Question: PROJECT PHASE 3: TIN-IE SERIES AND LINEAR REGRESSION DESCRIPTION The information gathered in Phase II will be explored further by applying time series linear regression

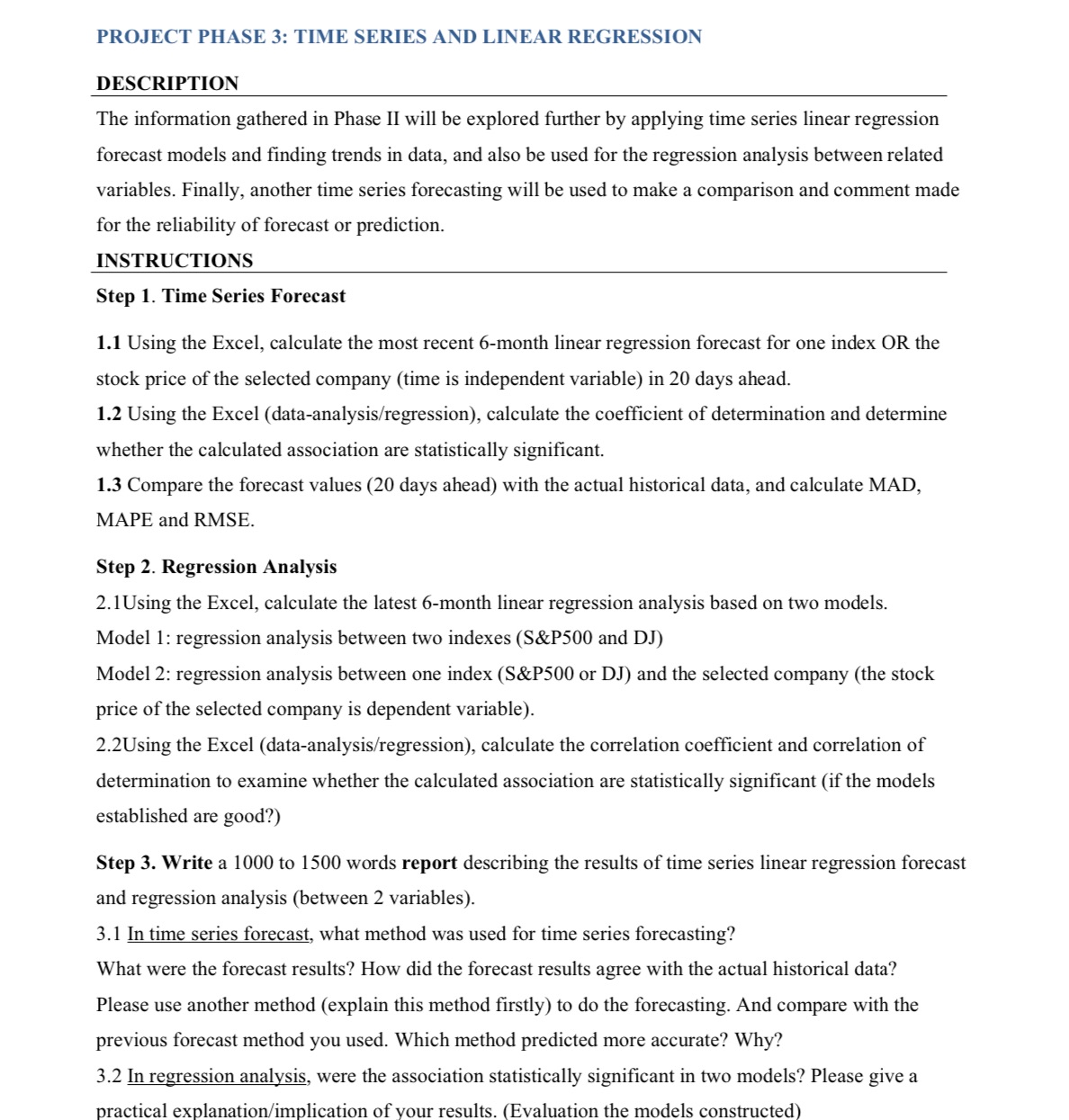

PROJECT PHASE 3: TIN-IE SERIES AND LINEAR REGRESSION DESCRIPTION The information gathered in Phase II will be explored further by applying time series linear regression forecast models and nding trends in data, and also be used for the regression analysis between related variables. Finally, another time series forecasting will be used to make a comparison and comment made for the reliability of forecast or prediction. INSTRUCTIONS Step 1. Time Series Forecast 1.1 Using the Excel, calculate the most recent 6-month linear regression forecast for one index OR the stock price of the selected company (time is independent variable) in 20 days ahead. 1.2 Using the Excel (data-analysisfregression), calculate the coefficient of determination and determine whether the calculated association are statistically significant. 1.3 Compare the forecast values (20 days ahead) with the actual historical data, and calculate MAD, MAPE and RMS E. Step 2. Regression Analysis 2.1Using the Excel, calculate the latest 6-month linear regression analysis based on two models. Model 1: regression analysis between two indexes (S&P500 and DJ) Model 2: regression analysis between one index (S&P500 or DJ) and the selected company (the stock price of the selected company is dependent variable). 2.2Using the Excel (data-analysisfregression), calculate the correlation coefcient and correlation of determination to examine whether the calculated association are statistically significant (if the models established are good?) Step 3. Write a 1000 to 1500 words report describing the results of time series linear regression forecast and regression analysis (between 2 variables). 3.1 In time series forecast, what method was used for time series forecasting? What were the forecast results? How did the forecast results agree with the actual historical data? Please use another method (explain this method rstly) to do the forecasting. And compare with the previous forecast method you used. Which method predicted more accurate? Why? 3.2 In regression analysis, were the association statistically signicant in two models? Please give a practical explanation! implication of your results. (Evaluation the models constructed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts