Question: Project Life Cycle Selection for New Payment System Founded in 2011, the Wealth Easy was one of the fastest online wealth management companies focused

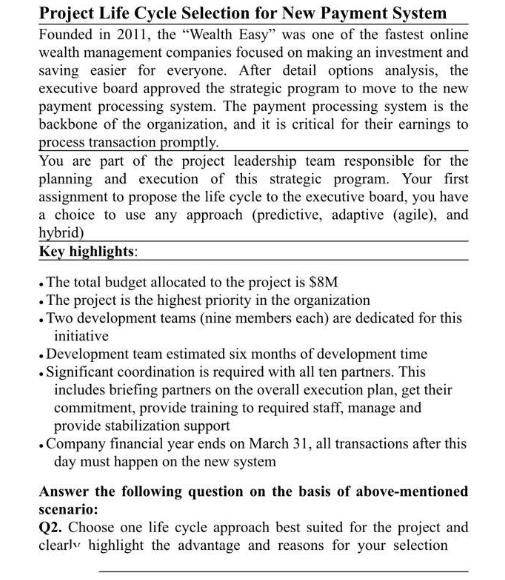

Project Life Cycle Selection for New Payment System Founded in 2011, the "Wealth Easy" was one of the fastest online wealth management companies focused on making an investment and saving easier for everyone. After detail options analysis, the executive board approved the strategic program to move to the new payment processing system. The payment processing system is the backbone of the organization, and it is critical for their earnings to process transaction promptly. You are part of the project leadership team responsible for the planning and execution of this strategic program. Your first assignment to propose the life cycle to the executive board, you have a choice to use any approach (predictive, adaptive (agile), and hybrid) Key highlights: . The total budget allocated to the project is $8M . The project is the highest priority in the organization . Two development teams (nine members each) are dedicated for this initiative .Development team estimated six months of development time .Significant coordination is required with all ten partners. This includes briefing partners on the overall execution plan, get their commitment, provide training to required staff, manage and provide stabilization support .Company financial year ends on March 31, all transactions after this day must happen on the new system Answer the following question on the basis of above-mentioned scenario: Q2. Choose one life cycle approach best suited for the project and clearl highlight the advantage and reasons for your selection

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

For the Wealth Easy project involving the implementation of a new payment processing system I recommend adopting a hybrid life cycle approach A hybrid ... View full answer

Get step-by-step solutions from verified subject matter experts