Question: Proposed solution to be checked: This was solved using: Given the following tables, find: a. Expected Return and Variance for the tangent portfolio b. Capital

Proposed solution to be checked:

This was solved using:

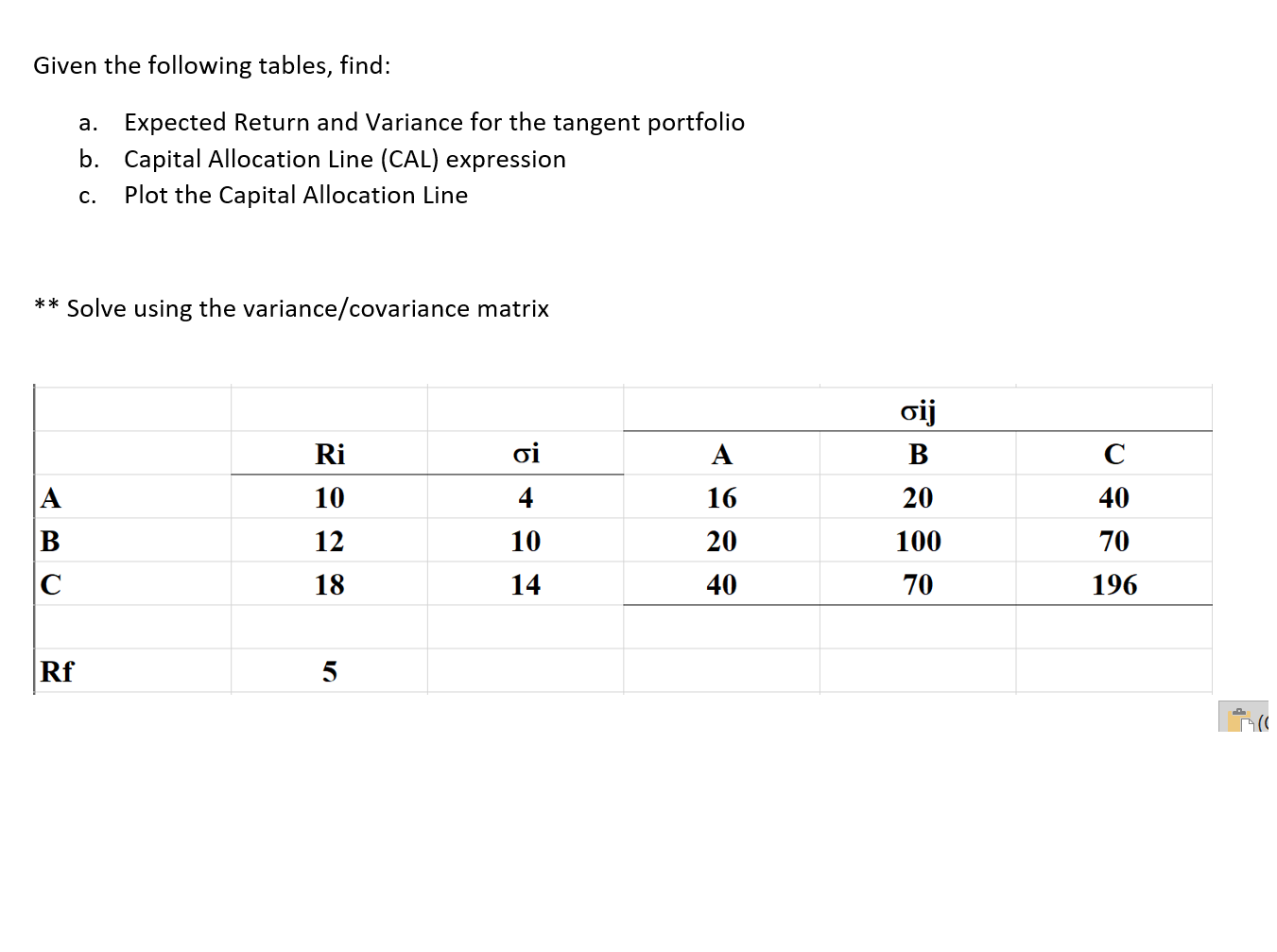

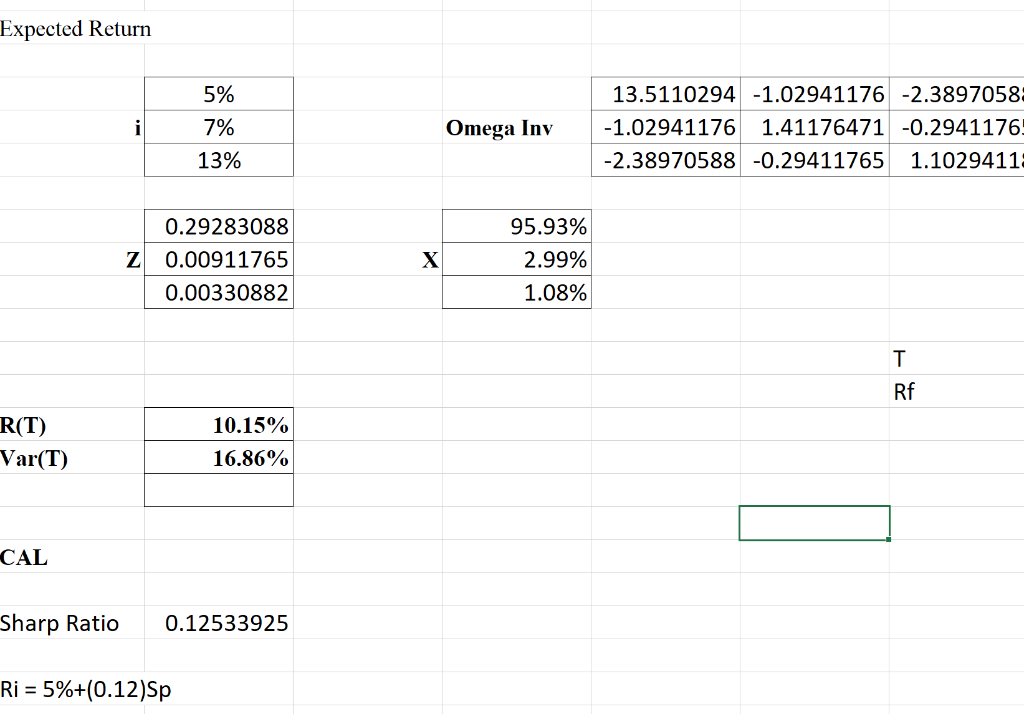

Given the following tables, find: a. Expected Return and Variance for the tangent portfolio b. Capital Allocation Line (CAL) expression Plot the Capital Allocation Line c. ** Solve using the variance/covariance matrix oi Ri 10 A 16 A 4 10 oij B 20 100 70 C 40 70 196 B 12 20 18 14 40 Rf 5 Expected Return i 5% 7% 13% Omega Inv 13.5110294 -1.02941176 -2.3897058 -1.02941176 1.41176471 -0.2941176 -2.38970588 -0.29411765 1.1029411 Z 0.29283088 0.00911765 0.00330882 X 95.93% 2.99% 1.08% T Rf R(T) Var(T) 10.15% 16.86% CAL Sharp Ratio 0.12533925 Ri = 5%+(0.12)Sp R, = xR, ' = x'x Given the following tables, find: a. Expected Return and Variance for the tangent portfolio b. Capital Allocation Line (CAL) expression Plot the Capital Allocation Line c. ** Solve using the variance/covariance matrix oi Ri 10 A 16 A 4 10 oij B 20 100 70 C 40 70 196 B 12 20 18 14 40 Rf 5 Expected Return i 5% 7% 13% Omega Inv 13.5110294 -1.02941176 -2.3897058 -1.02941176 1.41176471 -0.2941176 -2.38970588 -0.29411765 1.1029411 Z 0.29283088 0.00911765 0.00330882 X 95.93% 2.99% 1.08% T Rf R(T) Var(T) 10.15% 16.86% CAL Sharp Ratio 0.12533925 Ri = 5%+(0.12)Sp R, = xR, ' = x'x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts