Question: Tiny Nurseries Ltd. is a Canadian controlled private corporation operating in your province. The company has a December 31st year-end. Three asset sales occurred

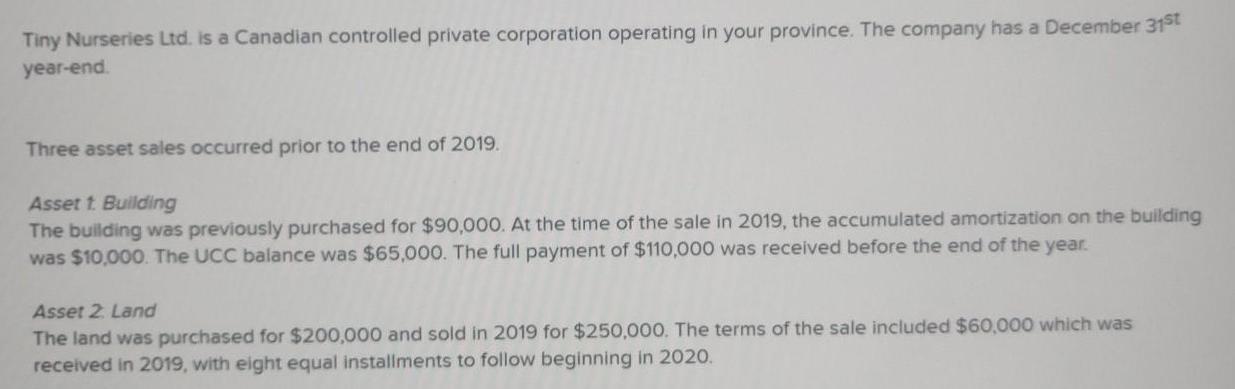

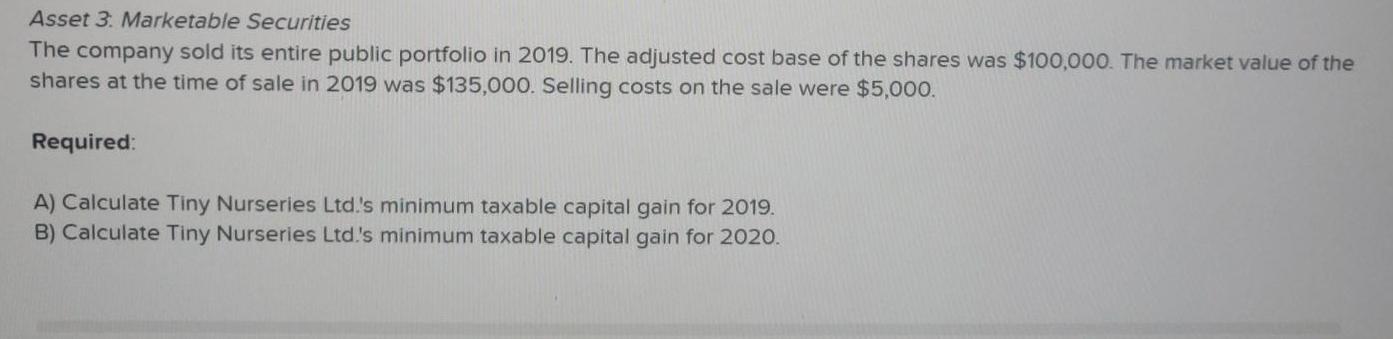

Tiny Nurseries Ltd. is a Canadian controlled private corporation operating in your province. The company has a December 31st year-end. Three asset sales occurred prior to the end of 2019. Asset t Building The building was previously purchased for $90,000. At the time of the sale in 2019, the accumulated amortization on the building was $10,000. The UCC balance was $65,000. The full payment of $110,000 was received before the end of the year. Asset 2 Land The land was purchased for $200,000 and sold in 2019 for $250,000. The terms of the sale included $60,000 which was received in 2019, with eight equal installments to follow beginning in 2020. Asset 3. Marketable Securities The company sold its entire public portfolio in 2019. The adjusted cost base of the shares was $100,000. The market value of the shares at the time of sale in 2019 was $135,000. Selling costs on the sale were $5,000. Required: A) Calculate Tiny Nurseries Ltd.'s minimum taxable capital gain for 2019. B) Calculate Tiny Nurseries Ltd.'s minimum taxable capital gain for 2020.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Answer Explanation Formula Slip A The Minimum taxabl... View full answer

Get step-by-step solutions from verified subject matter experts