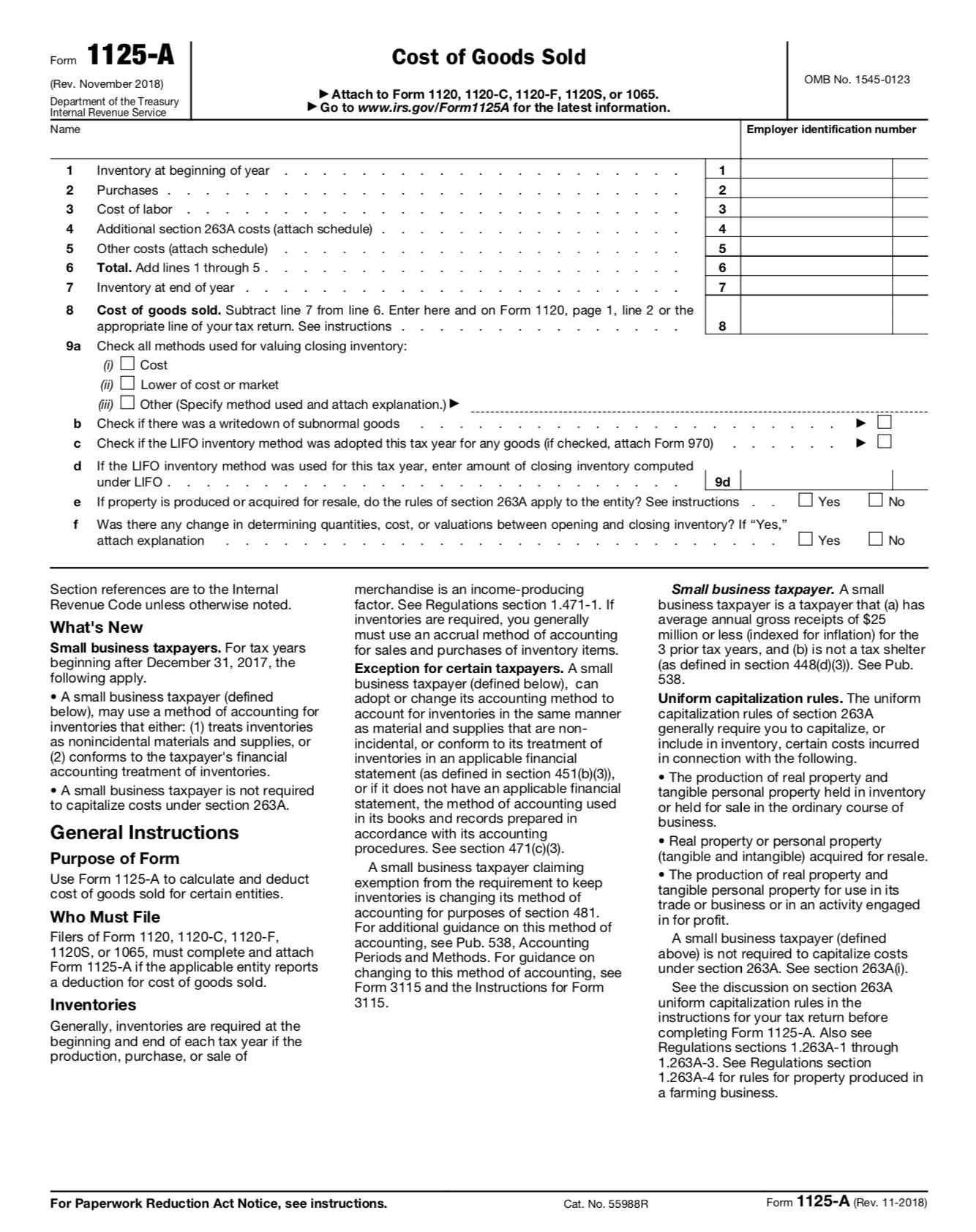

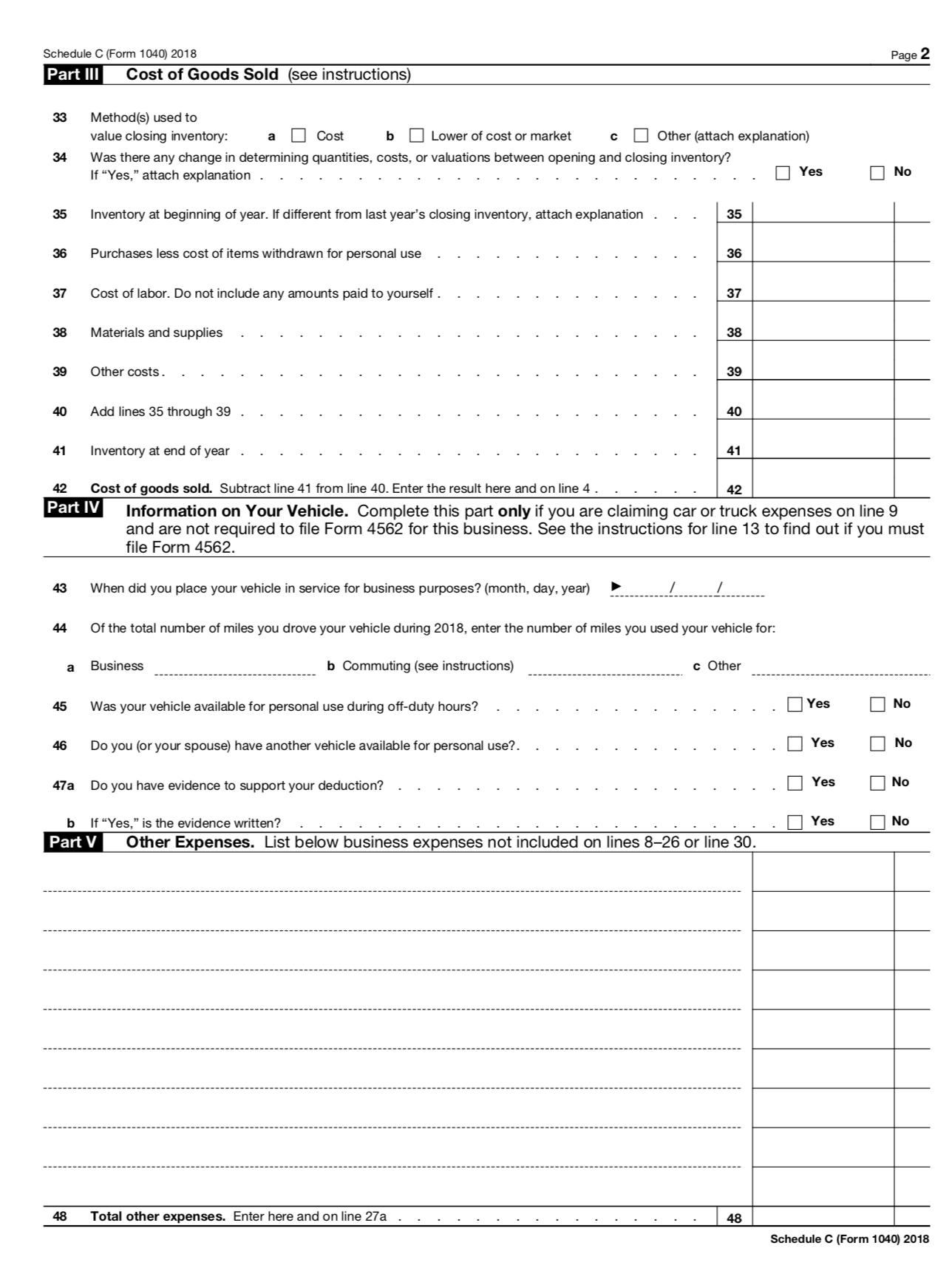

Your company is in the manufacturing. The cost of goods sold is calculated by adding the beginning of period inventory to the inventory purchases and subtracting the end of period inventory. Fill in Form 1125-A to calculate cost of goods sold. Any other items in Form 1125-A can be left blank.

For dividends, your company only has one source of dividend income—from a domestic corporation in which your company has a 30% ownership share. You can calculate the amount of dividend received deduction on Schedule C.

You must fill out both Schedule C and Form 1125-A, before completing Form 1120.

For form 1120 and all other forms, if nothing is listed, assume the number is zero. Hence, you do not have to fill out Schedules K, L, M-1, M-2 or any other supporting schedules, forms, and documents.

For the name of your corporation, list your name and the names of the classmates in your group, if you are filing one return for the group. You have the option of one or two people per group. The fillable tax forms are on Blackboard.

Specific numbers for your group are on the next page. All numbers are in US dollars. Numbers are not listed in any specific order except they are identified as either income or costs.

Fill out Schedule C, Form 1125-A and Form 1120 (pages 1, 2, and 3).

Determine either the amount of refund you receive or what you owe the US government on April 15, 2019.

2018 data for your corporation (Data set D)

Date incorporated January 1, 2007

Employer identification number 2007-07573

Beginning of period inventory $6,000,000

Purchases of inventory $14,300,000

End of period inventory $2,900,000

Gross sales $33,800,000

Returns and allowances $800,000

Other Income:

Royalties $130,000

Dividends received $340,000

Costs:

Repairs $150,000

Advertising $500,000

Bad debts $35,000

Employee benefits $800,000

Salary and wages to company employees $3,600,000

Compensation of corporate officers $1,950,000

Interest paid on bonds $64,365

Charitable contributions $44,778

Rent paid $265,800

Estimated total tax paid in 4 installments of $500,000 to US government during 2018, so taxes paid = $2,000,000.

Form (Rev. November 2018) Department of the Treasury Internal Revenue Service Name 1 Inventory at beginning of year 2 3 4 5 6 7 8 9a 1125-A e f Purchases. Cost of labor Additional section 263A costs (attach schedule) Other costs (attach schedule) Total. Add lines 1 through 5. Inventory at end of year Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or the appropriate line of your tax return. See instructions Check all methods used for valuing closing inventory: (i) Cost (ii) Lower of cost or market (iii) Other (Specify method used and attach explanation.) Check if there was a writedown of subnormal goods Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970) . Cost of Goods Sold Attach to Form 1120, 1120-C, 1120-F, 1120S, or 1065. Go to www.irs.gov/Form1125A for the latest information. Section references are to the Internal Revenue Code unless otherwise noted. b d If the LIFO inventory method was used for this tax year, enter amount of closing inventory computed under LIFO . 9d If property is produced or acquired for resale, do the rules of section 263A apply to the entity? See instructions Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If "Yes," attach explanation What's New Small business taxpayers. For tax years beginning after December 31, 2017, the following apply. A small business taxpayer (defined below), may use a method of accounting for inventories that either: (1) treats inventories as nonincidental materials and supplies, or (2) conforms to the taxpayer's financial accounting treatment of inventories. A small business taxpayer is not required to capitalize costs under section 263A. General Instructions Purpose of Form Use Form 1125-A to calculate and deduct cost of goods sold for certain entities. Who Must File Filers of Form 1120, 1120-C, 1120-F, 1120S, or 1065, must complete and attach Form 1125-A if the applicable entity reports a deduction for cost of goods sold. Inventories Generally, inventories are required at the beginning and end of each tax year if the production, purchase, or sale of merchandise is an income-producing factor. See Regulations section 1.471-1. If inventories are required, you generally must use an accrual method of accounting for sales and purchases of inventory items. Exception for certain taxpayers. A small business taxpayer (defined below), can adopt or change its accounting method to account for inventories in the same manner as material and supplies that are non- incidental, or conform to its treatment of inventories in an applicable financial statement (as defined in section 451(b)(3)), or if it does not have an applicable financial statement, the method of accounting used in its books and records prepared in accordance with its accounting procedures. See section 471(c)(3). A small business taxpayer claiming exemption from the requirement to keep inventories is changing its method of accounting for purposes of section 481. For additional guidance on this method of accounting, see Pub. 538, Accounting Periods and Methods. For guidance on changing to this method of accounting, see Form 3115 and the Instructions for Form 3115. 1234 For Paperwork Reduction Act Notice, see instructions. Cat. No. 55988R 5 6 7 8 OMB No. 1545-0123 Employer identification number Yes Yes 100 No Small business taxpayer. A small business taxpayer is a taxpayer that (a) has average annual gross receipts of $25 million or less (indexed for inflation) for the 3 prior tax years, and (b) is not a tax shelter (as defined in section 448(d)(3)). See Pub. 538. Uniform capitalization rules. The uniform capitalization rules of section 263A generally require you to capitalize, or include in inventory, certain costs incurred in connection with the following. The production of real property and tangible personal property held in inventory or held for sale in the ordinary course of business. Real property or personal property (tangible and intangible) acquired for resale. The production of real property and tangible personal property for use in its trade or business or in an activity engaged in for profit. A small business taxpayer (defined above) is not required to capitalize costs under section 263A. See section 263A (i). See the discussion on section 263A uniform capitalization rules in the instructions for your tax return before completing Form 1125-A. Also see Regulations sections 1.263A-1 through 1.263A-3. See Regulations section 1.263A-4 for rules for property produced in a farming business. Form 1125-A (Rev. 11-2018)

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Schedule C Income Royalties 130000 Dividends received 340000 Total Income 470000 Ded... View full answer

Get step-by-step solutions from verified subject matter experts