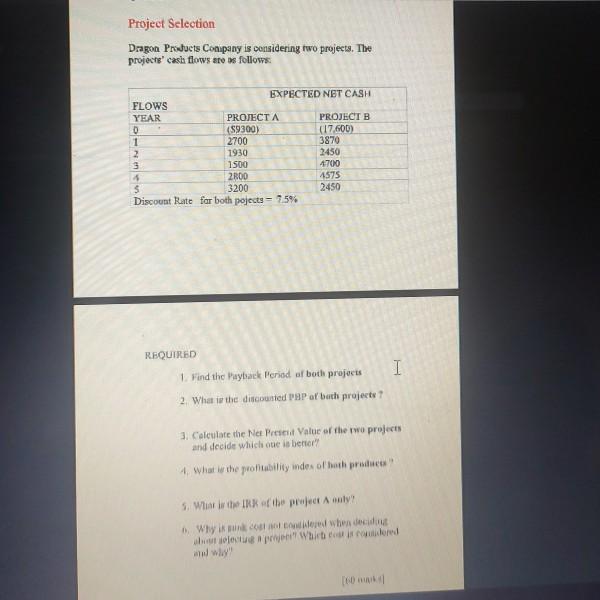

Question: Project Selection Dragon Products Conipany is considering two projects. The projects' cash flows to us follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B

Project Selection Dragon Products Conipany is considering two projects. The projects' cash flows to us follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B 0 (59300) (17.600) 1 2700 3870 2 1930 2450 3 1500 4700 2R00 4575 S 3200 2450 Discount Rate for both pojects - 75% REQUIRED I 1. Find the Mayback period of both projects 2. What is the discounted PSP of both projecte 3. Calculate the Net Present Value of the two projects and decide which one is better 4. What the profitability index of bath products 5. What the IR of the project only Why is not need when deciding What We White wwww Project Selection Dragon Products Conipany is considering two projects. The projects' cash flows to us follows: EXPECTED NET CASH FLOWS YEAR PROJECT A PROJECT B 0 (59300) (17.600) 1 2700 3870 2 1930 2450 3 1500 4700 2R00 4575 S 3200 2450 Discount Rate for both pojects - 75% REQUIRED I 1. Find the Mayback period of both projects 2. What is the discounted PSP of both projecte 3. Calculate the Net Present Value of the two projects and decide which one is better 4. What the profitability index of bath products 5. What the IR of the project only Why is not need when deciding What We White wwww

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts