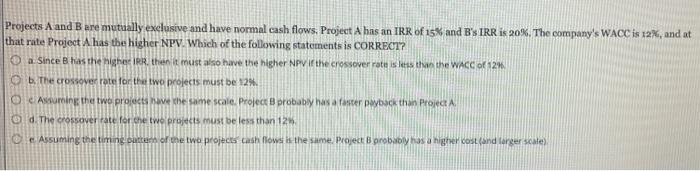

Question: Projects A and B are mutually exclusive and have normal cash flows. Project A has an IRR of 15% and B's IRR is 20% The

Projects A and B are mutually exclusive and have normal cash flows. Project A has an IRR of 15% and B's IRR is 20% The company's WACC is 12%, and at that rate Project A has the higher NPV. Which of the following statements is CORRECT? O a Since B has the higher then it must also have the higher NPV if the crossover Patients that the WACC of 12 O b The Crossover rate for the two projects must be 12%. O Auming the two projects have the same scale Project probably has a faster payback than Project d. The crossover rate for the two projects must be less than 125 Cc Assuming the timing cuttern of the two projects cash flows is the same. Project B probably has a higher cost and targer scate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts