Question: ) Propose and justify a dollar amount for Materiality for this 2021 audit of Edouard Inc. (assumes you accept the engagement) using the following bases:

) Propose and justify a dollar amount for Materiality for this 2021 audit of Edouard Inc. (assumes you accept the engagement) using the following bases: i. Rule of Thumb of between 5% - 10% of Operating Profit (i.e. Pre-tax profit) ii. Industry-standard of 0.4% of revenues [10 marks total for (c)] Note: Use the following definitions for the purposes of this assignment Current Ratio = Current Assets / Current Liabilities Quick Ratio or Acid Test = (Cash + Net Receivables) / Current Liabilities

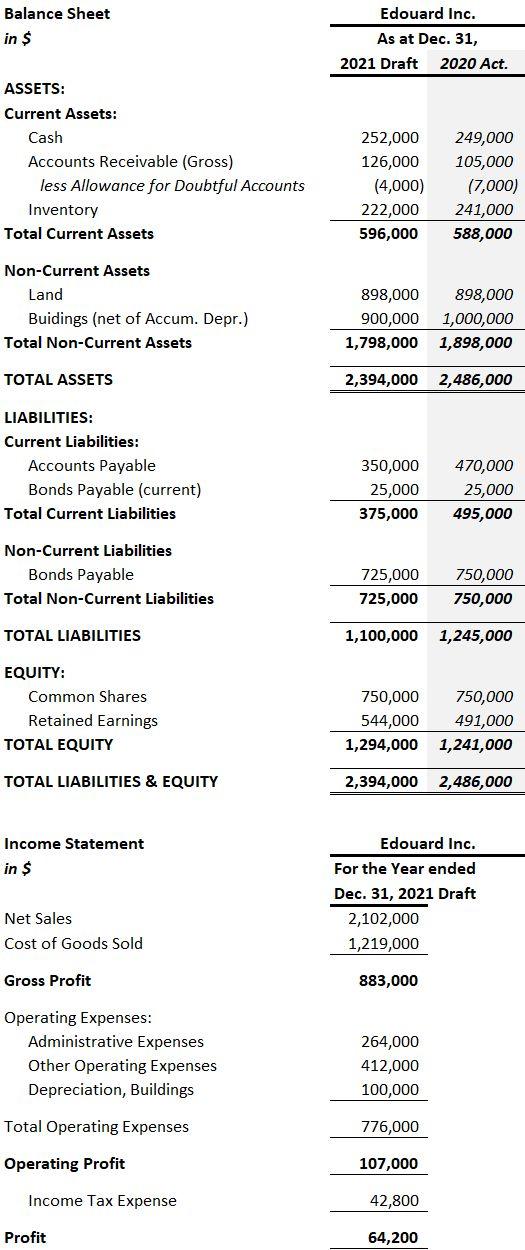

Edouard Inc. Balance Sheet in $ As at Dec. 31, 2021 Draft 2020 Act. ASSETS: Current Assets: Cash Accounts Receivable (Gross) less Allowance for Doubtful Accounts Inventory Total Current Assets 252,000 126,000 (4,000) 222,000 596,000 249,000 105,000 (7,000) 241,000 588,000 Non-Current Assets Land Buidings (net of Accum. Depr.) Total Non-Current Assets 898,000 898,000 900,000 1,000,000 1,798,000 1,898,000 TOTAL ASSETS 2,394,000 2,486,000 LIABILITIES: Current Liabilities: Accounts Payable Bonds Payable (current) Total Current Liabilities 350,000 25,000 375,000 470,000 25,000 495,000 Non-Current Liabilities Bonds Payable Total Non-Current Liabilities 725,000 725,000 750,000 750,000 TOTAL LIABILITIES 1,100,000 1,245,000 EQUITY: Common Shares Retained Earnings TOTAL EQUITY 750,000 544,000 1,294,000 750,000 491,000 1,241,000 TOTAL LIABILITIES & EQUITY 2,394,000 2,486,000 Income Statement in $ Edouard Inc. For the Year ended Dec. 31, 2021 Draft 2,102,000 1,219,000 Net Sales Cost of Goods Sold Gross Profit 883,000 Operating Expenses: Administrative Expenses Other Operating Expenses Depreciation, Buildings 264,000 412,000 100,000 Total Operating Expenses 776,000 Operating Profit 107,000 Income Tax Expense 42,800 Profit 64,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts