Question: Project S costs $2,563 up front, and its expected net cash inflows are $817 per year for 8 years (with the first inflow occurring

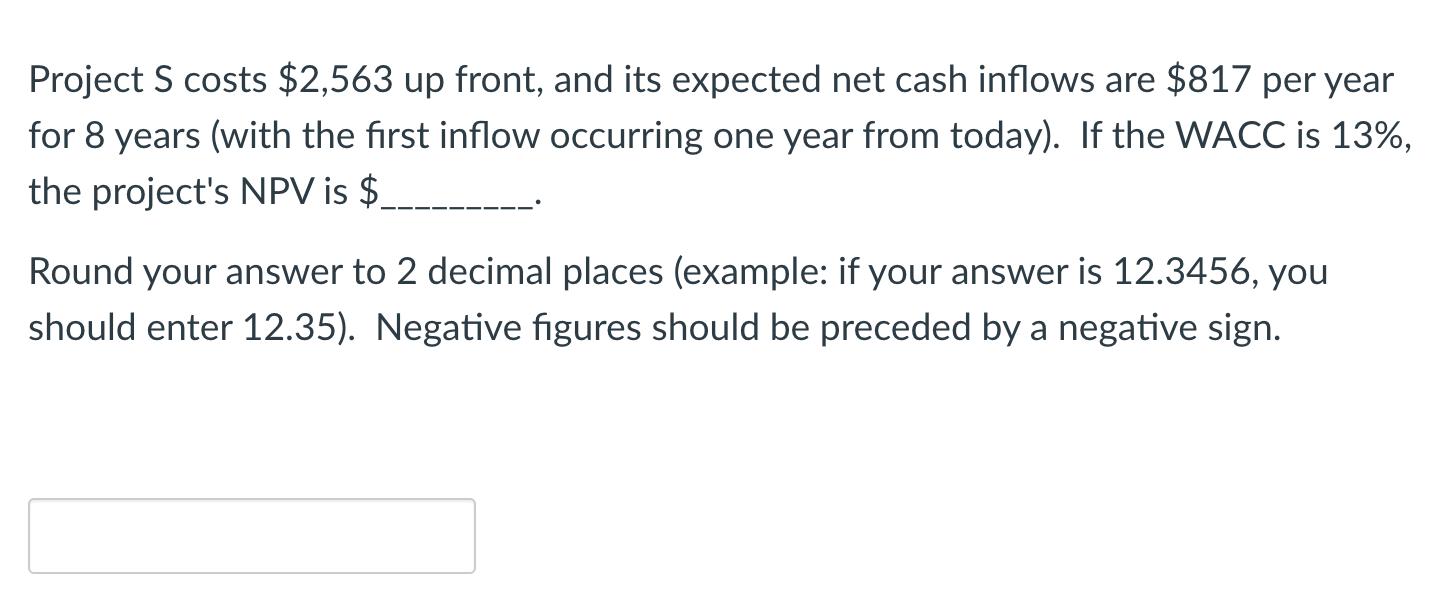

Project S costs $2,563 up front, and its expected net cash inflows are $817 per year for 8 years (with the first inflow occurring one year from today). If the WACC is 13%, the project's NPV is $ Round your answer to 2 decimal places (example: if your answer is 12.3456, you should enter 12.35). Negative figures should be preceded by a negative sign.

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV of the project we use the formula NPV sumt1n CF... View full answer

Get step-by-step solutions from verified subject matter experts