Question: Provaide clear explaination with this answer Option Valuation Binomial Option Pricing: Stock Volatility/Pricing 1.) Calculate the probabilities and final stock price of each possible path

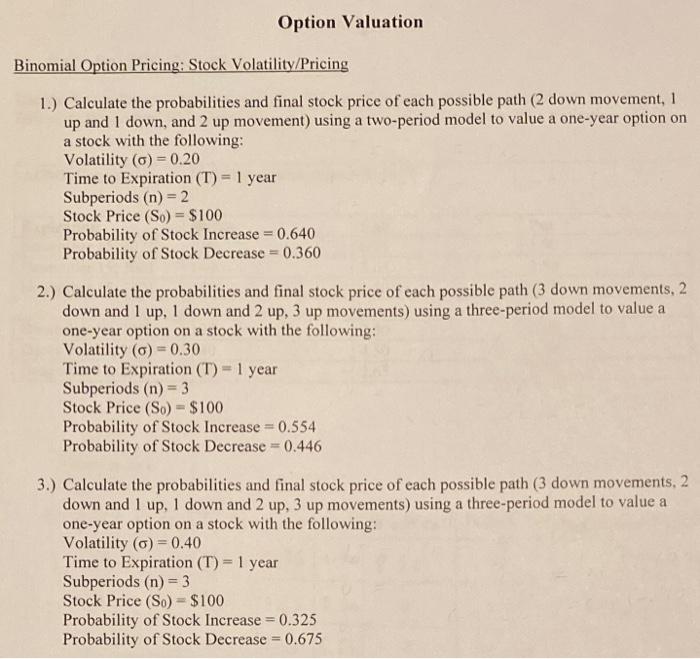

Option Valuation Binomial Option Pricing: Stock Volatility/Pricing 1.) Calculate the probabilities and final stock price of each possible path (2 down movement, 1 up and I down, and 2 up movement) using a two-period model to value a one-year option on a stock with the following: Volatility (o) = 0.20 Time to Expiration (T) = 1 year Subperiods (n) = 2 Stock Price (So) = $100 Probability of Stock Increase=0.640 Probability of Stock Decrease = 0.360 2.) Calculate the probabilities and final stock price of each possible path (3 down movements, 2 down and 1 up, 1 down and 2 up, 3 up movements) using a three-period model to value a one-year option on a stock with the following: Volatility (c) = 0.30 Time to Expiration (T) = 1 year Subperiods (n) = 3 Stock Price (S.) = $100 Probability of Stock Increase = 0.554 Probability of Stock Decrease = 0.446 3.) Calculate the probabilities and final stock price of each possible path (3 down movements, 2 down and I up, 1 down and 2 up, 3 up movements) using a three-period model to value a one-year option on a stock with the following: Volatility (0) = 0.40 Time to Expiration (T) = 1 year Subperiods (n) = 3 Stock Price (So) = $100 Probability of Stock Increase = 0.325 Probability of Stock Decrease = 0.675 Option Valuation Binomial Option Pricing: Stock Volatility/Pricing 1.) Calculate the probabilities and final stock price of each possible path (2 down movement, 1 up and I down, and 2 up movement) using a two-period model to value a one-year option on a stock with the following: Volatility (o) = 0.20 Time to Expiration (T) = 1 year Subperiods (n) = 2 Stock Price (So) = $100 Probability of Stock Increase=0.640 Probability of Stock Decrease = 0.360 2.) Calculate the probabilities and final stock price of each possible path (3 down movements, 2 down and 1 up, 1 down and 2 up, 3 up movements) using a three-period model to value a one-year option on a stock with the following: Volatility (c) = 0.30 Time to Expiration (T) = 1 year Subperiods (n) = 3 Stock Price (S.) = $100 Probability of Stock Increase = 0.554 Probability of Stock Decrease = 0.446 3.) Calculate the probabilities and final stock price of each possible path (3 down movements, 2 down and I up, 1 down and 2 up, 3 up movements) using a three-period model to value a one-year option on a stock with the following: Volatility (0) = 0.40 Time to Expiration (T) = 1 year Subperiods (n) = 3 Stock Price (So) = $100 Probability of Stock Increase = 0.325 Probability of Stock Decrease = 0.675

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts