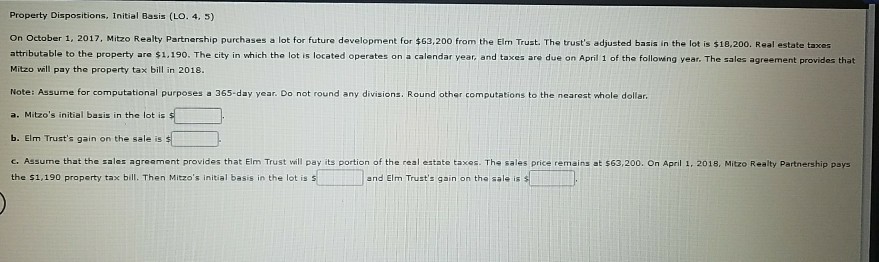

Question: Property Dispositions, Initial Basis (LO. 4. 5) On October 1, 2017. Mitzo Realty Partnership purchases a lot for future development for $63,200 from the Elm

Property Dispositions, Initial Basis (LO. 4. 5) On October 1, 2017. Mitzo Realty Partnership purchases a lot for future development for $63,200 from the Elm Trust. The trust's adjusted basis in the lot is $18,200. Real estate taxes attributable to the property are $1.190. The city in which the lot is located operates on a calendar Mitzo will pay the property tax bill in 2018 year, and taxes are due on April 1 of the folloing year. The sales agreement provides that Note: Assume for computational purposes a 365-day year. Do not round any divisions. Round other computations to the nearest whole dollar. a. Mitzo's initial basis in the lot is b. Elm Trust's gain on the sale is c. Assurne that the sales agreament provides that Elm Trust will pay its portion of the real estate taxes. The sales price remains at $63,200. On April 1. 2018, Mitzo Realty Partnership pays the $1,190 property tax bill. Then Mitzo's initial basis in the lot is and Elm Trust's gain on the sale is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts