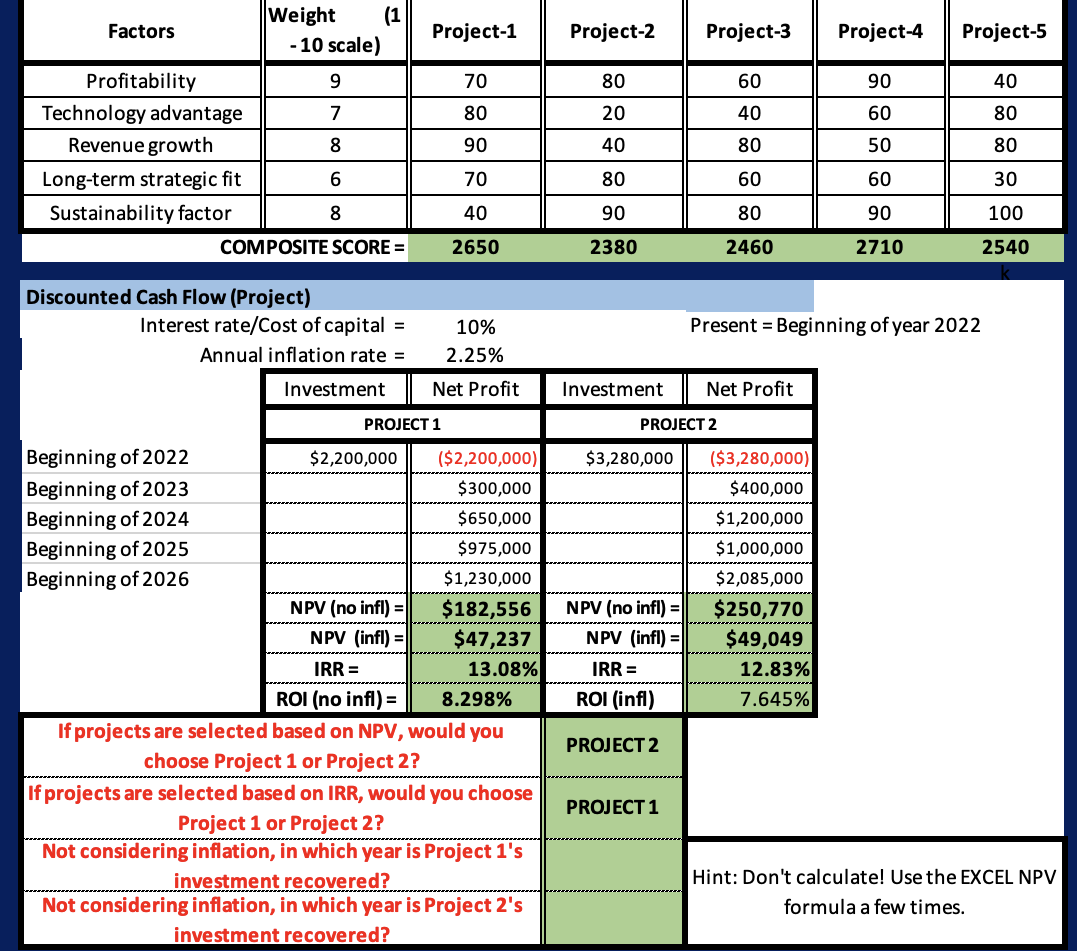

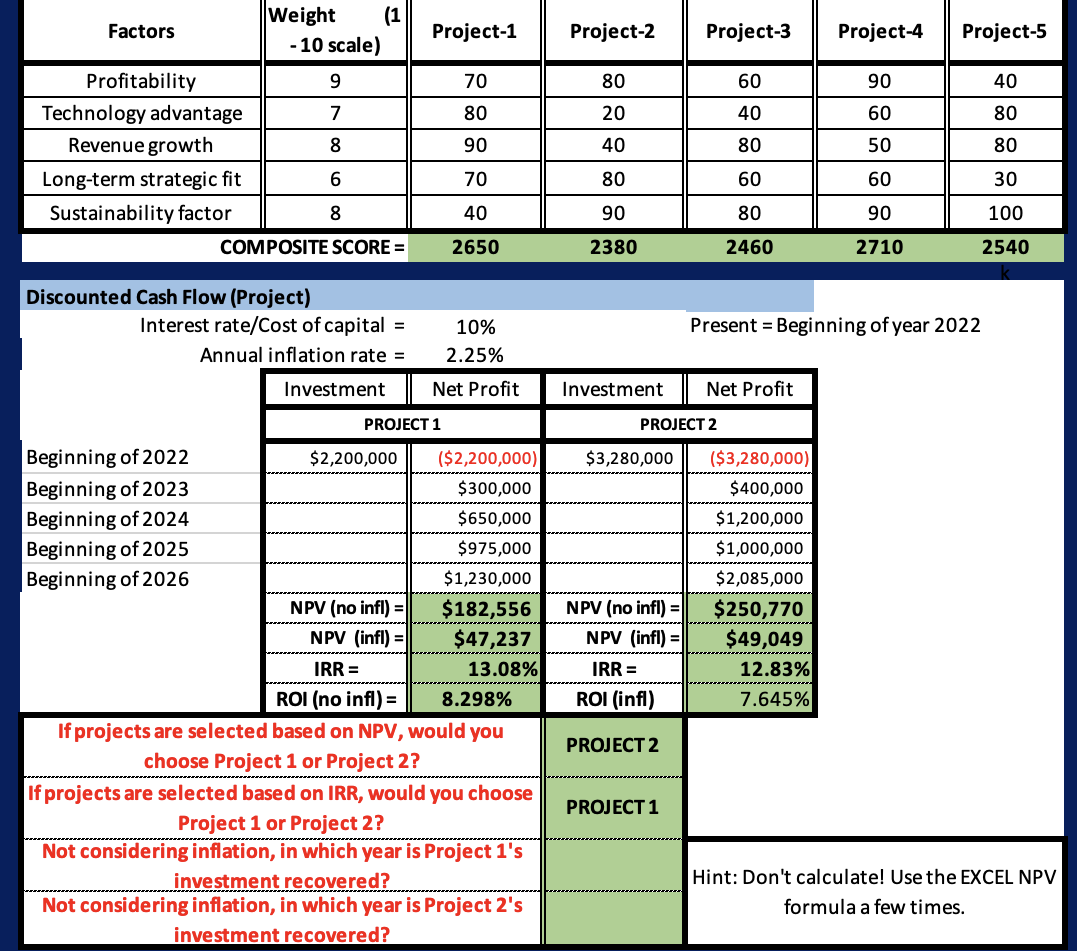

Question: Project-1 Project-2 Project-3 Project-4 Project-5 70 80 60 90 40 80 40 60 80 Weight Factors - 10 scale) Profitability 9 Technology advantage 7 Revenue

Project-1 Project-2 Project-3 Project-4 Project-5 70 80 60 90 40 80 40 60 80 Weight Factors - 10 scale) Profitability 9 Technology advantage 7 Revenue growth 8 Long-term strategic fit 6 Sustainability factor 8 COMPOSITE SCORE = 20 40 90 80 50 80 70 80 60 60 30 40 90 80 90 100 2650 2380 2460 2710 2540 Discounted Cash Flow (Project) Interest rate/Cost of capital = Annual inflation rate = Present = Beginning of year 2022 10% 2.25% Investment Net Profit Investment Net Profit PROJECT 1 PROJECT 2 $3,280,000 Beginning of 2022 $2,200,000 ($2,200,000) Beginning of 2023 $300,000 Beginning of 2024 $650,000 Beginning of 2025 $975,000 Beginning of 2026 $1,230,000 NPV (no infl) = $182,556 NPV (infl) = $ 47,237 IRR = 13.08% ROI (no infl) = 8.298% If projects are selected based on NPV, would you choose Project 1 or Project 2? If projects are selected based on IRR, would you choose Project 1 or Project 2? Not considering inflation, in which year is Project 1's investment recovered? Not considering inflation, in which year is Project 2's investment recovered? ($3,280,000) $400,000 $1,200,000 $1,000,000 $2,085,000 $250,770 $49,049 12.83% 7.645% NPV (no infl) = NPV (infl) = IRR = ROI (infl) PROJECT 2 PROJECT 1 Hint: Don't calculate! Use the EXCEL NPV formula a few times. Project-1 Project-2 Project-3 Project-4 Project-5 70 80 60 90 40 80 40 60 80 Weight Factors - 10 scale) Profitability 9 Technology advantage 7 Revenue growth 8 Long-term strategic fit 6 Sustainability factor 8 COMPOSITE SCORE = 20 40 90 80 50 80 70 80 60 60 30 40 90 80 90 100 2650 2380 2460 2710 2540 Discounted Cash Flow (Project) Interest rate/Cost of capital = Annual inflation rate = Present = Beginning of year 2022 10% 2.25% Investment Net Profit Investment Net Profit PROJECT 1 PROJECT 2 $3,280,000 Beginning of 2022 $2,200,000 ($2,200,000) Beginning of 2023 $300,000 Beginning of 2024 $650,000 Beginning of 2025 $975,000 Beginning of 2026 $1,230,000 NPV (no infl) = $182,556 NPV (infl) = $ 47,237 IRR = 13.08% ROI (no infl) = 8.298% If projects are selected based on NPV, would you choose Project 1 or Project 2? If projects are selected based on IRR, would you choose Project 1 or Project 2? Not considering inflation, in which year is Project 1's investment recovered? Not considering inflation, in which year is Project 2's investment recovered? ($3,280,000) $400,000 $1,200,000 $1,000,000 $2,085,000 $250,770 $49,049 12.83% 7.645% NPV (no infl) = NPV (infl) = IRR = ROI (infl) PROJECT 2 PROJECT 1 Hint: Don't calculate! Use the EXCEL NPV formula a few times