Question: q20 pls provide Complete solution. thankyou so much. Question 20 1 pts A company conducts research and develops products and processes which it patents and

q20 pls provide Complete solution. thankyou so much.

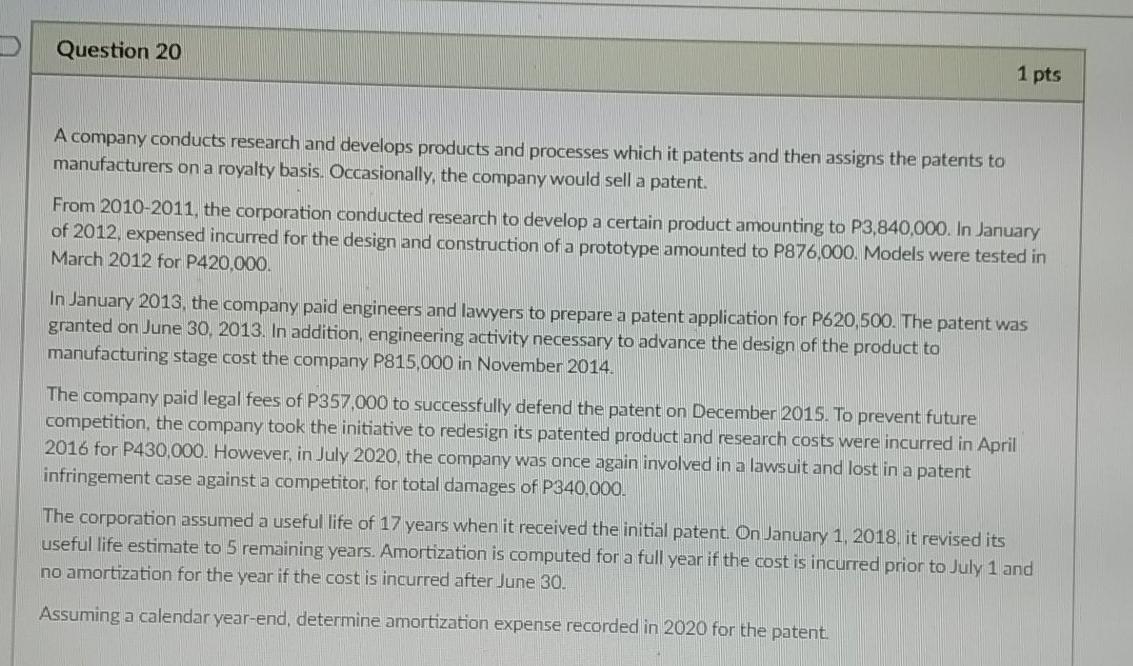

Question 20 1 pts A company conducts research and develops products and processes which it patents and then assigns the patents to manufacturers on a royalty basis. Occasionally, the company would sell a patent. From 2010-2011, the corporation conducted research to develop a certain product amounting to P3,840,000. In January of 2012, expensed incurred for the design and construction of a prototype amounted to P876,000. Models were tested in March 2012 for P420,000. In January 2013, the company paid engineers and lawyers to prepare a patent application for P620,500. The patent was granted on June 30, 2013. In addition, engineering activity necessary to advance the design of the product to manufacturing stage cost the company P815,000 in November 2014. The company paid legal fees of P357,000 to successfully defend the patent on December 2015. To prevent future competition, the company took the initiative to redesign its patented product and research costs were incurred in April 2016 for P430,000. However, in July 2020, the company was once again involved in a lawsuit and lost in a patent infringement case against a competitor, for total damages of P340,000. The corporation assumed a useful life of 17 years when it received the initial patent On January 1, 2018. it revised its useful life estimate to 5 remaining years. Amortization is computed for a full year if the cost is incurred prior to July 1 and no amortization for the year if the cost is incurred after June 30. Assuming a calendar year-end, determine amortization expense recorded in 2020 for the patent The corporation assumed a useful life of 17 ye when it received the initial patent. On January 1, 2018. it revised its useful life estimate to 5 remaining years. Amortation is computed for a full year if the cost is incurred prior to July 1 and no amortization for the year if the cost is incurred after June 30. Assuming a calendar year-end, determine amortization expense recorded in 2020 for the patent 148.800 87.600 198,705 O 148.305 P W Question 20 1 pts A company conducts research and develops products and processes which it patents and then assigns the patents to manufacturers on a royalty basis. Occasionally, the company would sell a patent. From 2010-2011, the corporation conducted research to develop a certain product amounting to P3,840,000. In January of 2012, expensed incurred for the design and construction of a prototype amounted to P876,000. Models were tested in March 2012 for P420,000. In January 2013, the company paid engineers and lawyers to prepare a patent application for P620,500. The patent was granted on June 30, 2013. In addition, engineering activity necessary to advance the design of the product to manufacturing stage cost the company P815,000 in November 2014. The company paid legal fees of P357,000 to successfully defend the patent on December 2015. To prevent future competition, the company took the initiative to redesign its patented product and research costs were incurred in April 2016 for P430,000. However, in July 2020, the company was once again involved in a lawsuit and lost in a patent infringement case against a competitor, for total damages of P340,000. The corporation assumed a useful life of 17 years when it received the initial patent On January 1, 2018. it revised its useful life estimate to 5 remaining years. Amortization is computed for a full year if the cost is incurred prior to July 1 and no amortization for the year if the cost is incurred after June 30. Assuming a calendar year-end, determine amortization expense recorded in 2020 for the patent The corporation assumed a useful life of 17 ye when it received the initial patent. On January 1, 2018. it revised its useful life estimate to 5 remaining years. Amortation is computed for a full year if the cost is incurred prior to July 1 and no amortization for the year if the cost is incurred after June 30. Assuming a calendar year-end, determine amortization expense recorded in 2020 for the patent 148.800 87.600 198,705 O 148.305 P W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts