Question: Proper working capital management requires a manager to focus on a firm's working capital, with a particular emphasis on maintaining an optimal level of cash

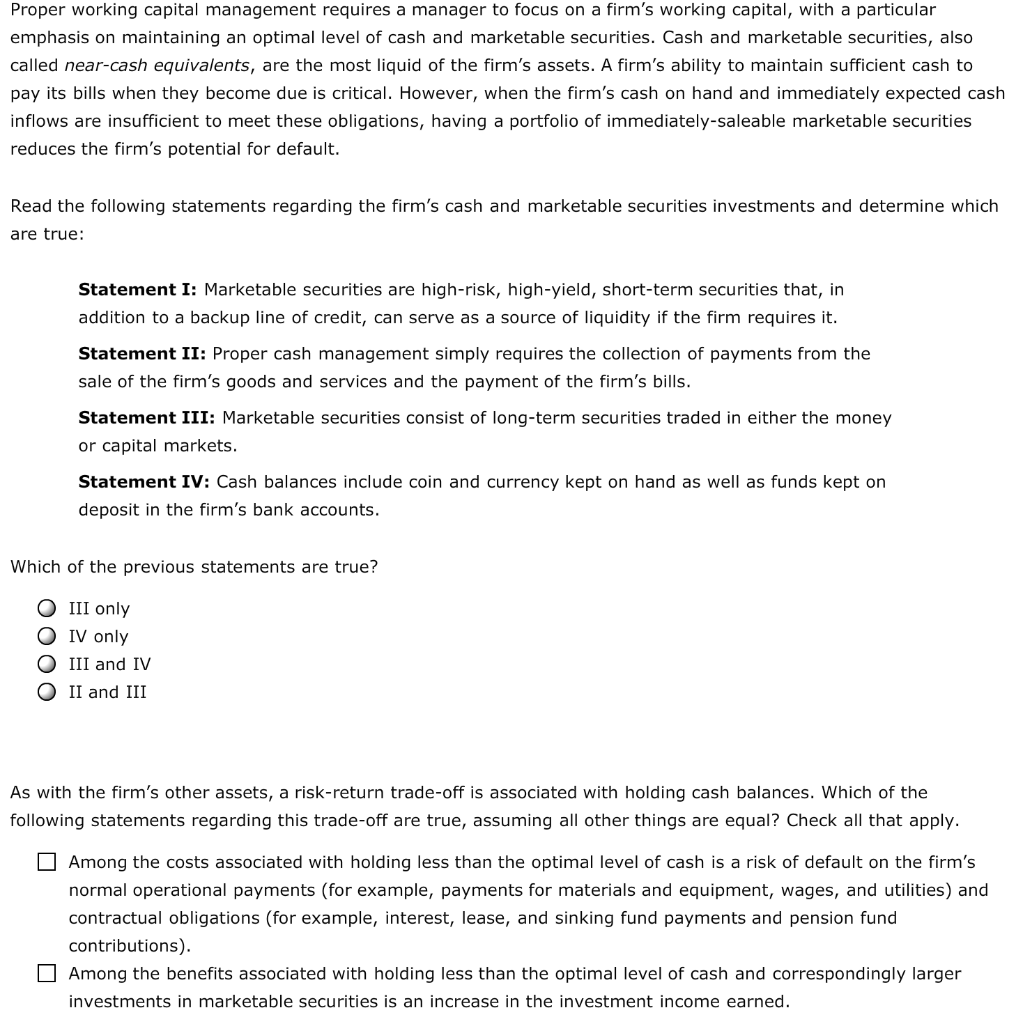

Proper working capital management requires a manager to focus on a firm's working capital, with a particular emphasis on maintaining an optimal level of cash and marketable securities. Cash and marketable securities, also called near-cash equivalents, are the most liquid of the firm's assets. A firm's ability to maintain sufficient cash to pay its bills when they become due is critical. However, when the firm's cash on hand and immediately expected cash inflows are insufficient to meet these obligations, having a portfolio of immediately-saleable marketable securities reduces the firm's potential for default. Read the following statements regarding the firm's cash and marketable securities investments and determine which are true: Statement I: Marketable securities are high-risk, high-yield, short-term securities that, in addition to a backup line of credit, can serve as a source of liquidity if the firm requires it. Statement II: Proper cash management simply requires the collection of payments from the sale of the firm's goods and services and the payment of the firm's bills. Statement III: Marketable securities consist of long-term securities traded in either the money or capital markets. Statement IV: Cash balances include coin and currency kept on hand as well as funds kept on deposit in the firm's bank accounts. Which of the previous statements are true? O III only OIV only O III and IV O II and III As with the firm's other assets, a risk-return trade-off is associated with holding cash balances. Which of the following statements regarding this trade-off are true, assuming all other things are equal? Check all that apply. Among the costs associated with holding less than the optimal level of cash is a risk of default on the firm's normal operational payments (for example, payments for materials and equipment, wages, and utilities) and contractual obligations (for example, interest, lease, and sinking fund payments and pension fund contributions). Among the benefits associated with holding less than the optimal level of cash and correspondingly larger investments in marketable securities is an increase in the investment income earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts