Question: Provide: LP model ( including definition of variables ) , optimal solution, optimal objective value ) winstonco is considering investing in three projects. if we

Provide: LP model including definition of variables

optimal solution, optimal objective value

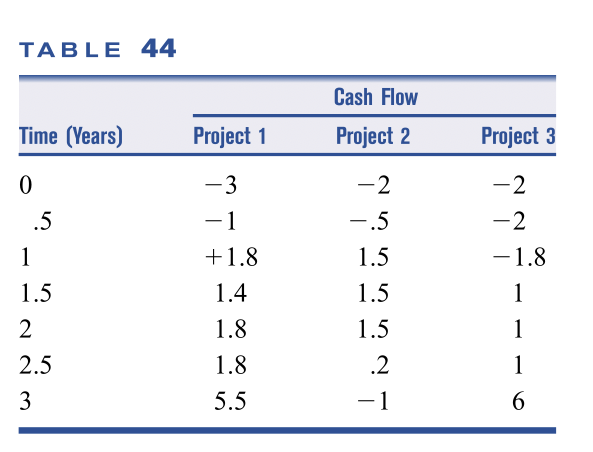

winstonco is considering investing in three projects. if we fully invest in a project, the realized cash flows in millions of dollars will be shown in table For example, project requires cash outflow of $ million today and returns $ million years from now. Today we have $ million in cash. At each time point and years from today we may, if desired borrow up to $ million at per months interest. Leftover cat ears per months interest. For example, if after borrowing and investing at time we have $ million we would receive $ in interest at time years. Winstonco's goal is to maximize cash on hand after it accounts for time cash flows. What investment and borrowing strategy should be used? Remember that we may invest in a fraction of a project. For example, if we invest in of project then we would have cash outflows of $ million at time and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock